OPINION: Macroeconomic Announcements Significantly Impact Bitcoin Volatility Levels, with CPI and Fed Rate Decisions Having the Most Impact

Regularly scheduled macroeconomic announcements significantly affect the actual and implied volatility of Bitcoin (BTC) in the cryptocurrency market, Volmex Research said in a newly released paper on September 26th. A regression analysis of BTC price ranges and volatility levels found that these events continue to trigger volatility in both the spot and options markets. The study also notes that CPI and Fed decisions have the greatest impact on volatility levels, confirming that these events are key drivers of uncertainty dissipation; CPI typically leads to sustained volatility for up to 24 hours, while the impact of Fed decisions dissipates more quickly, particularly in implied volatility metrics. Additionally, robustness tests using multiple time windows and incorporating ethereum (ETH) prices further validate the findings. This finding provides traders and market participants with a basis for strategy development in response to price volatility triggered by these important macroeconomic announcements, especially in the cryptocurrency derivatives market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

10x Research: Everyone is optimistic about 2026, but the data does not support this view

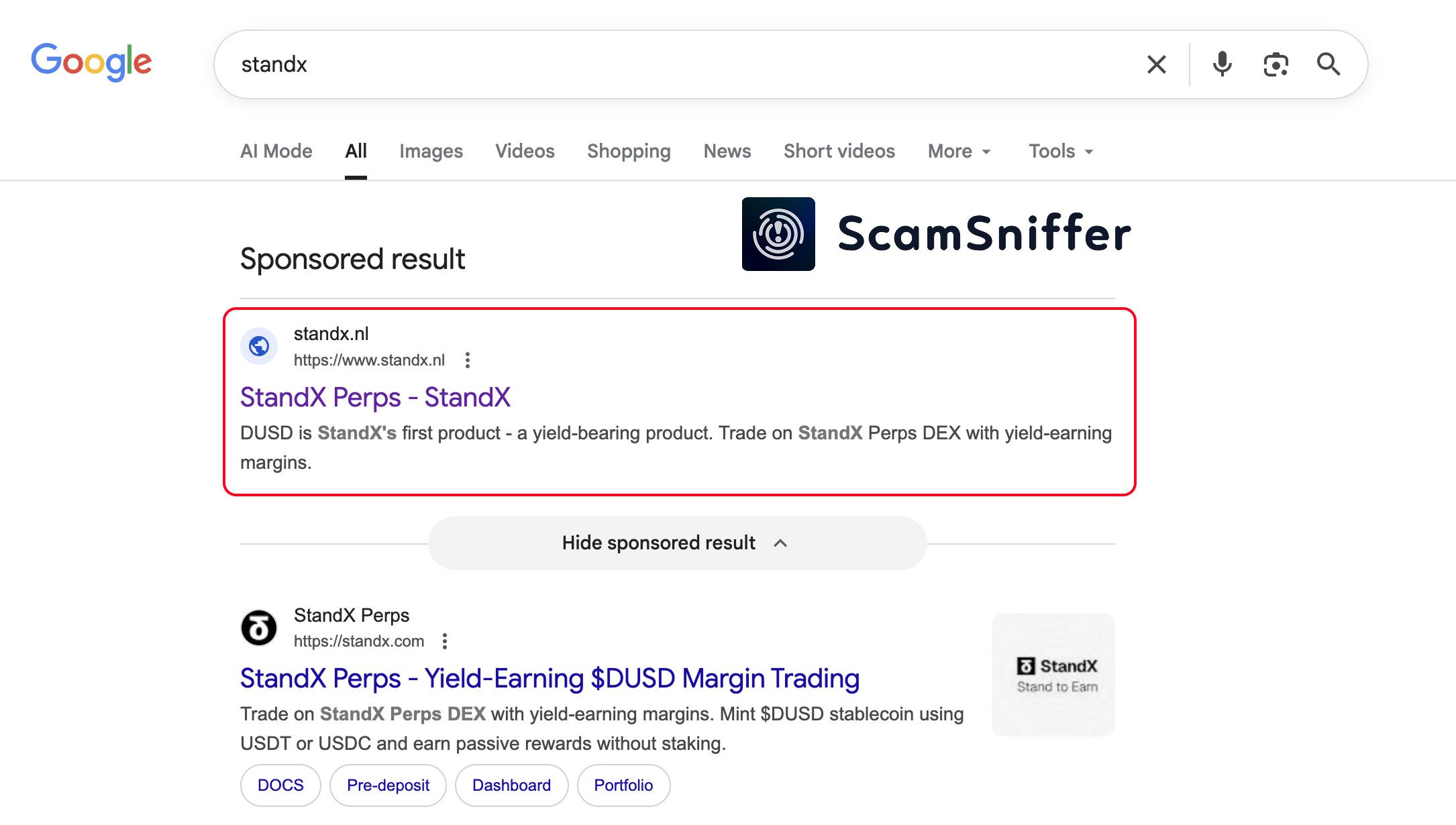

Scam Sniffer: Fake "StandX" ads appear in Google search