QCP Capital: Price volatility has been smaller over the past week, but bullish sentiment on BTC has increased

PANews reported on April 6 that QCP Capital, headquartered in Singapore, said that the Perp-June Basis of BTC and ETH has experienced unusually large sell-offs in the past two days, causing the entire forward curve to compress to 15-17%. They suspect the flow could be related to Ethena or could be large investors squeezing out high forward returns while reducing leveraged positions.

In addition, despite the smaller price fluctuations in the past week, QCP Capital said it still found that bullish sentiment on BTC has increased. The main reasons include increased inflows of BTC spot ETF funds, positive news such as traditional financial institutions joining Blackrock’s ETF, large purchases of BTC call options, BTC Leverage reduction and the upcoming BTC halving event.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

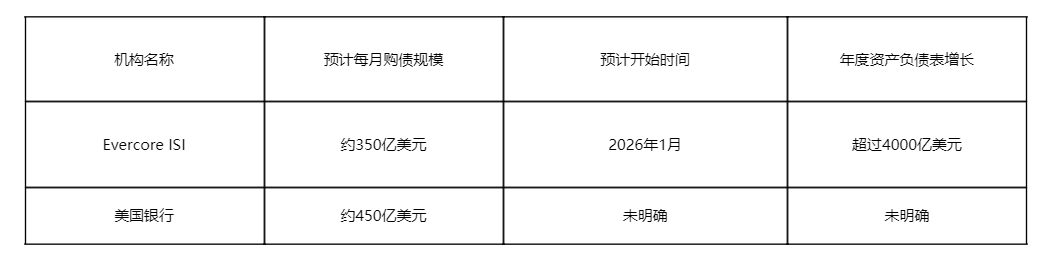

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

The U.S. financial system is undergoing its most significant transformation in a century.

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts