Bitget Research: Bitcoin Briefly Falls Below $69,000, TON Ecosystem Tokens Maintain Strong Performance

Bitget Research2024/04/10 08:02

By:Victoria & John

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

Yesterday, the market experienced a brief pullback, with BTC briefly dipping below $69,000. The wealth effect in the market has diminished, and the entire market is awaiting tonight's U.S. CPI inflation data.

-

Sectors with strong wealth creation effects: Bitcoin ecosystem and the Blue chip chains.

-

Top searched tokens and topics: Marginfi and Monad.

-

Potential airdrop opportunities: Aleo and Zerolend.

Data collection time: April 10, 2024, 4:00 AM (UTC)

1. Market Environment

Yesterday, Bitcoin briefly fell below $69,000 before rising back above $69,500, narrowing its 24-hour decline to 3%. In the past 24 hours, the entire market experienced liquidations totaling $208 million, including $124 million in long positions and $83.86 million in short positions, with a majority being long liquidations. US stocks fluctuated, and the entire market is awaiting tonight's U.S. CPI inflation data.

Yesterday, a total of 9 spot Bitcoin ETFs (including Grayscale’s GBTC) saw a net reduction of 1476 BTC, resulting in a net outflow of approximately $101.7 million. Grayscale reduced its BTC holdings by 2990 BTC, resulting in a net outflow of approximately US$205.9 million. The wealth effect has recently been more pronounced in some new tokens such as SAGA which saw a notable increase after its BN listing, and SHDW which also enjoyed significant gains following its Coinbase listing. Investors are encouraged to keep an eye on new token listings and the Bitcoin ecosystem's market trends as the Bitcoin halving approaches.

2. Wealth Creation Sectors

2.1 Sector Movements — Bitcoin ecosystem (CKB and STX)

Main reason: With the Bitcoin halving approaching, BTC ecosystem projects have become the focus of market attention. On the 15th of this month, BTC will undergo the Nakamoto Upgrade, with significant announcements expected around the halving.

Gainers: In the past 24 hours, CKB broke its one-year high, reaching $0.034.

Factors affecting future market conditions:

-

The introduction and effectiveness of new and existing Bitcoin ecosystem projects around the halving, and the actions of major funds during this period will directly impact the sector's trend. Additionally, the RGB++ protocol developed by CKB has been very popular recently. It's an asset issuance protocol within the BTC ecosystem with a good wealth effect. Stacks' ecosystem development has been solid, and the overall segment TVL continues to reach new heights. The network's performance will significantly improve after the Nakamoto Upgrade. The project is a solid BTC L2 target to buy the dip in the near future.

2.2 Sector Movements — Blue chip blockchains (FTM and TON)

Main reason: As BTC fluctuates near the $70,000 mark, the wealth effect from the market has extended to the tokens of major chains. Meanwhile, the TON ecosystem actively engaged with the community during the Hong Kong Web3 Festival. This activity circulates the wealth effect within its ecosystem, creating potential buying pressure for the assets of this chain.

Gainers: FTM returns to fluctuate near $1; TON reaches a new all-time high, briefly reaching $7.

Factors affecting future market conditions:

-

Impressive data all around: Since February, TON's network activity has gradually increased, with over 800,000 active addresses in the past week, representing a 97.8% increase from the previous month. Less than halfway through April, TON's monthly active users have already surpassed 1 million, 121% higher than the entire March.

-

Continuous efforts in ecosystem development: At the Web3 festival held in Hong Kong, TON once again highlighted its unique advantages in "social scenarios," introducing representative projects within the TON ecosystem. For instance, the Web3 pet game Catizen surpassed 1.3 million players two weeks after launching on TON, with daily active users reaching 210,000 and more than 1.7 million on-chain transactions. The official network of Fantom Sonic is scheduled to launch in spring 2024. Investors can pay attention to the positive developments and consider investing as appropriate.

2.3 Sectors to Focus on Next — Memecoins (BOME, MEME, and WIF)

Main reasons: 1. Vitalik Buterin also stated at the Hong Kong Web3 Festival that memecoins have value to the ecosystem and publicly supported the issuance of memecoins; 2. As the Bitcoin halving approaches and BTC's rally attracts significant external capital, memecoins are expected to see favorable price movements.

