AVAX Soars 9% Daily, SOL Taps $110 as BTC Jumped Above $48K (Weekend Watch)

Avalanche’s native token is today’s top performer from the larger-cap alts.

Bitcoin’s positive price performances continued in the past 24 hours as the asset jumped above $48,000 and marked a new monthly peak.

The altcoins are also in the green, with ETH tapping $2,500 and SOL jumping to $110.

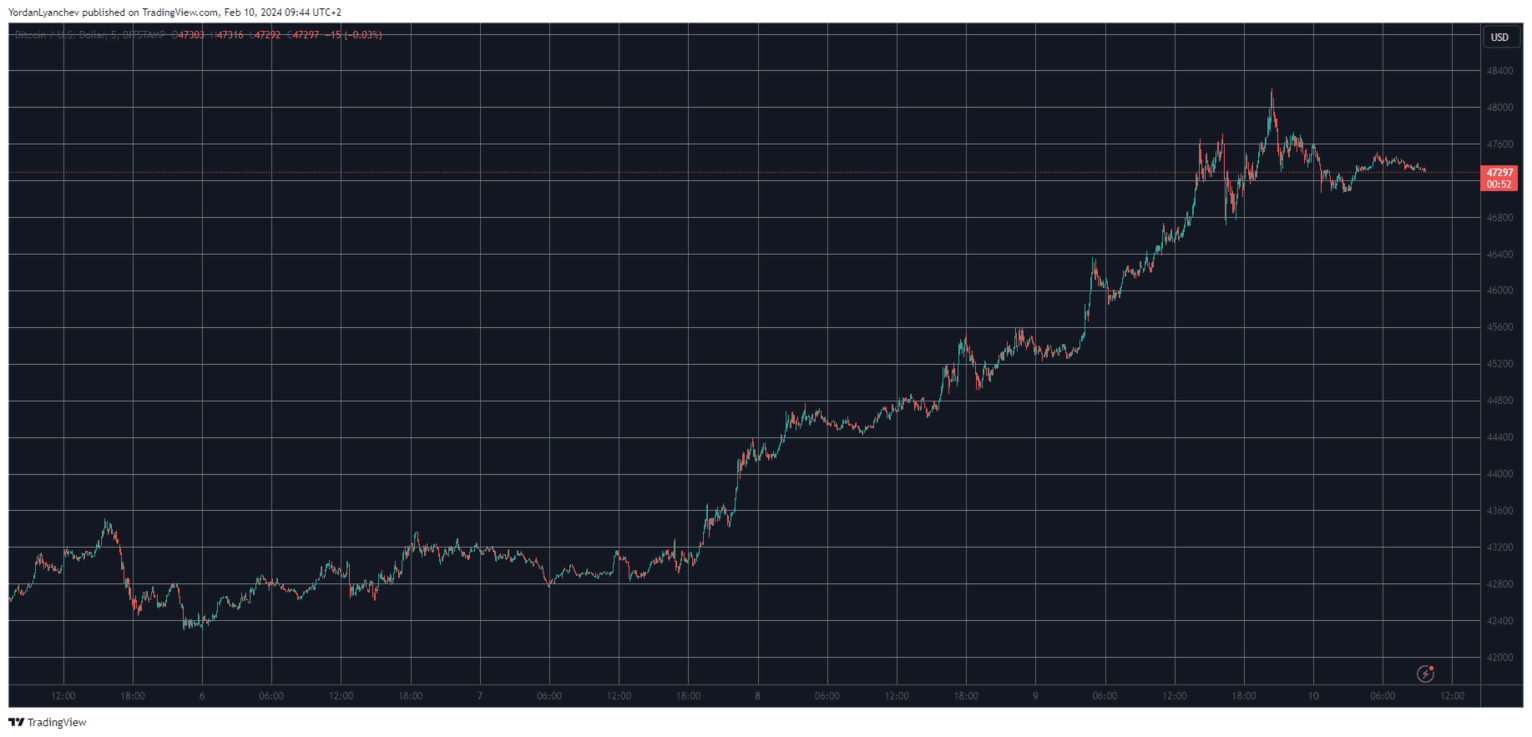

BTC on the Rise

A lot can change in the cryptocurrency market within a week, and this is what happened to BTC in the past seven days. Last weekend, the asset had recovered from the most recent declines and stood at around $43,000.

The next several days were highly uneventful, and Bitcoin remained at that level aside from a few brief and minor pumps and dumps. However, the landscape finally started to change Wednesday evening and especially Thursday morning when BTC broke above its tight trading range and jumped to $45,000.

