Bitcoin spot ETF’s total net inflow yesterday was US$332 million, and the ETF’s net asset ratio reached 4.04%

According to SoSoValue data, the total net inflow of Bitcoin spot ETF yesterday (March 6th, Eastern Time) was $332 million.

Yesterday, Grayscale ETF GBTC had a single-day net outflow of $276 million. The Bitcoin spot ETF with the highest single-day net inflow yesterday was BlackRock's IBIT ETF, with a net inflow of $281 million. Currently, IBIT has a total historical net inflow of $9.45 billion. Following that is Fidelity's FBTC ETF, with a single-day net inflow of approximately $205 million and a total historical net inflow for FBTC reaching $5.55 billion.

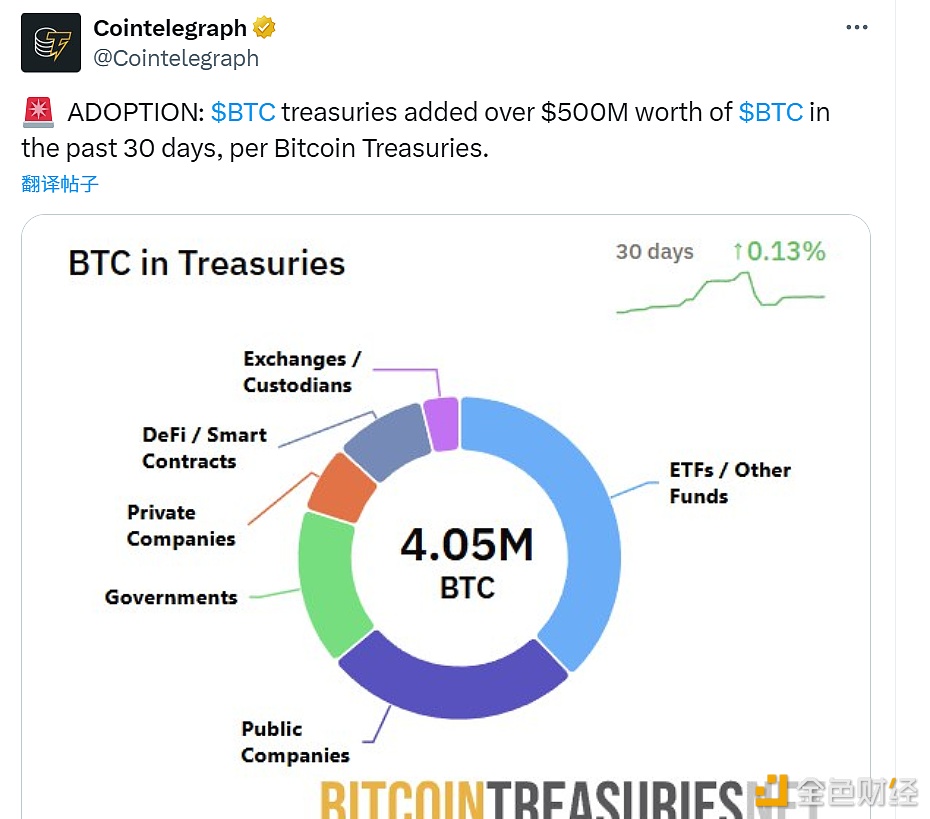

As of now, the total asset value of Bitcoin spot ETF is $53.11 billion, and the ETF's net asset ratio (market value as a percentage of total Bitcoin market value) is 4.04%. The cumulative historical net inflows have reached $8.89 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase

SOL treasury companies and ETF total holdings exceed 24.2 million SOL, equivalent to approximately $3.44 billions

Institutions increased their BTC holdings by over $500 million in the past 30 days