Daily crypto liquidations surge as bitcoin price retreats from $70,000 again

Bitcoin’s price briefly surpassed the $70,000 threshold; however, it quickly fell by 3.5% to around $67,000.The past day’s price fluctuations resulted in a spike in long crypto positions getting liquidated on centralized exchanges.Ether reached a new monthly peak of $3,937 before retracing to $3,710 at the time of writing.

Bitcoin BTC -3.070% has experienced a decline from above $70,000, with the high volatility triggering an increase in liquidations.

On Tuesday, Bitcoin’s price briefly surpassed the $70,000 threshold; however, it quickly fell by 3.5% to around $67,000—causing a significant number of leveraged position liquidations throughout the market.

The largest digital asset by market cap is currently changing hands for $67,400, according to The Block’s price page . Bitcoin's price is 8.5% short of the all-time high of $73,737 made on March 14.

Amid the approval of a spot Ethereum ETH -3.38% ETFs yesterday, this volatility led to the liquidation of over $378 million in leveraged positions over the past 24 hours—with long positions accounting for $295 million of that total, according to CoinGlass data .

Ether was the leading cryptocurrency in these liquidations, with over $147 million liquidated, of which $105 million were long positions.

Liquidations occur when a trader’s position is automatically closed because they lack sufficient funds to maintain their position, often due to market movements that deplete their initial margin or collateral.

Meanwhile, the price of ETH has experienced significant volatility over the past day, reaching a new monthly peak of $3,937 before retracing to $3,710 at the time of writing. Nonetheless, the price of ether has risen over 20% since the beginning of the week.

Major altcoins such as SOL, the native coin of the Solana network, dropped slightly to $167, marking a daily drawdown of 4%.

The GM 30 Index , representing a selection of the top 30 cryptocurrencies, has increased by 3.8% to 143 during the past 24 hours.

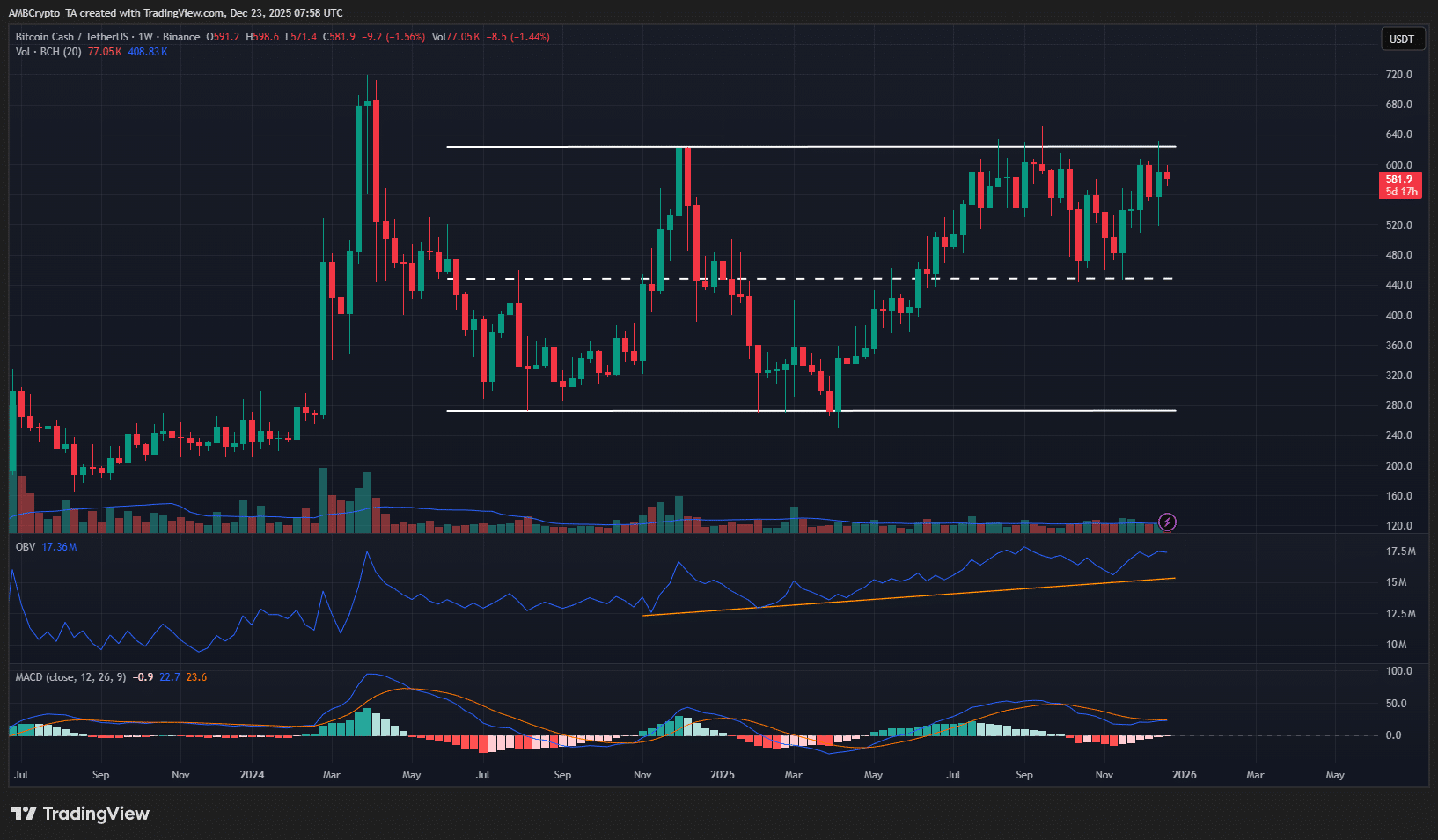

Bitcoin price chart | Source: The Block

Spot Ethereum ETFs approved

On Thursday, the U.S. Securities and Exchange Commission (SEC) approved eight spot Ethereum ETFs from BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark Invest, Franklin Templeton and Invesco Galaxy, just four months following its authorization of spot Bitcoin ETFs.

A spot Ethereum ETF tracks the market price of ether directly, allowing investors to invest in the asset without holding the cryptocurrency themselves. This development was evident in the market dynamics of Grayscale’s Ethereum Trust, which saw its discount decrease from -24% to -6% just before the approval.

While the 19b-4 forms have been approved, the spot Ethereum ETF issuers' S-1 registration statements still need to go effective before trading can commence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TaskOn Brings White Label Services and CEX Mode in Latest Update

Cardano Price Prediction 2026: DeepSnitch AI Shows 400% Rally Potential as Ghana Legalizes Crypto Trading

Solana: Short-term pain, long-term hope? SOL faces liquidation test

Bitcoin Cash – Why buying BCH before a $624 breakout is risky