Data: Mainstream CEX Accumulated Multi-Order Liquidation Intensity Will Reach $517 Million If BTC Falls Below $58,000

According to Coinglass, if Bitcoin were to fall below $58,000, the cumulative long liquidation strength of mainstream CEX would be $517 million;

Conversely, if Bitcoin rallies above $60,000, the cumulative short liquidation strength of mainstream CEX would be 665 million.

It is noted that the liquidation chart does not show the exact number of contracts to be liquidated, or the exact value of contracts being liquidated. What the bars on the liquidation chart show is actually the importance, or strength, of each liquidation cluster relative to neighboring liquidation clusters.

Thus, the chart shows how much the underlying price will be affected if it reaches a certain position. Higher “clearing bars” indicate that the price will react more strongly to the liquidity wave when it arrives.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan launches its first tokenized money market fund

JPMorgan to launch its first tokenized money market fund on Ethereum, with a seed fund size of 100 millions

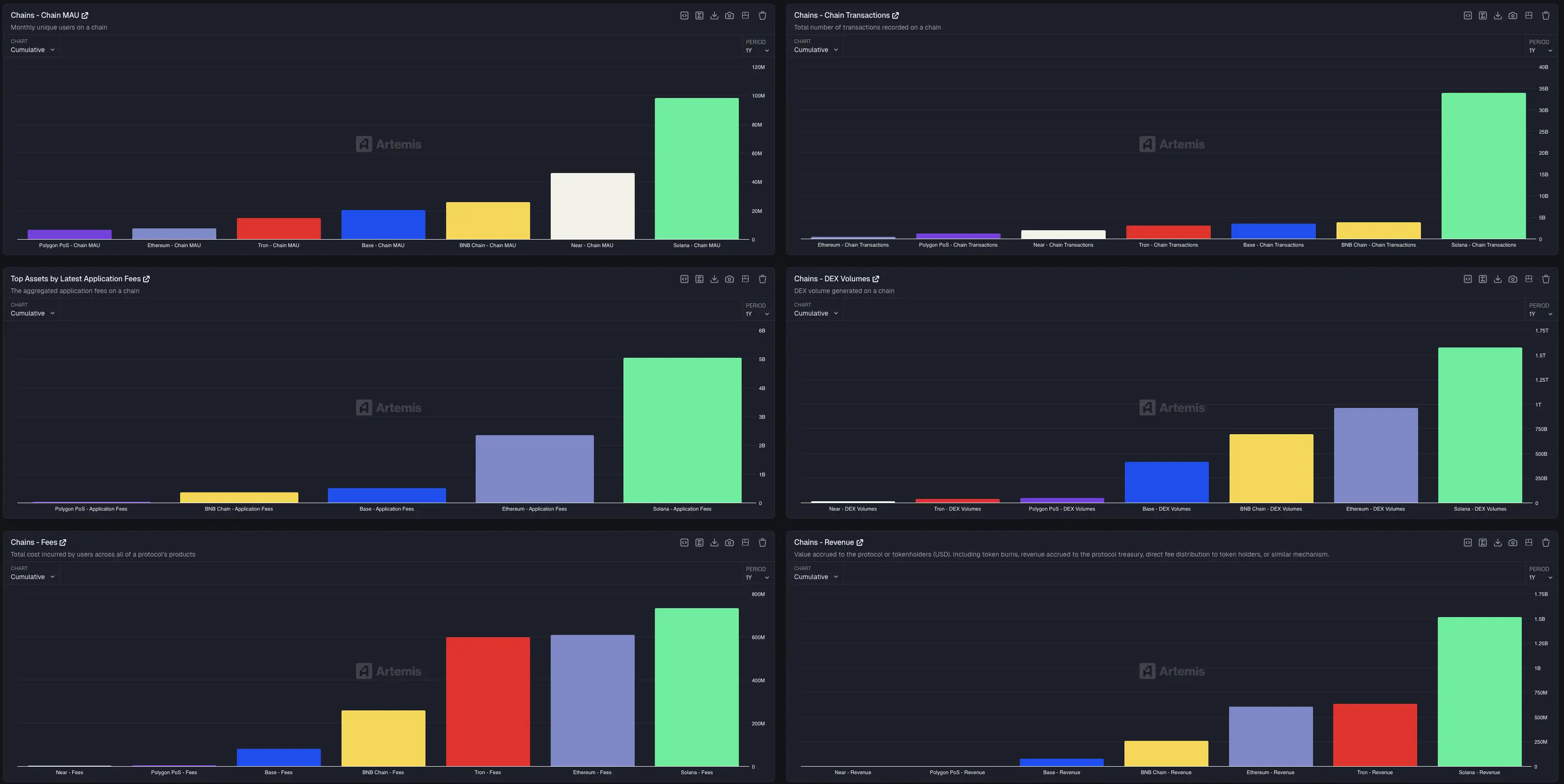

Artemis CEO: Solana leads the market in key on-chain metrics, with transaction volume 18 times that of BNB