Bitcoin records worst monthly performance since FTX collapse, interest rate outlook becomes a drag

The prospect of "higher and longer" interest rates is putting pressure on the cryptocurrency market, with Bitcoin experiencing its largest monthly decline since the collapse of SBF's FTX empire in November 2022. Bitcoin fell nearly 16% in April, and the Bitcoin and Ethereum ETFs launched in Hong Kong on Tuesday failed to provide momentum. Increasing evidence suggests that the Federal Reserve may signal a delay in interest rate cuts after this week's meeting. Chris Weston, research director at Pepperstone, said the recent rise in US Treasury yields and real interest rates is putting pressure on gold, Bitcoin, and the US stock market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

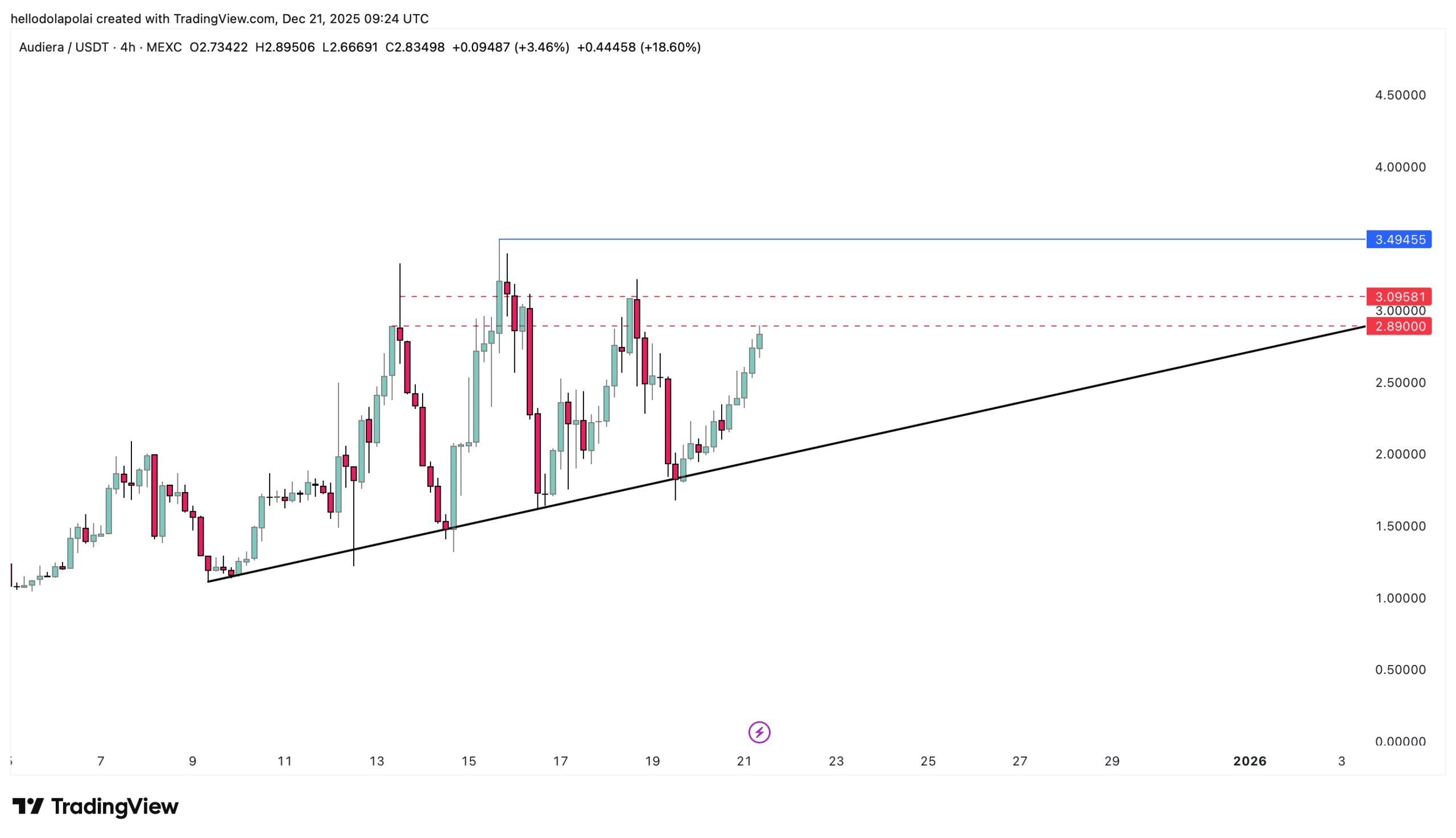

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreDTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low