Ethereum (ETH), the second largest cryptocurrency, has failed to reclaim the $3,000 price mark since early August. However, things could begin looking positive for the asset once again.

An analyst from the blockchain analytics platform CryptoQuant has shared a chart explaining how a continued cash inflow into the Ethereum futures market could elevate the biggest altcoin.

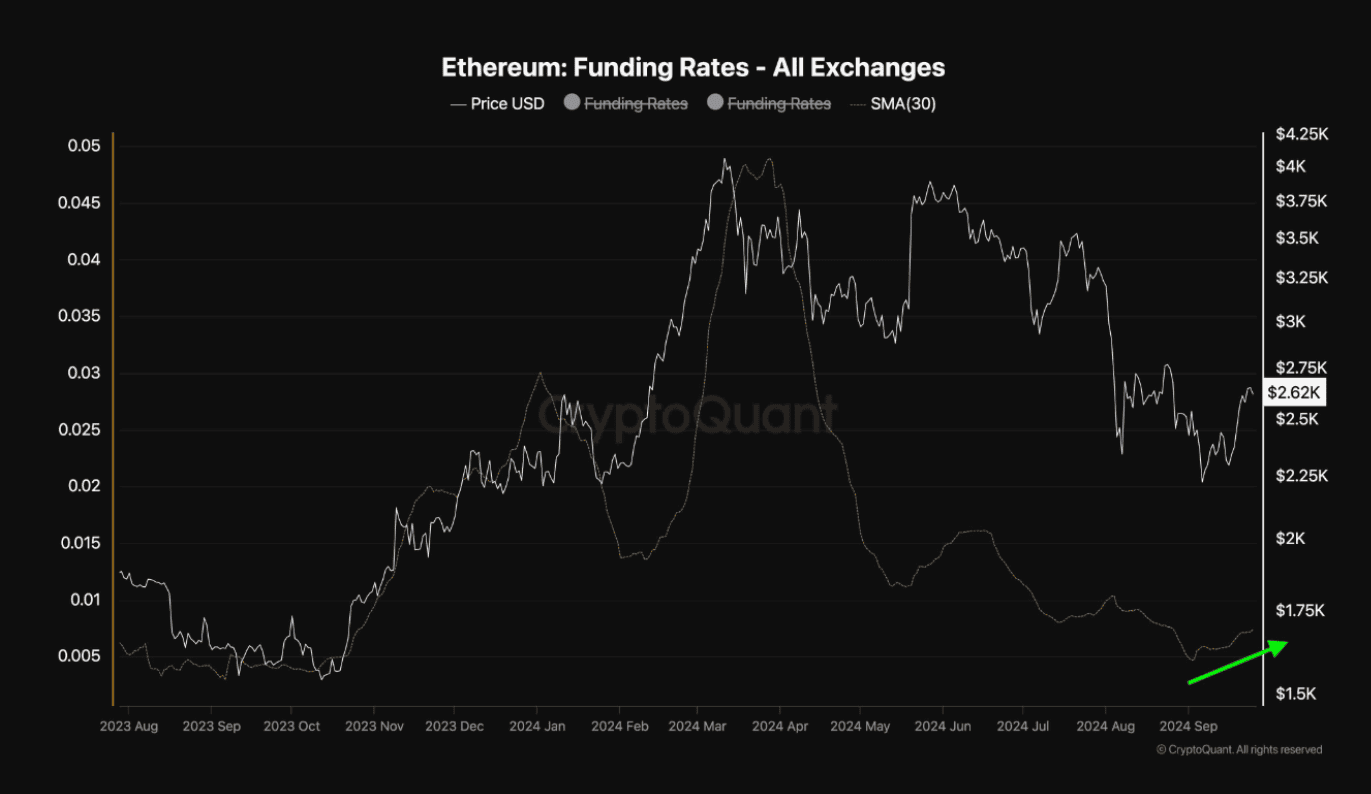

Source: CryptoQuant

Source: CryptoQuant

Funding Rates to Drive ETH’s Price Rebound

According to the analyst, the perpetual futures market contributes to the price movement of underlying digital assets. More buy actions in the futures market indicate investors’ interest in the crypto asset, hence projecting its value to higher prices. Conversely, more sell actions are subsequently accompanied by a price decrease.

The chart above shows Ethereum’s moving average of funding rates, an indicator used to ascertain whether futures traders buy or sell. Within the past 30 days, the ETH funding rates reveal that futures traders have gradually leaned towards more buying activities than selling, indicating that they are more bullish about the second-leading crypto asset.

But There’s a Catch

While the CryptoQuant analyst expressed optimism that ETH could unlock higher prices, they revealed that there is a catch:

“For Ethereum to continue its recovery and target higher price levels, the demand in the perpetual futures market must keep rising in the coming weeks. A sustained uptrend in the funding rates could drive further price surges in the mid-term.”

This implies that ETH perpetual futures traders must remain bullish for the leading altcoin to gain momentum. Any significant drawback in the funding rates metric will stall ETH’s price in the near term.

Meanwhile, ETH continues trading at around $2,600, representing a 16% price decrease from early August when the asset sold for $3,100. The crypto’s price has remained in this range for nearly two months despite the continuous outflows recorded in the United States spot Ethereum exchange-traded fund (ETF) market.