Citibank Says Family Office Interest in Crypto Assets Continues To Increase, Especially in One Region

Interest in crypto assets by family offices is on the rise, according to a survey conducted by the fourth largest bank in the US by total assets, Citibank.

Citibank’s Global Family Office 2024 Survey Report says that around 25% of the family offices that participated “had already invested or were planning to invest in digital assets.”

The survey drew responses from 338 family offices, one-third of which were based in North America and the remainder in the rest of the world.

“The early adopters category (17%) is likely to grow in the years ahead, having already committed some allocations to digital assets or crypto-related investments. Another 10% of family offices were “digital asset curious,” i.e., considering an allocation but still researching the subject or seeking advice.”

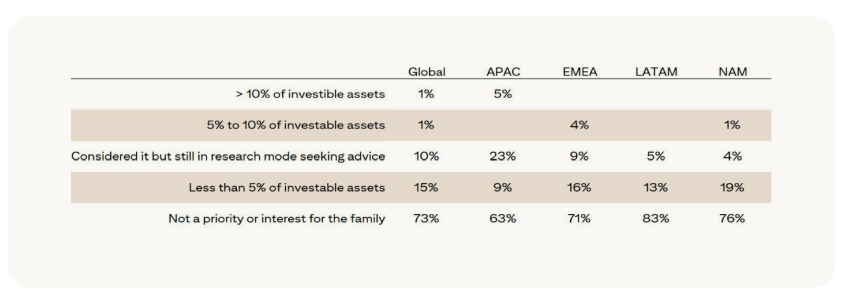

Family offices in the Asia Pacific region, according to the survey, were the most active in investing in digital assets.

“Asia Pacific led in digital assets adoption, with 37% of respondents invested or interested in investing. One in twenty family offices in that region reported more than 10% of investable assets in digital assets. By contrast, Latin American family offices were the least interested, with 83% not yet prioritizing an allocation to this area.”

Source: Citibank

Source: Citibank

Per the survey, around 24% of family offices are interested in investing in crypto assets directly while 18% prefer crypto-linked investment products such as exchange-traded funds (ETFs).

“At the same time, two-thirds of participants were undecided about which digital asset product to explore, underscoring family offices’ ongoing need for education about this emerging asset class.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/IM_VISUALS/Sensvector

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial listing] Bitget to list Theoriq (THQ). Grab a share of 3,016,600 THQ

CandyBomb x VSN: Trade VSN, XRP or SOL to share 2,931,200 VSN

New users get a 100 USDT margin gift—Trade to earn up to 1088 USDT!

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— Enjoy up to 10% APR and trade to unlock an additional pool of 50,000 USDT