Global crypto investment products' inflow streak tops $3 billion as Ethereum overtakes Solana YTD: CoinShares

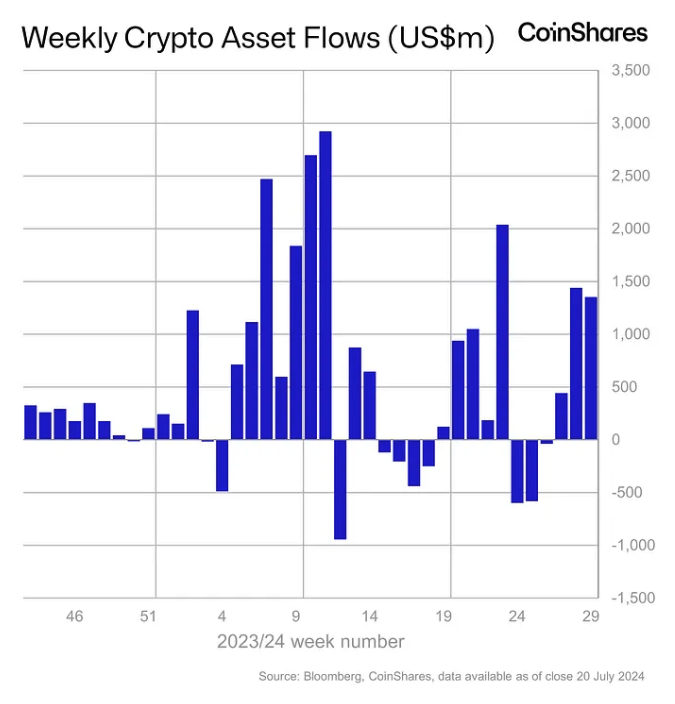

Digital asset investment products attracted another $1.35 billion in net inflows last week, bringing their latest positive streak to $3.2 billion, according to CoinShares.“Ethereum seems to have turned a corner,” overtaking Solana as the altcoin with the most inflows year-to-date, CoinShares Head of Research James Butterfill said.

Global crypto investment products at asset managers such as Ark Invest, Bitwise, BlackRock, Fidelity, Grayscale, ProShares and 21Shares registered net inflows for a third consecutive week last week, totaling $1.35 billion, according to CoinShares' latest report.

The run brings total net inflows to $3.2 billion since the beginning of July as “positive sentiment continues,” CoinShares Head of Research James Butterfill wrote . Exchange-traded product trading volumes also increased substantially, up 45% week-over-week to $12.9 billion, 22% of broader crypto market volumes.

Weekly crypto asset flows. Images: CoinShares .

Bitcoin BTC +0.93% -based investment products dominated as usual, with $1.27 billion in net inflows globally, while short-Bitcoin ETPs also saw $1.9 million in further net outflows. That brings short-Bitcoin net outflows to $44 million since March, “representing a massive 56% of assets under management — highlighting enduring positive sentiment since the April halving event,” Butterfill said.

U.S. spot Bitcoin exchange-traded funds made up the majority of those flows, adding nearly $1.2 billion in net inflows last week with Friday’s figure for Ark Invest’s ARKB ETF still pending.

'Ethereum seems to have turned a corner'

“The outlook for Ethereum ETH +0.028% seems to have turned a corner,” Butterfill added. Ethereum funds witnessed another $45 million of net inflows last week to surpass Solana SOL +4.58% as the altcoin-based investment product with the most net inflows year-to-date at $103 million compared to $71 million.

The Securities and Exchange Commission approved eight 19b-4 forms for spot Ethereum ETFs from BlackRock, Fidelity, Bitwise, VanEck, Ark Invest, Invesco, Franklin Templeton and Grayscale on May 23.

However, the issuers still need to have their S-1 registration statements become effective before trading can begin, which is anticipated to happen on Tuesday.

Regionally, U.S. and Switzerland-based funds led with $1.3 billion and $66 million in net inflows, respectively. However, Brazil and Hong Kong-based crypto investment products saw minor net outflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster announces a $10 million trading competition, combined with Stage 4 airdrop and Rocket Launch incentives, driving multi-layered growth in platform depth and liquidity.

After achieving strong performance in Stage 3, Stage 4 (Harvest) airdrop plan was launched, and the “Double Harvest” trading competition with a total reward of 10 million USD will be introduced on November 17.

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.