Bitcoin (BTC) Faces Supply Overhang Challenges in June 2024

Bitcoin (BTC) is grappling with significant supply overhang challenges as of June 2024, according to a recent market commentary by Grayscale. This overhang is reportedly influencing the cryptocurrency's market performance, adding to the complexities of an already volatile digital asset market.

Market Dynamics and Supply Overhang

The supply overhang refers to a situation where the supply of Bitcoin available for trading exceeds the demand, leading to downward pressure on its price. This phenomenon can occur due to various factors, including large amounts of Bitcoin being moved to exchanges, increased mining activities, or significant sell-offs by major holders.

Grayscale's analysis highlights that this supply overhang is a critical factor contributing to Bitcoin's recent price fluctuations. The commentary notes that while Bitcoin has historically shown resilience, current market conditions present unique challenges.

Influence of Macroeconomic Factors

In addition to the supply overhang, macroeconomic factors are also playing a substantial role in shaping Bitcoin's market dynamics. Rising interest rates, regulatory developments, and global economic uncertainties are contributing to the overall market sentiment. Investors are closely monitoring these factors, which are likely to influence their trading and investment decisions.

Grayscale's report emphasizes the importance of understanding these macroeconomic variables and their interplay with Bitcoin's supply dynamics. The combination of these elements is creating a complex environment for traders and investors alike.

Future Outlook

Looking ahead, the future of Bitcoin remains uncertain as it navigates these supply and demand challenges. Analysts suggest that any significant shifts in the macroeconomic landscape or changes in regulatory policies could potentially alter the current market dynamics.

Grayscale's commentary underscores the need for continuous monitoring of both internal and external factors affecting Bitcoin. As the cryptocurrency market evolves, staying informed and adapting to new developments will be crucial for market participants.

For more detailed insights, refer to the original market commentary by Grayscale here .

Image source: ShutterstockDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

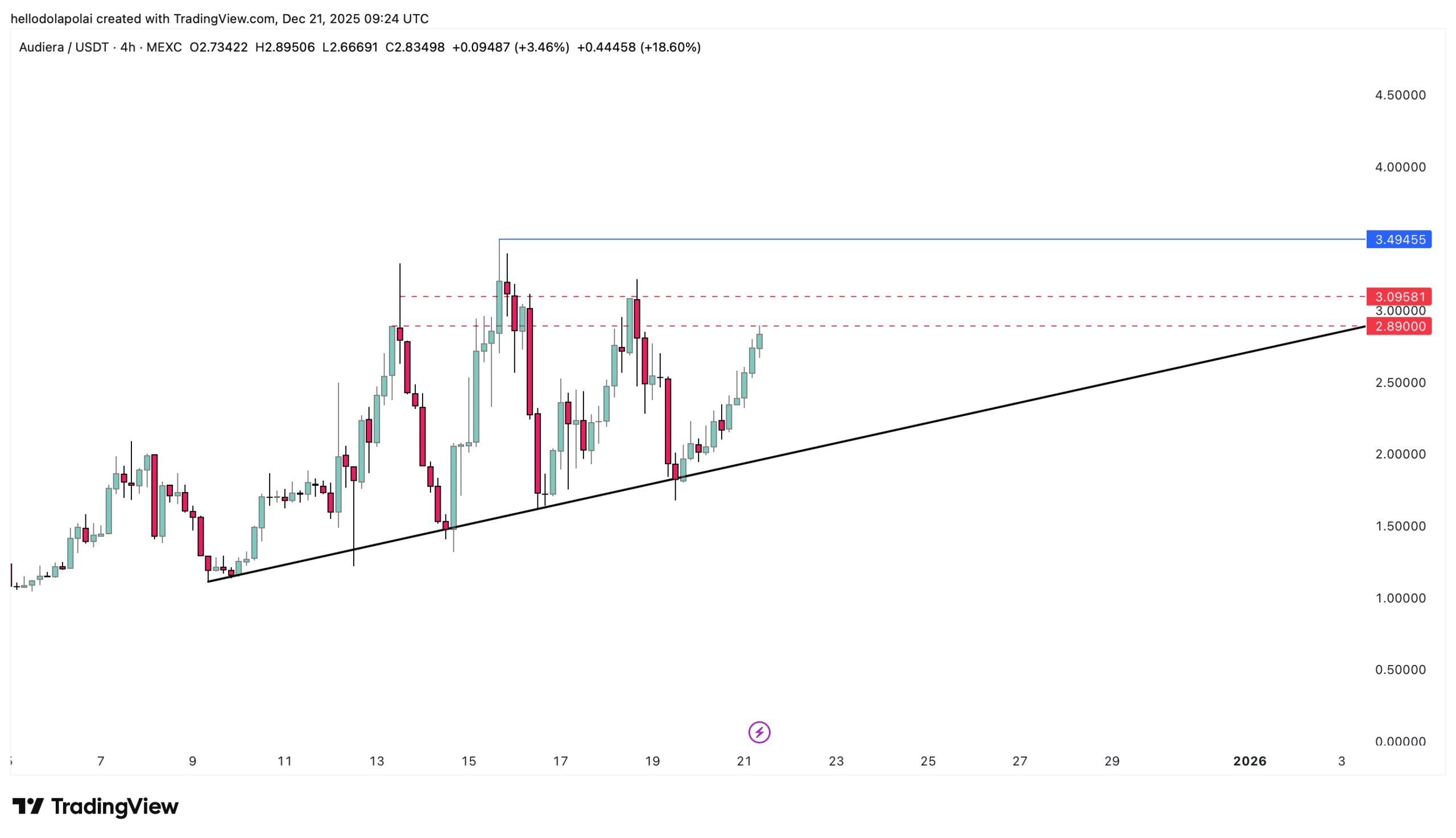

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreDTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low