Why the US Presidential Election May Matter for Bitcoin Price

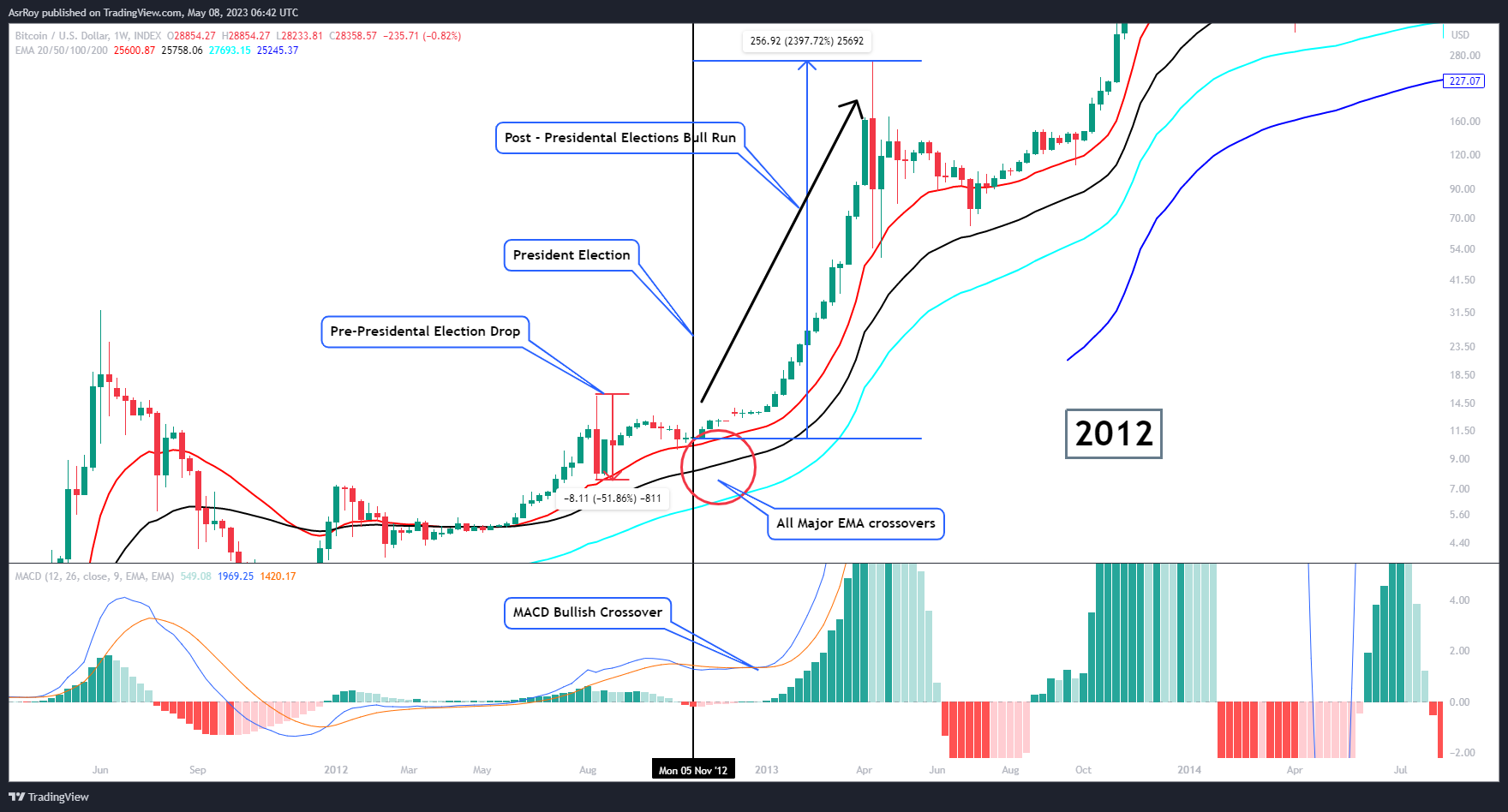

Crypto analyst Aditya Siddhartha links one of the most significant Bitcoin (BTC) uptrends that occurred in 2012 to the US presidential election.

Сидхарта noted , that Bitcoin's 2012 bull run was preceded by a significant 52% price drop. However, after the bullish MACD crossover and all the major exponential moving average (EMA) bullish crossovers, the market started to gather momentum, starting an upward march.

In 2012, the MACD and EMA indicators provided positive signals, boosting investor confidence and fueling a surge in demand for BTC. This led to a bull run after the presidential election, with the price of Bitcoin increasing by an impressive 11,800%.

Similarly, in 2016, the price of Bitcoin fell 41% before the presidential election. After the bullish MACD crossover and all major bullish EMA crossovers, the market gained momentum, leading to a new uptrend.

READ MORE:

How Exchange Traded Funds Can Manipulate Bitcoin PriceAfter the election, the price of Bitcoin rose by 2,800%, which was driven by increased demand from investors and growing awareness of Bitcoin's potential as a store of value and digital asset.

