Cathie Wood’s Ark Invest offloaded $45 million worth of Coinbase shares last week

Cathie Wood’s Ark Invest offloaded 217,305 Coinbase shares last week — valued at nearly $45 million as of market close on Friday.Ark also sold $11.4 million worth of Robinhood shares over the same period.

Investment manager Ark Invest offloaded 217,305 Coinbase shares from its Innovation exchange-traded fund (ARKK) last week, worth $44.7 million at current prices, according to the company’s latest trade filing.

Some 86,298 Coinbase shares, worth over $17 million, were sold from the fund on Wednesday alone as Ark Invest continued to rebalance its fund weightings amid the surge in COIN’s price this month. Ark also offloaded $16 million worth of Coinbase stock the week before last.

Coinbase stock traded for $205.77 at market close on Friday, up 22% for the week and 60% over the past month, according to TradingView. The stock has gained over 150% in a year but remains 40% down from an all-time high of $342.98 set during November 2021’s last crypto bull market peak.

COIN/USD price chart. Image: TradingView .

Coinbase stock hits multi-month highs despite heavy web traffic causing a temporary platform glitch

On Wednesday, COIN closed above the $200 mark for the first time since January 2022 — despite heavy web traffic causing a temporary $0 balance glitch on the crypto exchange as daily trading volume more than doubled to over $8.6 billion.

Coinbase is currently valued at $38.3 billion, according to The Block’s data dashboard .

Ark Invest sells $11.4 million worth of Robinhood shares

Ark Invest also offloaded 686,864 Robinhood shares from its Next Generation Internet (ARKW) and Fintech Innovation (ARKF) funds last week — worth around $11.4 million.

Shares in the stock and crypto trading app closed at $16.58 on Friday, gaining more than 12% for the week and 50% over the past month, per TradingView.

HOOD/USD price chart. Image: TradingView .

On Thursday, Robinhood’s self-custodial crypto wallet integrated token swaps on the Layer 2 network Arbitrum in addition to prior support for Ethereum and Polygon-based swaps.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

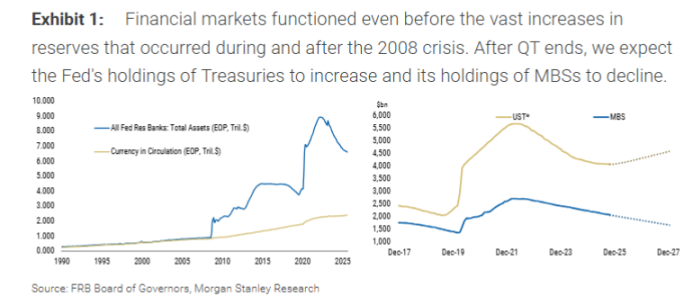

Morgan Stanley: Fed Ending QT ≠ Restarting QE, Treasury's Debt Issuance Strategy Is the Key

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.