- Shiba Inu’s open interest increased by 53.98%, reaching $64.78 million, signaling growing interest in SHIB derivatives trading.

- Avalanche’s 24-hour trading volume grew by 6.70%, reflecting continuous buying pressure as the token maintains bullish momentum.

- SHIB derivatives liquidations totaled $800.82K, evenly split between long and short positions, showing a highly active and balanced market.

Shiba Inu (SHIB) and Avalanche (AVAX) are in the spotlight after a crypto analyst predicted SHIB would overtake AVAX in market dominance.

With both tokens showing strong upward momentum, traders are closely watching for shifts in dominance. Additionally, data from major exchanges further supports this bullish sentiment in both tokens. Besides, data from major exchanges further supports this bullish sentiment in both tokens.

Shiba Inu Breaks Out with Strong Gains

Shiba Inu’s price surged to $0.000019 , driven by a 24-hour trading volume of $1.37 billion. Its market cap has hit $11.25 billion, reflecting a 23.37% increase in the last 24 hours. The price chart shows a sharp upward movement, with the latest candle closing at $0.00001906, a gain of 2.36%. The increased trading volume suggests growing buying interest, confirming a bullish trend.

Read also: Shiba Inu ($SHIB) Poised for New All-Time Highs: A Trend Analysis

Additionally, the Shiba Inu Relative Strength Index (RSI) stands at 80.22, indicating overbought conditions. While an RSI above 70 often signals a potential pullback, the ongoing momentum could keep these levels elevated longer. Therefore, traders are watching for signs of a possible correction.

Source: TradingView

Source: TradingView

Moreover, the Moving Average Convergence Divergence (MACD) has crossed above the signal line, affirming the bullish trend. The expanding histogram bars further indicate continued upward pressure. This trend suggests that the buying pressure is still strong and may persist.

Avalanche Maintains Steady Growth

Avalanche ( AVAX ) has also performed well, with its price reaching $29.39. Its 24-hour trading volume stood at $502 million, marking a 6.70% rise. The token’s market cap reached $11.93 billion. The chart reflects a steady upward trend with a 1.30% price increase, driven by continuous buying pressure.

Source: TradingView

Source: TradingView

Furthermore, Avalanche’s RSI is at 67.50, approaching the overbought zone. If the RSI crosses 70, a pullback or consolidation could follow. However, the token’s momentum remains strong for now. Additionally, the MACD line for AVAX remains above the signal line, with histogram bars expanding suggesting sustained bullish sentiment in the near term.

Read also: Altcoin Rally: AVAX Targets $33, TON Eyes $6.33, and WIF Poised for 145% Gain

Shiba Inu’s Derivatives Market Sees a Surge in Activity

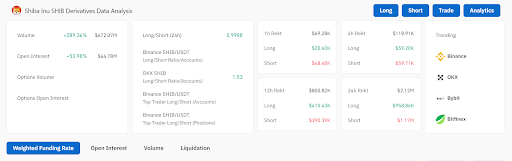

Shiba Inu’s derivatives market has experienced a surge, with trading volume climbing by 289.36% to $672 million. Open interest increased by 53.98%, reaching $64.78 million. The 24-hour long/short ratio is nearly balanced at 0.9988, indicating no strong directional bias among traders. But OKX data shows a stronger long sentiment, with a ratio of 1.53.

Source: Coinglass

Source: Coinglass

Moreover, liquidations in the last 12 hours totaled $800.82K, split evenly between long and short positions. Major platforms for SHIB derivatives include Binance, OKX, Bybit, and Bitfinex. This surge reflects a highly active market with balanced sentiment and significant interest in SHIB derivatives.

Avalanche’s Derivatives Market Also Shows Increased Activity

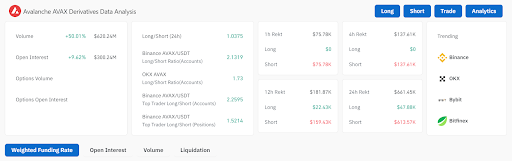

On the other hand, Avalanche’s derivatives market has also seen increased activity. Trading volume rose by 50.01% to $620 million, and open interest grew by 9.62% to $300.24 million. Additionally, the 24-hour long/short ratio stands at 1.0375, signaling a slight bullish bias. Binance data shows a stronger long sentiment at 2.1319.

Source: Coinglass

Source: Coinglass

Moreover, liquidations in AVAX totaled $661.45K in the past 24 hours, with shorts accounting for $613.57K. This suggests that short sellers have been more vulnerable in the current market conditions. Major platforms for AVAX derivatives trading include Binance, OKX, Bybit, and Bitfinex. The market remains cautiously optimistic with a slight bullish lean.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.