Analyst: The abnormal flow of spot Bitcoin ETF seems to be affected by investors' uncertainty about the Fed's rate hike path

Golden Finance reported that BTC Markets cryptocurrency analyst Rachael Lucas said that the abnormal flow of spot Bitcoin ETFs seems to be affected by investors' uncertainty about the Fed's interest rate hike path, especially when the United States is expected to release a major economic report on May 31. If US inflation data exceeds expectations and personal income and spending trends rise, it may curb investors' optimism that the Fed may cut interest rates in September. A more hawkish Fed may have a negative impact on demand for risky assets, including Bitcoin and related ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The total number of institutions currently holding Bitcoin has reached 355.

SOL treasury companies and ETFs hold over 24.2 million SOL, worth approximately $3.44 billion.

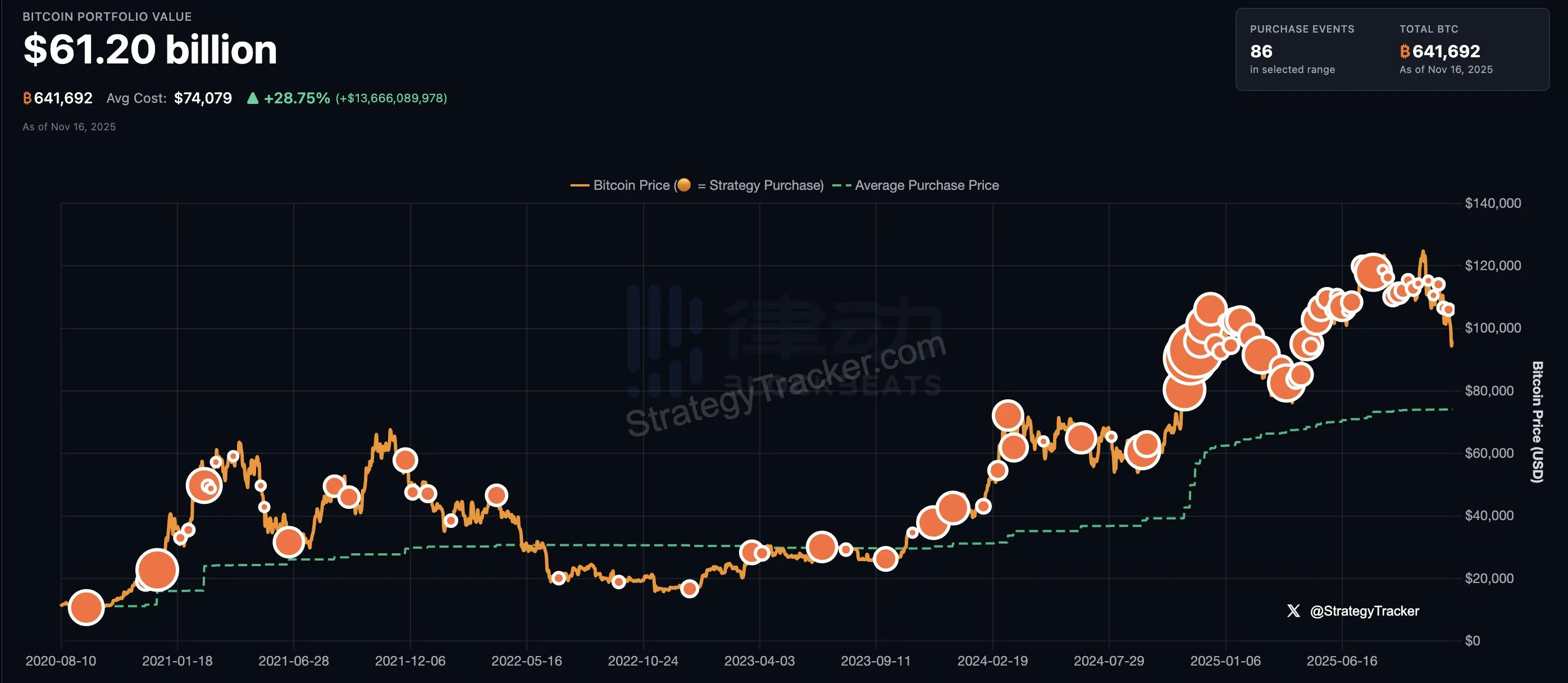

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase