It’s nearly two years since FTX filed for bankruptcy. Yet, the debtors in charge of the FTX estate continue to find and recover funds supposedly mismanaged by the previous administration under Sam Bankman-fried.

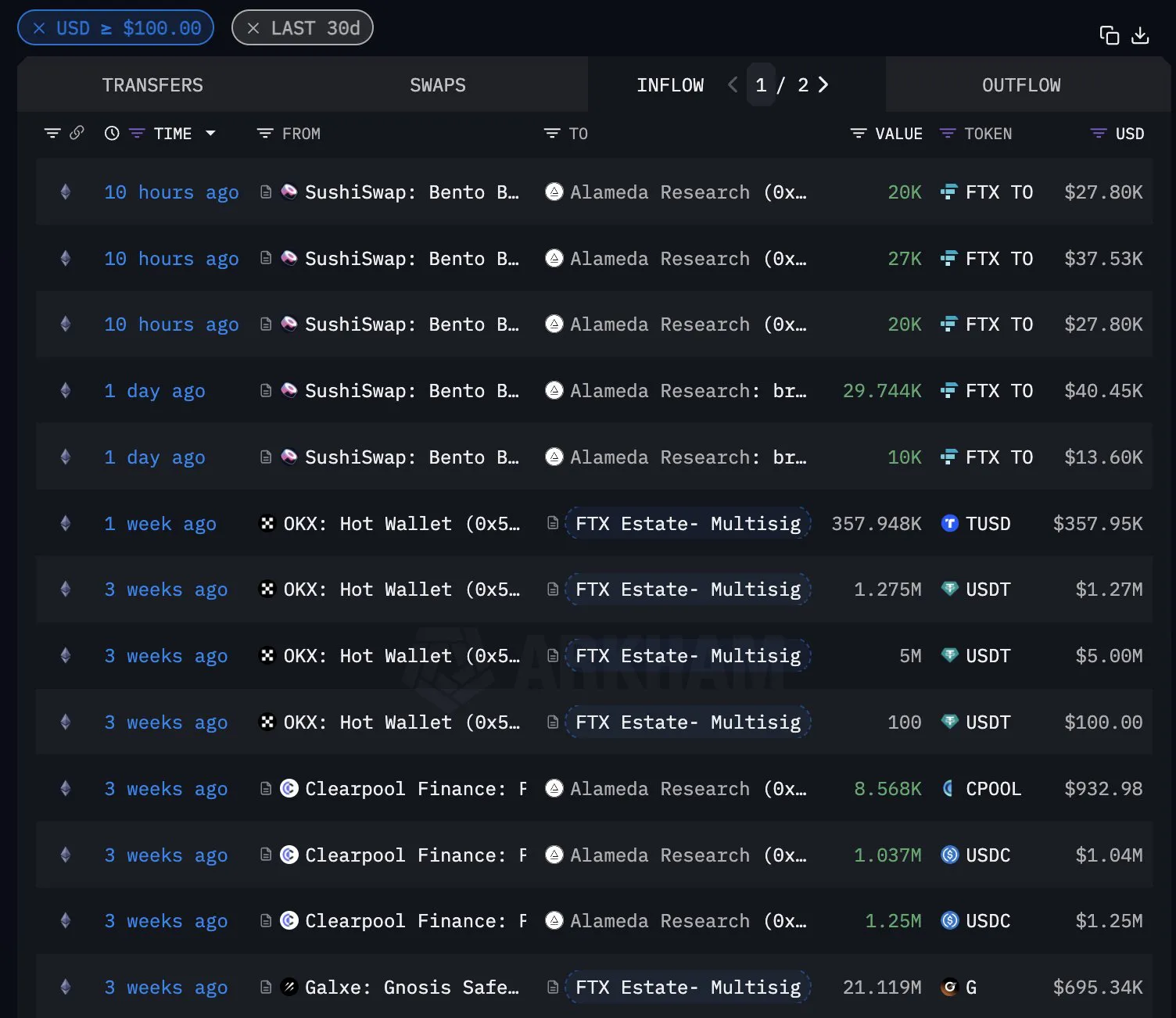

So far this month, FTX estate wallet has seen more than $10 million in inflows from several protocols, including Clearpool, Sushiswap, and more, according to the transaction history shared by Coinbase director, Conor Grogan.

As of May, FTX was reported to have recovered property valued between $14.5 billion and $16.3 billion. Grogan said the estate may still have 7 to 8 figures worth of assets locked elsewhere.

“From what I can see, FTX still has 7-8 figures locked in various protocols and abandoned Alameda wallets,” Grogan noted. The financial network of FTX has been intricate, and this has extended the duration it has taken to retrieve the assets.