Factors affecting future market conditions:

-

Traffic and exposure: The value of memecoins mainly lies in their ability to create a wealth effect. If memecoins continue to trend upward and receive media exposure, it will attract more users to speculate, which in turn provides solid support for their prices.

-

Project narratives: Memecoin projects will continue to create trading opportunities through narratives. Users are advised to pay attention to AMA events hosted by memecoin projects. If a project announces plans for promotions, product updates, or token updates during an AMA, it could be a good opportunity to enter the market.

3. Top Searches

3.1 Popular DApps

Marginfi: In its latest post on X, Marginfi announced the upcoming release of a high-yield decentralized stablecoin, YBX, supported by Solana's ecosystem LST. It will offer yield from Solana staking (approximately 8%), MEV capture mechanism (using Jito's MEV client with LST), and lending rates (in the form of marginfi). Marginfi's credit promotion is also ongoing, and YBX may make further moves with the points promotion in the future. Users should keep an eye on this, as participating in YBX could likely lead to airdropped credits.

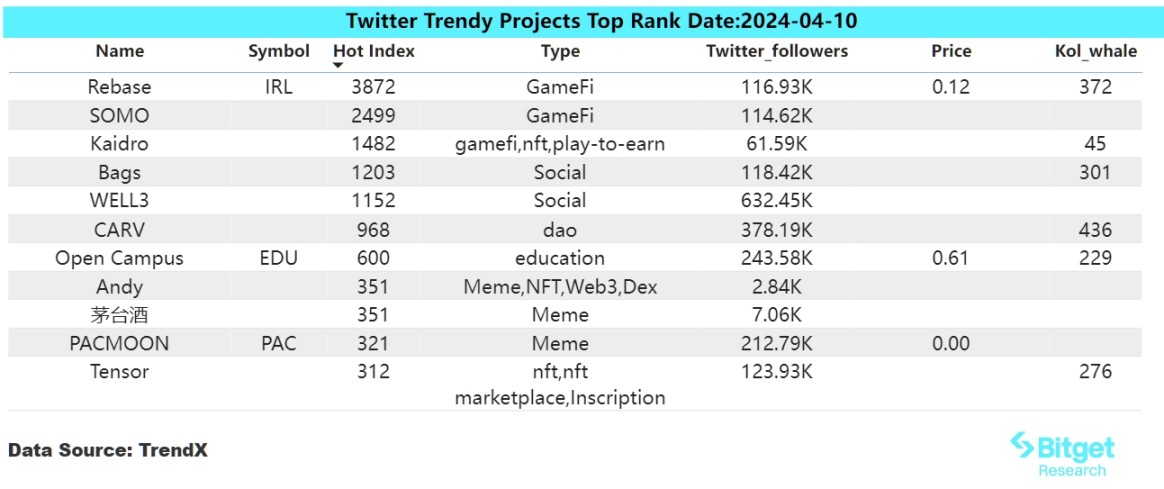

3.2 X (former Twitter)

Open Campus: Open Campus is a community-driven educational protocol and a leading project in the education segment. On April 9, the project launched the L3 Rollup network, EDU Chain, where it aims to build a vibrant DApp ecosystem. Currently, with a market cap of $1 billion, there is still considerable room for growth. Users are encouraged to consider monitoring the recent price changes.

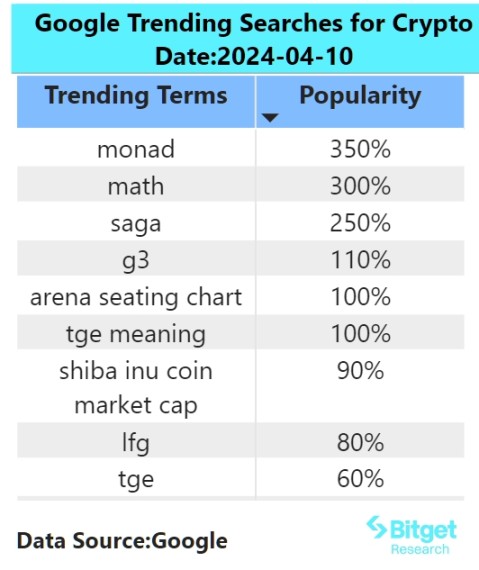

3.3 Google Search (global and regional)

Global focus:

