Tether USD stablecoin supply inches close to 100 billion

The dollar-pegged stablecoin has a current supply at its all-time high range of around 99.5 billion.Tether, USDT’s issuer, recorded its highest net profit of $2.9 billion in the fourth quarter of 2023, according to its attestation report.

Its market capitalization, which multiplies supply by price, breached $100 billion at one stage as its value fluctuated. Tether claims on its website that all USDT tokens are pegged at a 1:1 ratio with the U.S. dollar.

Tether supply has grown alongside the rise of bitcoin and the general cryptocurrency market this year, led by major events such as the launch of spot bitcoin ETFs in the U.S. The dollar-pegged stablecoin had a $91.69 billion market capitalization on Jan. 1, according to CoinMarketCap data.

With the growth, Tether has further distanced itself from Circle’s runner-up stablecoin USDC , which has a circulation supply of 28.9 billion, according to The Block data.

Tether reached a record net profit of $2.9 billion in the fourth quarter of last year, with much of the profit coming from the appreciation of the company’s U.S. Treasuries, bitcoin and gold holdings, according to its attestation report.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

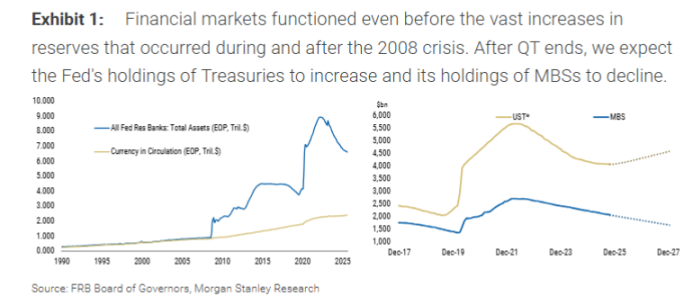

Morgan Stanley: Fed Ending QT ≠ Restarting QE, Treasury's Debt Issuance Strategy Is the Key

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.