Will Ethereum ETFs help ETH Reach a New ATH in 2024?

Will Kay, head of indexes at Kaiko, pointed out in a report Monday that "ETH prices may be particularly sensitive to early inflows into newly launched ETFs.

He cautioned that an overall understanding of demand may not become apparent for several months and it is unclear how initial product receipts may impact the asset.

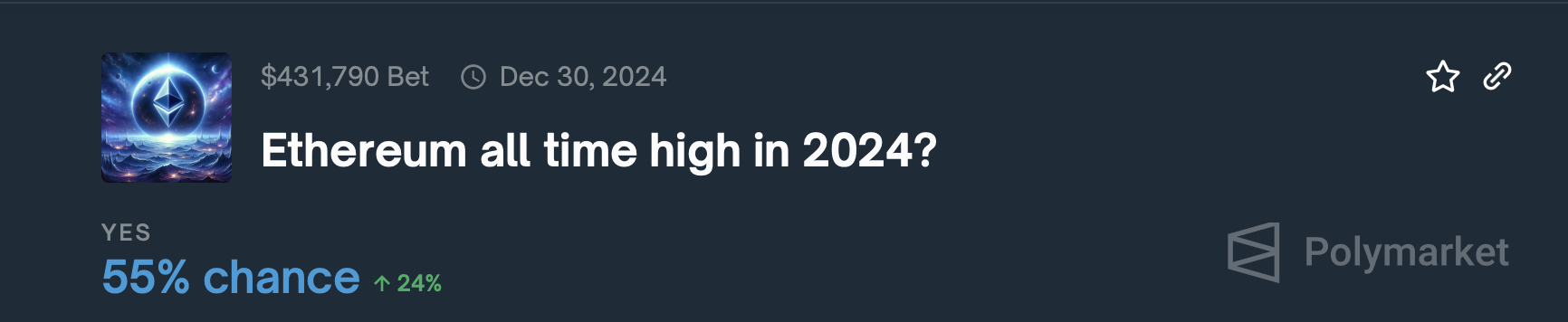

Despite expectations of significant inflows into spot ETFs this year, traders on the Polymarket prediction market are less optimistic about the likelihood of ETH reaching a new all-time high thanks to these ETFs.

Prediction markets, which use geographically diverse consumer forecasts of future events, are theoretically less biased as participants consider “risk-on versus forecast.”

READ MORE:

Bakkt може да улови значителен дял от обема на търговията с BTCIn Polymarket’s largest pool of predictions versus price movements for Etheriem, 55% of participants predict ETH could reach a new all-time high in 2024.

Approximately 30% believe ETH could exceed $4,600 by the fourth quarter.

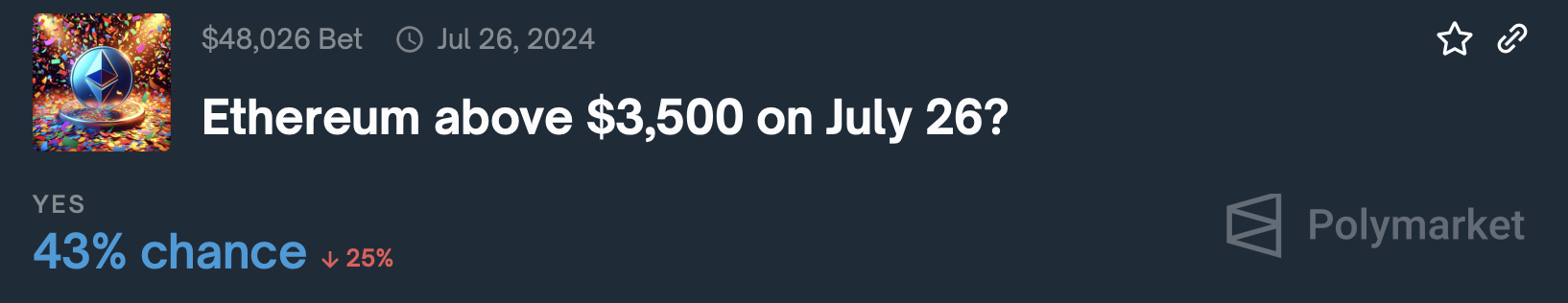

In a separate pool, forecasters are betting on a less than 43% chance ETH will exceed $3,500 by July 26.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?