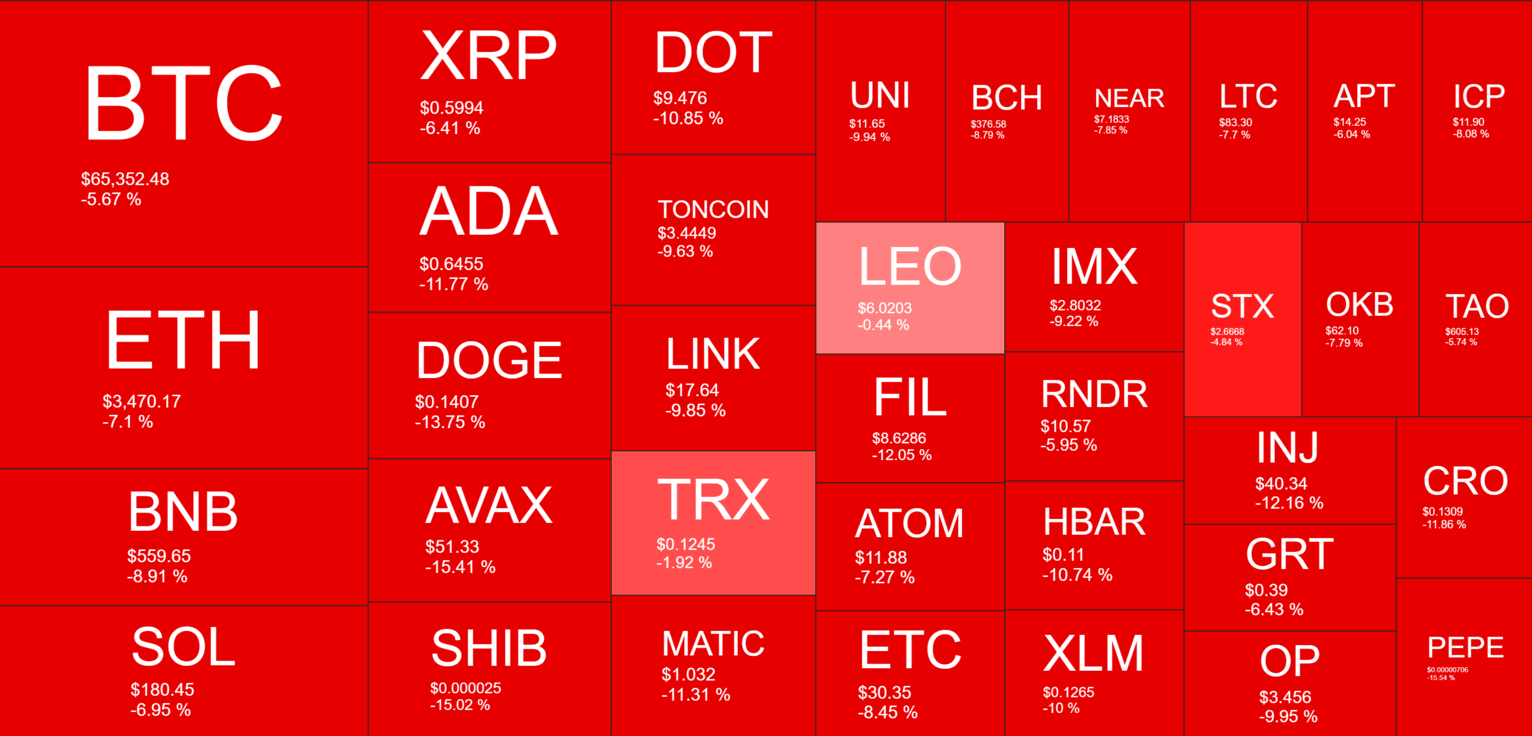

Bitcoin Slumps to 10-Day Lows, DOGE and SHIB Among the Double-Digit Losers (Weekend Watch)

Avalanche, Cardano, and Polygon have also dropped by double digits in the past 24 hours.

This weekend doesn’t resemble the previous few, which were a lot less volatile, as the primary cryptocurrency has dumped hard to a ten-day low of under $65,000.

The alternative coins are also well in the red, and the total crypto market cap has lost over $100 billion daily and more than $300 billion in the past few days.

BTC Dumps Hard

Monday began on a high note as BTC soared from $67,000 after retracing on Sunday evening to over $70,000 to register a new all-time high. The asset kept climbing in the following days and peaked at $73,800, which is the current ATH as of now.

It was reached on Thursday but was followed by a massive rejection . The bears finally took control of the market and pushed Bitcoin south to under $66,000 on Friday. BTC recovered some ground on Saturday and even challenged $70,000.

However, it didn’t see much success there and was quickly driven back down to $68,000. The last 12 hours or so saw another decline that led to BTC charting a ten-day low of $64,500 (on Bitstamp). Despite recovering around a grand since that low, Bitcoin is still more than 5% down on the day.

Its market capitalization has plunged to under $1.3 trillion, but its dominance over the alts has gained 0.5% daily.

Alts in Red Again

The altcoins have followed BTC on the way down with massive declines. Ethereum had been gaining a lot of traction until the Friday rejection and had exceeded $4,000. However, ETH lost that level two days ago and is now under $3,500 after another 7% daily drop.

Similar declines are evident from Binance Coin, Solana, and Ripple. Even more losses come from the likes of Avalanche (-15%), Shiba Inu (-15%), Dogecoin (-14%), Polygon (-11%), and Polkadot (-10%).

The mid- and lower-cap alts have also bled out in the past day. This has resulted in another decline of more than $100 billion for the total market cap, which is now down to under $2.6 trillion. This means that the metric has shed over $300 billion since Friday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

You’d better honestly ask yourself: which side are you on? Do you like cryptocurrency?