Bitcoin ( BTC ) circled $65,500 at the April 15 Wall Street open as traders licked their wounds after the weekend BTC price washout.

Bitcoin eats up fresh bid liquidity as BTC price fights for $65K

Bitcoin is in no mood for a comprehensive BTC price recovery as the week gets underway.

BTC price stems volatility after weekend dip bounce

Data from Cointelegraph markets Pro and TradingView tracked a comparatively calm start to the United States “TradFi” trading week.

The lack of volatility at the time of writing contrasted firmly with scenes from the weekend in which BTC/USD dropped to near $61,000.

This came in the form of a knee-jerk reaction to geopolitical instability in the Middle East, with Bitcoin avoiding some of the deeper losses that hit altcoins.

Now, traders turned to what many saw as a difficult period to navigate in the short term. Bitcoin’s block subsidy halving was just days away — an event that traditionally brings unsettled trading conditions in its own right.

“With the halving coming up in less than a week, I won't be surprised to see a pump to the halving followed by a dump after the halving to shakeout weak hands before the next leg up,” Keith Alan, co-founder of trading resource Material Indicators, wrote in part of commentary on X (formerly Twitter).

“Of course escalating geopolitical tensions might alter the trajectory, so certainly tuned into that.”

Alan highlighted changing exchange order book liquidity conditions, suggesting that overhead resistance above $70,000 would remain in place until bulls could lure bids closer to current spot price.