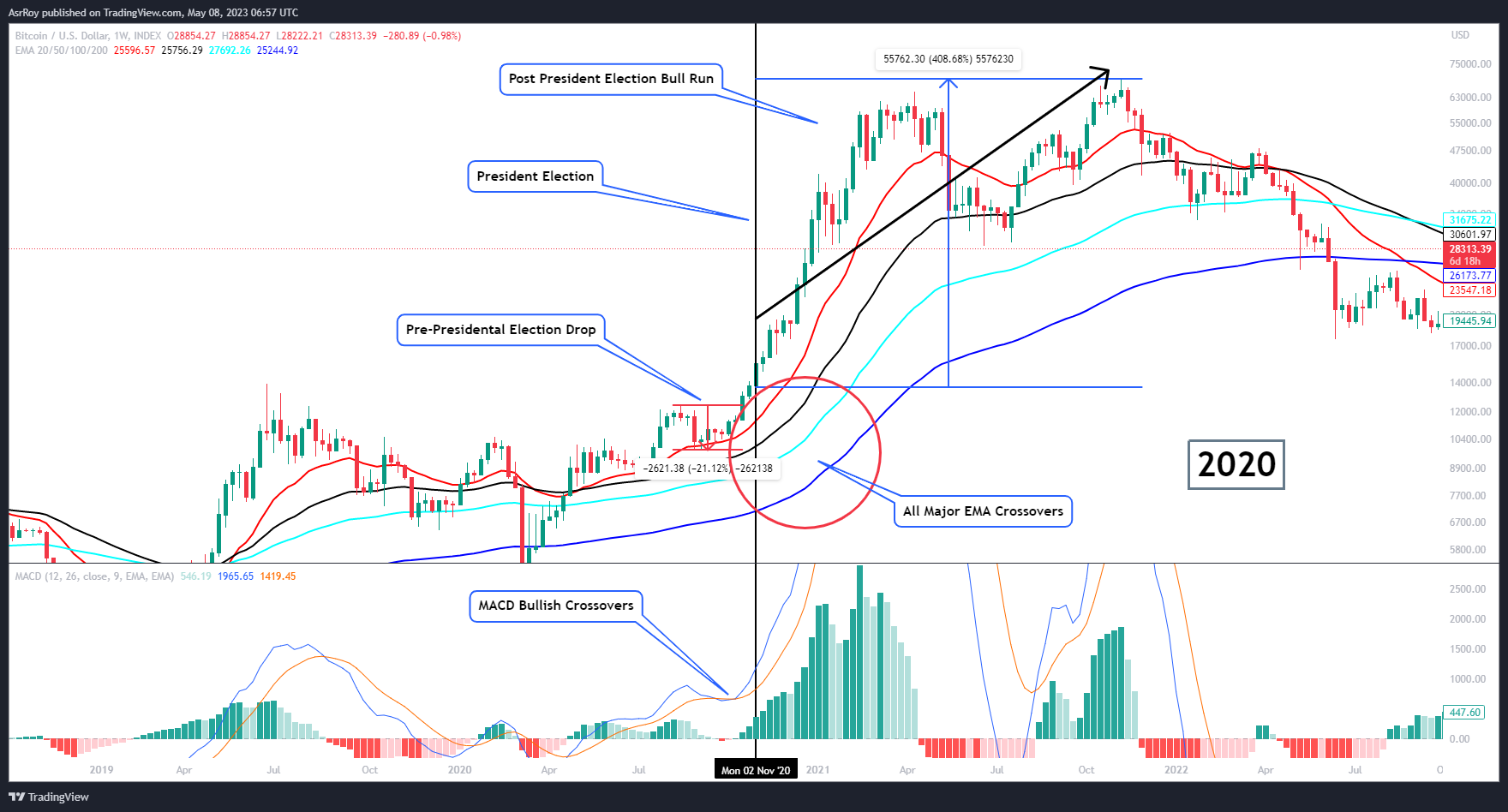

In 2020, Bitcoin saw a 22% drop before the presidential election, which was largely due to the uncertainty surrounding the election results and their potential economic impact. After the election, however, the price of Bitcoin saw a 410% increase.

After the elections scheduled for this year, the analyst predicts that the MACD bullish crossover and all major EMA bullish crossovers will once again signal positive market movements, increasing investor confidence and demand for Bitcoin. He expects that after the election, the price of Bitcoin could rise to the $180,000-$200,000 range.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Crypto Market Watch (11.10-11.17): Extreme Market Panic, Privacy Sector Stands Out

Last week, both the open interest and trading volume of altcoin contracts on exchanges declined, reflecting a continued lack of liquidity following the sharp drop on October 11.

Multiple grand rewards are coming, TRON ecosystem Thanksgiving feast begins

Five major projects within the TRON ecosystem will jointly launch a Thanksgiving event, offering a feast of both rewards and experiences to the community through trading competitions, community support activities, and staking rewards.

Yala Faces Turmoil as Stability Falters Dramatically

In Brief Yala experienced a dramatic 52.9% decline, challenging its stability. Liquidity management emerged as a critical vulnerability in stablecoins. Investor skepticism deepened despite major fund support.