Kaiko detects large fund transfers from the Alameda wallet

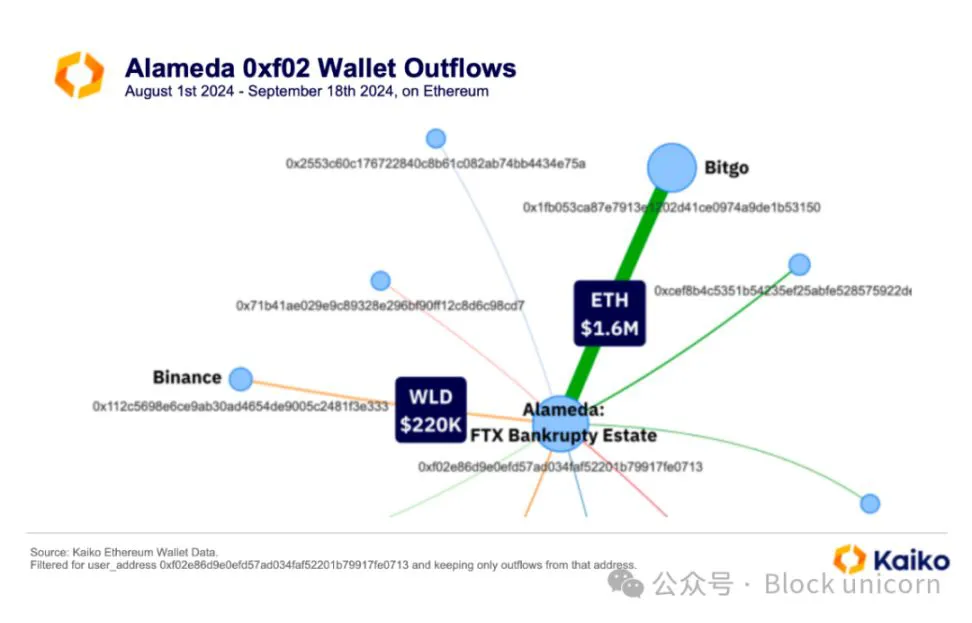

Recently, Kaiko, a blockchain data and analytics firm, detected high activity from a wallet that was reportedly connected to Alameda Research. In the last month, they have been transferring a large amount of money through this wallet, and there are speculations that the estate is trying to consolidate funds. Kaiko’s investigation showed that the wallet sent $1.6 million ETH to BitGo and $220,000WLD to Binance

These transactions suggest that FTX bankruptcy estate is in the process of preparing to pay claims to its creditors. Earlier this year, FTX said it was able to get enough tokens to pay most of the creditors based on the value of their tokens at the time of the company’s bankruptcy. The repayment process is expected to start after the approval of the FTX wind-down plan, which is likely to be done in early October.

Impact of Alameda’s large holdings on the market

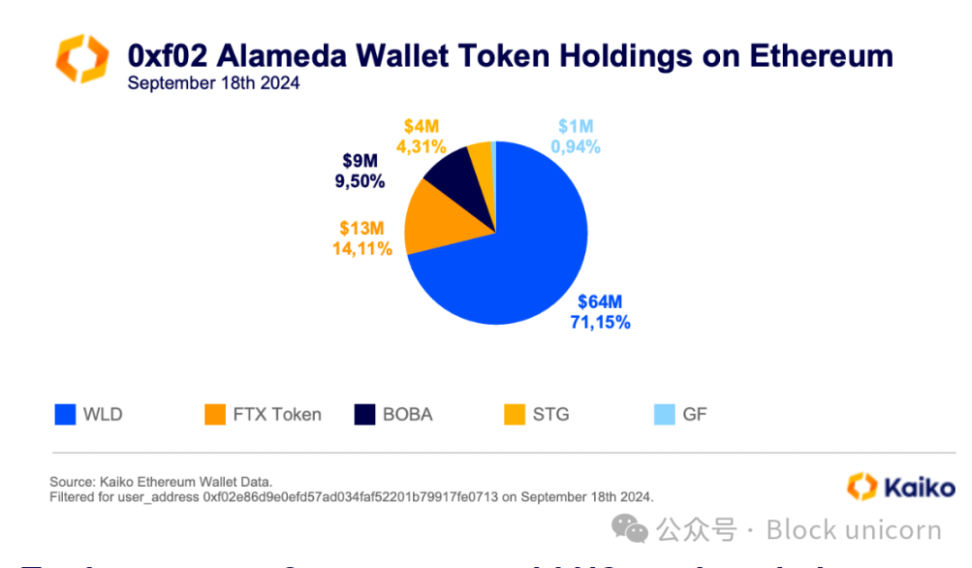

Alameda Research’s last wallet still has $64 million of Worldcoin (WLD) tokens because Alameda was an early investor in this token. Tools for Humanity, the developers of Worldcoin, have been releasing these tokens since July, and Alameda’s stake is a considerable part of the token’s total supply. The sale of these assets could greatly affect the price of Worldcoin, which has fallen by 30% since the unlock started.

In addition to its WLD holdings, Alameda’s wallet contains smaller assets that are not as liquid, such as $13 million of tokens from FTT, the token of the FTX exchange, and $9 million of BOBA tokens from Bona Network. These holdings are not very liquid as the daily market depth is only $0.7 million, making it almost impossible to sell large amounts without affecting the price.

Data from Kaiko also shows that there is more consolidation through several transfers from smaller wallets belonging to Alameda Research, with the biggest transfer being $1.27 million USDT from OKX. Alameda has also been reported to still possess unknown wallets, including Solana (SOL), which may influence the Solana market.