XRP price jumps 5% as Bitcoin continues to fall

Amid the correction in the cryptocurrency market, altcoin XRP has shown signs of recovery.

The seventh-largest cryptocurrency by market capitalization, with a valuation of over $28.8 billion, is trading at $0.517 at press time after a surprising 5.75% rise in the last 24 hours and $1.57 billion in trading volume.

Before the price spike XRP fell 5% in one month, ranging from $0.54 to $0.46.

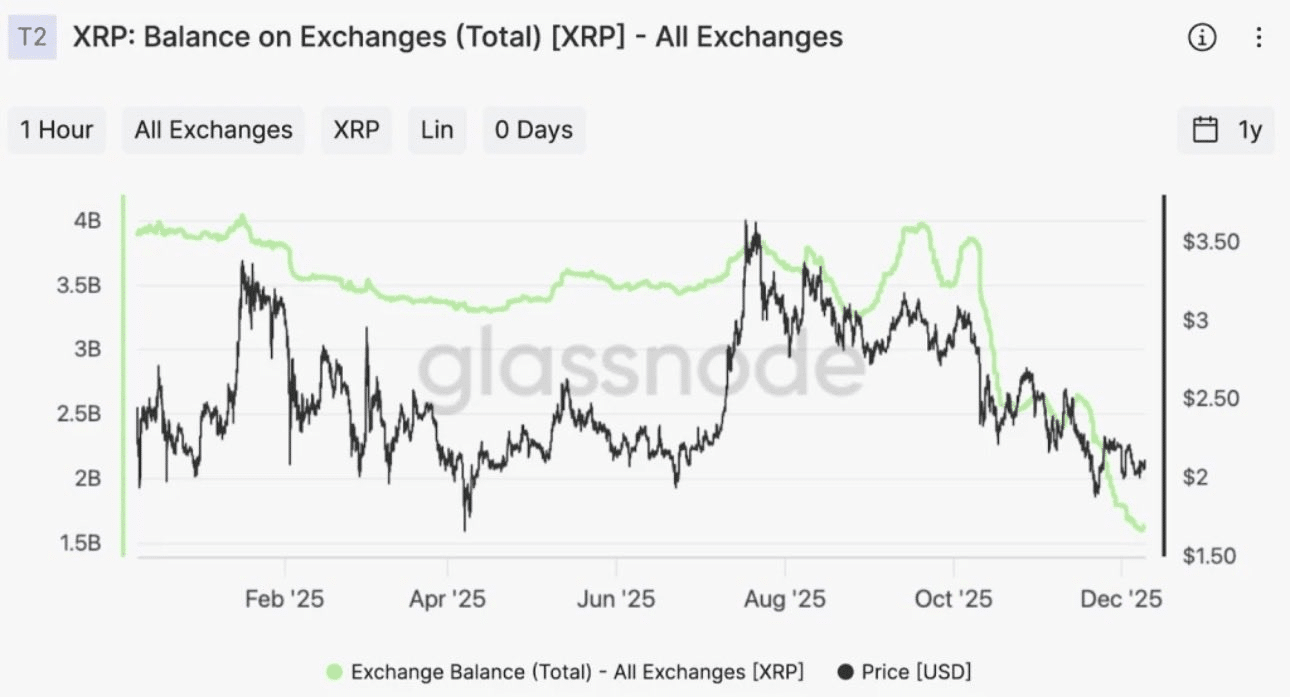

One major XRP investor drew considerable attention to himself by transferring around 31 million coins to a centralized exchange platform during one of these recent price drops, raising concerns among investors.

READ MORE:

This is why altcoin prices fell last weekAnother whale just recently transferred 30.35 million XRP to two centralized exchanges.

This transaction, valued at $14.5 million, underscores the selling pressure that could push the altcoin price back down, even as XRP surges while the entire market is in the red.

Technical indicators for XRP are mixed: MACD is showing bearish sentiment, while RSI readings are closing at midpoints, indicating mixed buying and selling forces between bulls and bears, respectively.

Also, if the bullish momentum continues, XRP could head towards $0.70 or possibly $1 in the next phase of the bull market.

Alternatively, whether support levels like $0.49 and $0.45 could stabilize the price amid market uncertainty.

At the same time, Bitcoin was trading at $65,500 after a 2% drop in the last 24 hours, continuing the correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Reasons why XRP is poised to lead 2026 DESPITE drop below $2

BTC Exodus: Bitcoin ETFs See $825 Million in Outflows Over Five Trading Days

Bitcoin Nears Record Stretch of 1079 Days Without Heavy Selling as Market Holds Steady at High Levels

Ethereum’s TVL Could Explode in 2026 as Stablecoins and RWAs Expand