Monad: Monad has completed the largest cryptocurrency domain financing to date in 2024, raising $225 million. The round was led by Paradigm, with participation from IOSG Ventures, SevenX Ventures, Electric Capital, and Greenoaks. Monad is one of the representative projects of the parallel EVM concept, achieving parallel execution where multiple transactions can run in parallel independently. This process generates pending results that track the inputs and outputs (state changes) of each transaction. These pending results are then committed one by one in the original order of transactions, ensuring consistency with serial execution. Given the chain's tendency to airdrop for interactions, Monad's final airdrop amount is likely to be substantial.

Regional focus:

(1) No significant trends in Africa and Asia:

The interest in these regions is more dispersed, featuring topics such as Meme, Restaking, RWA, and some recently launched cryptocurrencies making it to the hot searches list. This situation indicates a divergence in the overall market. As the broader market is relatively stable, sector rotation begins to occur.

(2) Increased focus on AI in English-speaking countries and Europe:

AI continues to be a hot topic with ongoing developments. Dexter, the founder of Whales Market, has officially launched the website for his AI project, gm.ai, and is about to introduce an official gateway to the gmAI ecosystem. Additionally, the decentralized AI network project Ritual received millions in investment from Polychain Capital, further heightening the overall attention on AI.

4. Potential Airdrop Opportunities

Aleo – Substantial financing, announced airdrop

Aleo is a Layer 1 privacy blockchain utilizing zkSNARKs technology for high scalability, supporting a large number of transactions without the need to process all data. Aleo has secured $228 million in financing from leading investment firms such as a16z and Coinbase Ventures, showcasing a strong investment background and financial strength.

The team has made public their plans to conduct an airdrop in the first quarter of this year, distributing 25 million Aleo tokens to developers, white hat testers, provers, and validators.

How to participate: 1. Go to the Leo wallet, create a wallet, and then visit the official faucet to claim tokens; 2. Use the testnet cross-chain bridge to bridge the received assets; 3. Interact on Aleoswap.

Zerolend – Imminent token launch, quick airdrop realization

ZeroLend is a classic lending project, supporting zkSync, Manta Network, Blast, Linea, and Ethereum, allowing users to deposit supported tokens and earn profits. In February this year, ZeroLend completed a $3 million seed round founding at a valuation of $25 million, with participation from Momentum 6, Blockchain Founders Fund, Morning Star Ventures, and others.

The governance token ZERO is planned to be launched on April 29, with the airdrop promotion still ongoing. Depositing or lending assets will qualify for airdrop token rewards.

How to participate: 1. Connect your wallet to ZeroLend; 2. Deposit ETH/USDT/USDC assets into the lending market; 3. Repeatedly lend any of the aforementioned assets.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

CandyBomb x IR: Trade to share 600,000 IR

Bitget Announcement•2025/12/17 09:00

CandyBomb x THQ: Trade futures to share 133,333 THQ!

Bitget Announcement•2025/12/17 08:00

[Initial listing] Bitget to list Theoriq (THQ). Grab a share of 3,016,600 THQ

Bitget Announcement•2025/12/16 14:30

CandyBomb x VSN: Trade VSN, XRP or SOL to share 2,931,200 VSN

Bitget Announcement•2025/12/16 11:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$86,608.58

-0.34%

Ethereum

ETH

$2,919.87

-0.73%

Tether USDt

USDT

$0.9998

-0.01%

BNB

BNB

$856.62

-0.68%

XRP

XRP

$1.91

-0.02%

USDC

USDC

$0.9999

+0.00%

Solana

SOL

$126.56

-1.45%

TRON

TRX

$0.2792

-0.08%

Dogecoin

DOGE

$0.1299

-0.72%

Cardano

ADA

$0.3776

-2.50%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now