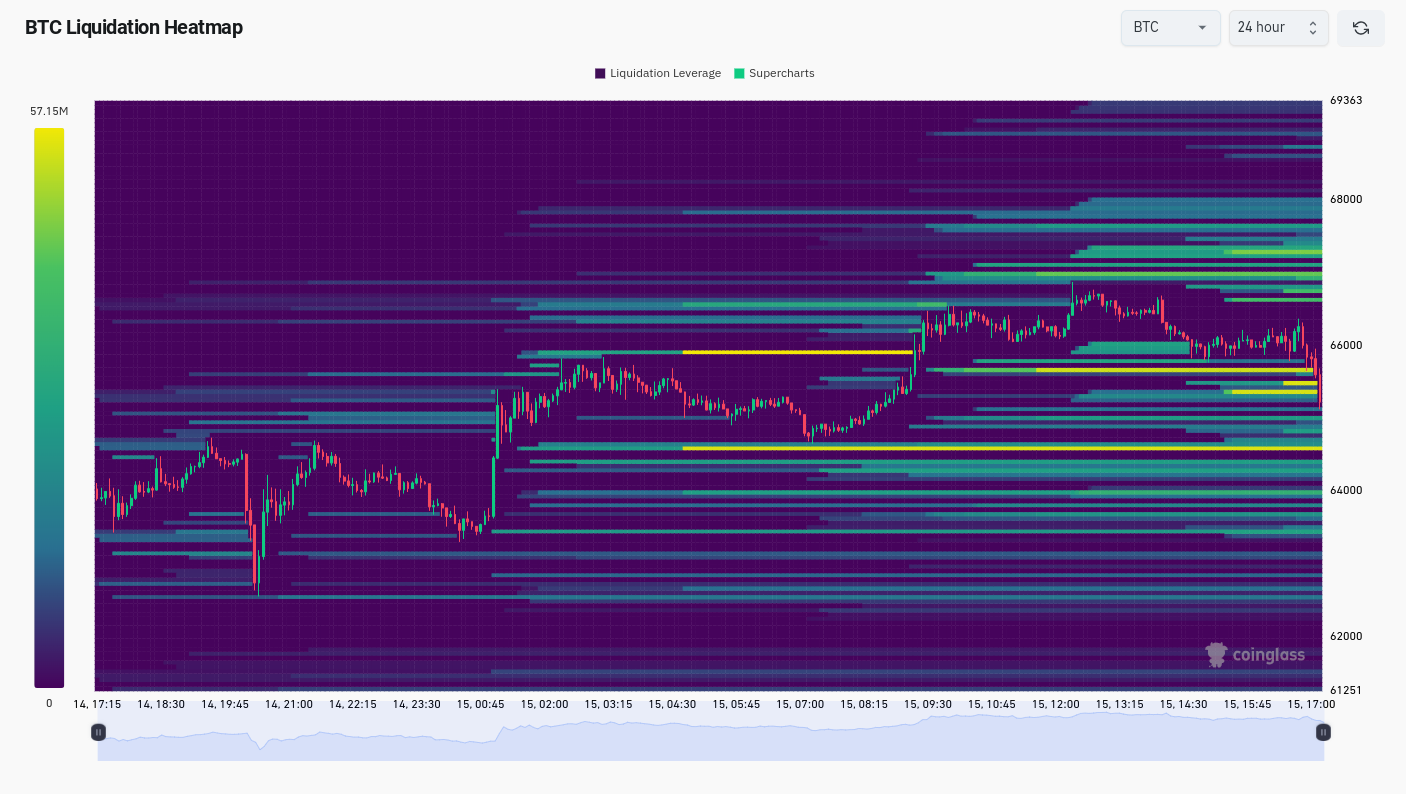

Data from monitoring resource CoinGlass meanwhile showed Bitcoin eating into bid liquidity at and below $66,000 at the time of writing.

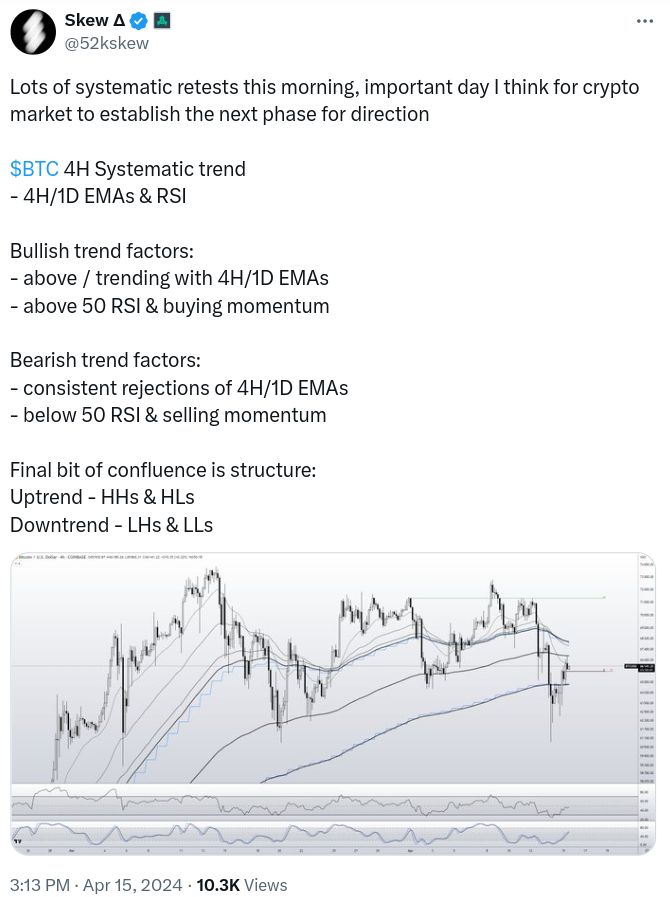

“Lots of systematic retests this morning, important day I think for crypto market to establish the next phase for direction,” popular trader Skew meanwhile continued.

Skew highlighted the need to preserve exponential moving averages (EMAs) on both 4-hour and daily timeframes. Bitcoin’s relative strength index (RSI) further needed to return above the central 50 level.

Bitcoin ETF buyers under the microscope

With news that Hong Kong had approved both spot Bitcoin and Ether ( ETH ) exchange-traded funds (ETFs), attention once more focused on their U.S. counterpart.

Given the drop over the weekend, Skew was among those concerned that investors might vote with their feet on the first trading day of the week.

“Red premarket, going to be keeping an eye on these today and potential price impact of spot flows,” he wrote in part of an X post about spot ETF markets.

As Cointelegraph reported , overall ETF inflows have slowed considerably versus their peak in recent weeks.

The day meanwhile saw only a modest outflow from the Grayscale Bitcoin Trust (GBTC), coming in at an estimated 1,600 BTC ($105 million).

The data, compiled by crypto intelligence firm Arkham, was uploaded to X by popular trader Daan Crypto Trades, who suggested that GBTC flows had become less important as a metric.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?