Bitcoin Broke Through US$64K, Ethereum US$3.5K

Bitget2024/03/04 05:07

By:Bitget

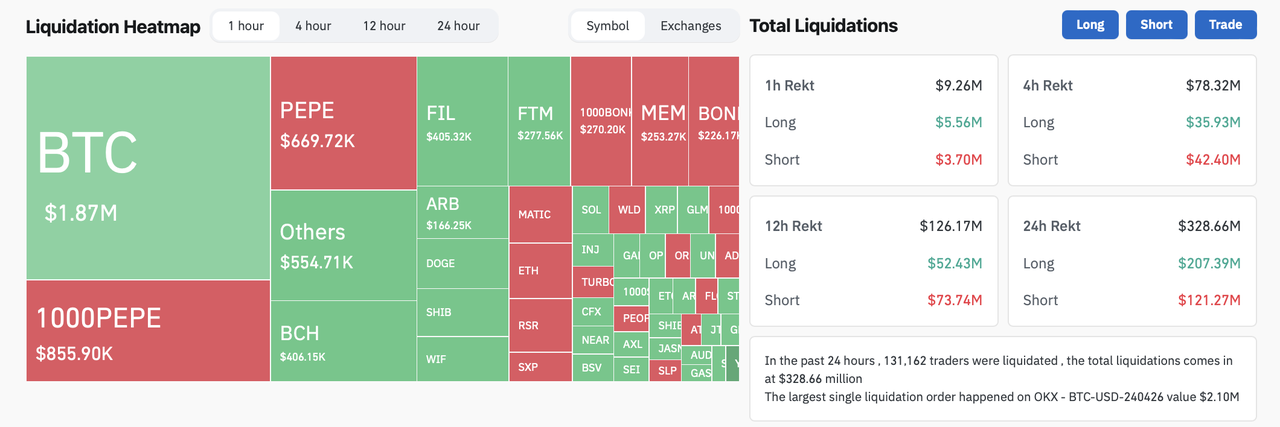

In the past 24 hours, BTC rose 3.47% to break through US$64,000. ETH gained 2.57% to cross US$3,500. Coinglass shows that in the past 24 hours, US$328.66 million has been liquidated, including US$207.39 million in long order. A total of 131,162 people have been liquidated.

Source: Coinglass

The U.S. dollar drifted weaker on Monday, pressured by lower Treasury yields, as traders waited for more crucial economic data for fresh clues on the timing of Federal Reserve interest rate cuts. The euro was firm following Friday's 0.33% advance, with a European Central Bank policy decision looming on Thursday. The yen stuck near the closely watched 150 per dollar level, as investors tried to assess whether the Bank of Japan's exit from its negative interest rate policy could happen as soon as this month.

Source: Yahoo Finance

Futures Market Updates

There's no significant difference in the Long/Short ratio in Bitcoin and

Ethereum futures

markets, but Longs are paying real high

funding rates for Shorts.

Bitcoin Futures Updates

Total BTC Open Interest: $28.70B (+5.43%)

BTC Volume (24H): $66.21B (+64.24%)

BTC Liquidations (24H): $22.93M (Long)/$38.69M (Short)

Long/Short Ratio: 50.84%/49.16%

Funding Rate: 0.0793%

Ether Futures Updates

Total ETH Open Interest: $11.60B (+1.27%)

ETH Volume (24H): $29.16B (+59.44%)

ETH Liquidations (24H): $13.92M (Long)/$19.28M (Short)

Long/Short Ratio: 50.95%/49.05%

Funding Rate: 0.0627%

Top 3 OI Surges

NFT: $1.35M (+156.95%)

GLM: $1.26B (+112.68%)

RATS: $30.73M (+87.10%)

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Market share plummets by 60%, can Hyperliquid return to the top with HIP-3 and Builder Codes?

What has Hyperliquid experienced recently?

Chaincatcher•2025/12/15 17:49

The European class struggle behind Tether's acquisition of Juventus

Bitpush•2025/12/15 17:39

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$85,909.29

-3.41%

Ethereum

ETH

$2,938.93

-4.92%

Tether USDt

USDT

$1.0000

-0.03%

BNB

BNB

$845.91

-4.29%

XRP

XRP

$1.89

-4.82%

USDC

USDC

$0.9998

-0.01%

Solana

SOL

$125.09

-4.06%

TRON

TRX

$0.2793

+0.98%

Dogecoin

DOGE

$0.1281

-4.54%

Cardano

ADA

$0.3816

-4.12%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now