Friday provided even more gains as Bitcoin first exploded above $46,000 and then soared past $47,000 and even briefly $48,000. In fact, the cryptocurrency charted a new monthly high of $48,200 late last night.

Since then, the asset has lost about a grand but still trades 2% up on the day. Its market capitalization has soared to $930 billion, and its dominance over the altcoins stands tall at 52%.

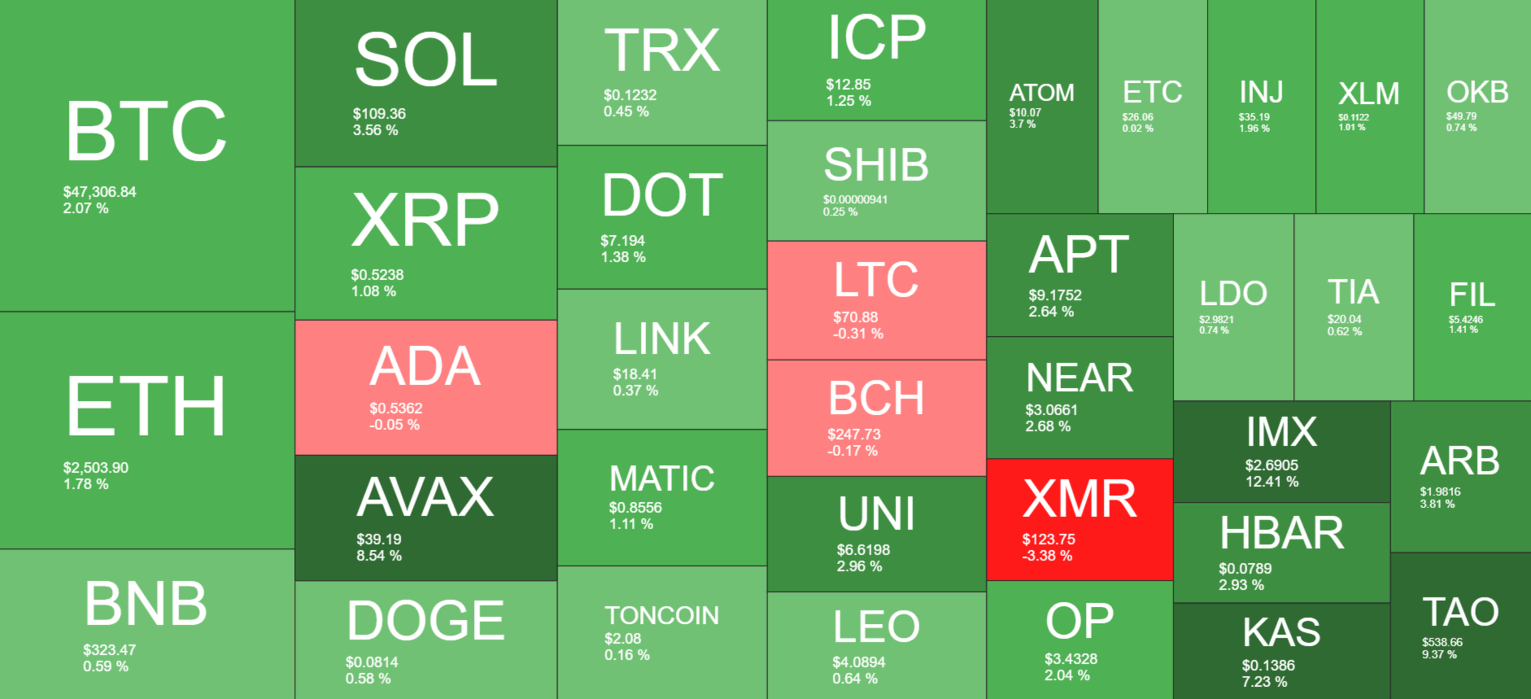

AVAX Steals the Spotlight

Most altcoins charted impressive gains over the past several days as well, and the landscape is quite positive on a daily scale now. Ethereum has added another 2% of value in the past 24 hours and now trades inches above $2,500. Solana has tapped $110 after a 3.5% daily jump.

Binance Coin, Ripple, Tron, Dogecoin, Polkadot, Chainlink, and Polygon are also with minor gains of around 1%.

Avalanche has soared the most from the larger-cap alts. AVAX is up by almost 9% and now trades close to $40. Further gains from the mid-cap alts come from the likes of IMX (13%), KAS (7%), and TAO (9%).

The total crypto market cap has added another $30 billion overnight and now sits close to $1.8 trillion on CMC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.