Bitcoin’s price finally looks set to break back above the $60K level after weeks of consolidation. However, there is still one more key resistance level that the price needs to overcome.

Technical Analysis

By: Edris Derakhshi (TradingRage)

The Daily Chart

On the daily timeframe, Bitcoin’s price is demonstrating a willingness to finally break above the $60K resistance level, following its rebound from $52K.

The RSI also shows values above 50, indicating that the market momentum is bullish once again. However, for the cryptocurrency to begin a new long-term rally, the price should first rise above the 200-day moving average, which is located near the $64K resistance level.

The 4-Hour Chart

The 4-hour chart clarifies the recent price action, as the market has been making higher highs and lows since bouncing from the $52K support level.

As this suggests, it is only a matter of time for the $60K resistance level to be broken to the upside, which would pave the way for BTC to rally toward the significant $64K resistance area. The RSI is also showing bullish momentum in this timeframe and has yet to reach the overbought region. Therefore, the market seems to be on the verge of an increase, at least in the short term.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

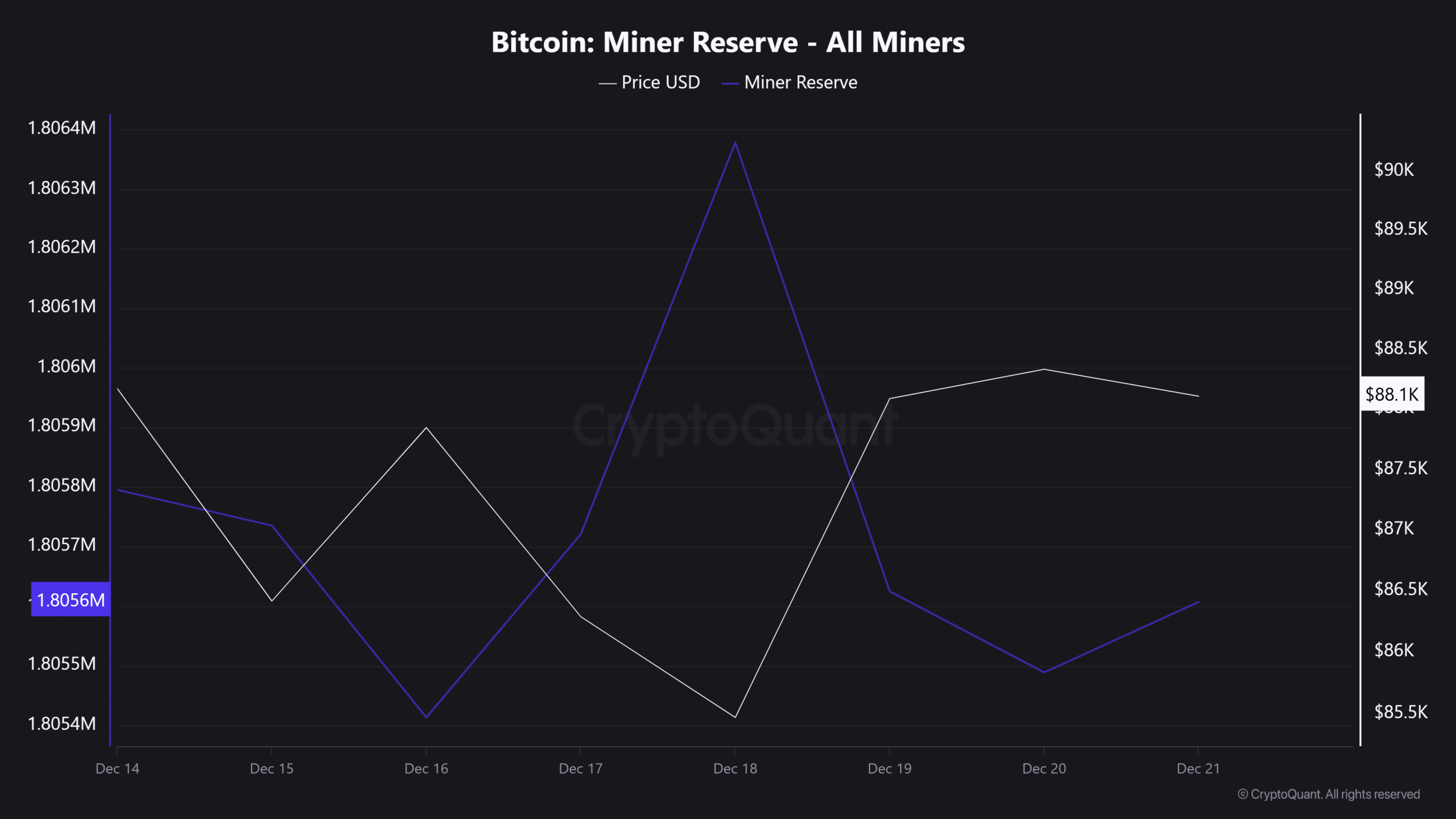

Bitcoin Exchange Supply Ratio

To sell their coins in the crypto market, most people have to first deposit them into an exchange. The amount of BTC held in exchange wallets is, therefore, a proxy for market supply (at least retail), and analyzing its trends could be beneficial.

This chart presents the BTC exchange supply ratio, which measures the ratio of the BTC held in exchanges to the total supply of the coin.

As it shows, the metric has been declining rapidly since February, indicating that heavy accumulation occurred during the recent consolidation. As a result, if sufficient demand is present, the market can begin a new rally toward higher prices.