Report: It is anticipated that macroeconomic factors will become increasingly relevant to digital asset classes in the coming weeks

Coinbase released its "Weekly: Constructive Outlook" report on Friday, predicting that macro factors will become more relevant to digital asset classes in the coming weeks, which could provide support for performance. The report also discussed the outlook for the U.S. economy. It explained that compared to a few months ago, the likelihood of a soft landing seems to have increased as the U.S. economy appears to have made minimal trade-offs between economic activity and inflation. Coinbase analysts believe deflationary trends will continue and expect the Federal Reserve to cut interest rates by 100 basis points this year. This forecast contrasts sharply with the suggested 75 basis points in dot plots and nearly 150 basis points priced into federal funds futures contracts. Their conclusion is: We expect that US will start cutting interest rates in May, gradually reduce quantitative tightening policies shortly thereafter while coinciding with special events such as Bitcoin halving, creating a positive environment for broader asset classes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cathie Wood: The crypto market may have bottomed out, Bitcoin remains the top choice for institutions

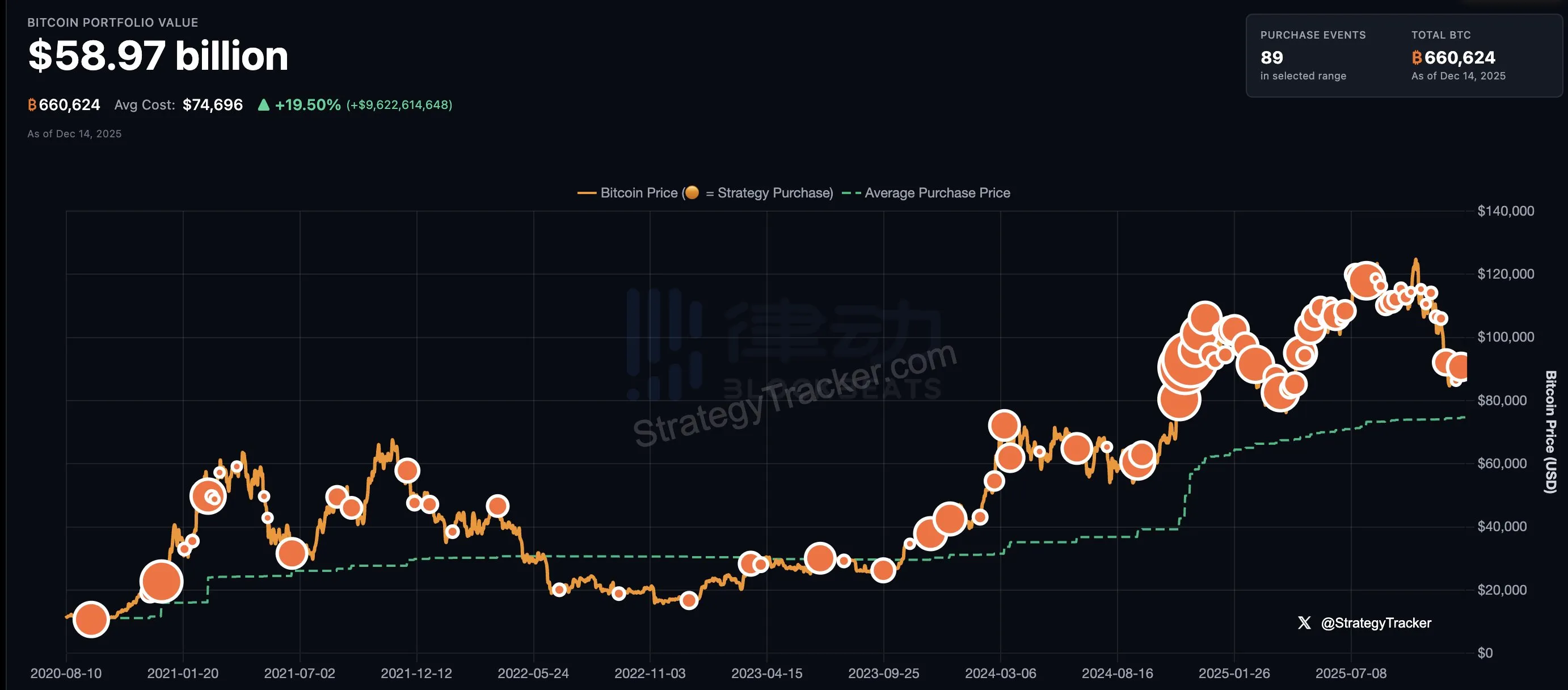

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC accumulation

Analyst: Bitcoin’s key support level is at $86,000; a breach could trigger a deeper correction

Aevo confirms that the old Ribbon DOV vaults were attacked and lost $2.7 million, and will compensate active users.