- Chainlink exhibits bullish breakout from double-bottom pattern, indicating potential rise if it sustains above $13.10 level.

- Current Long/Short ratio at 1.031 and positive OI-weighted funding rate at 0.0087% reflect bullish trader sentiment.

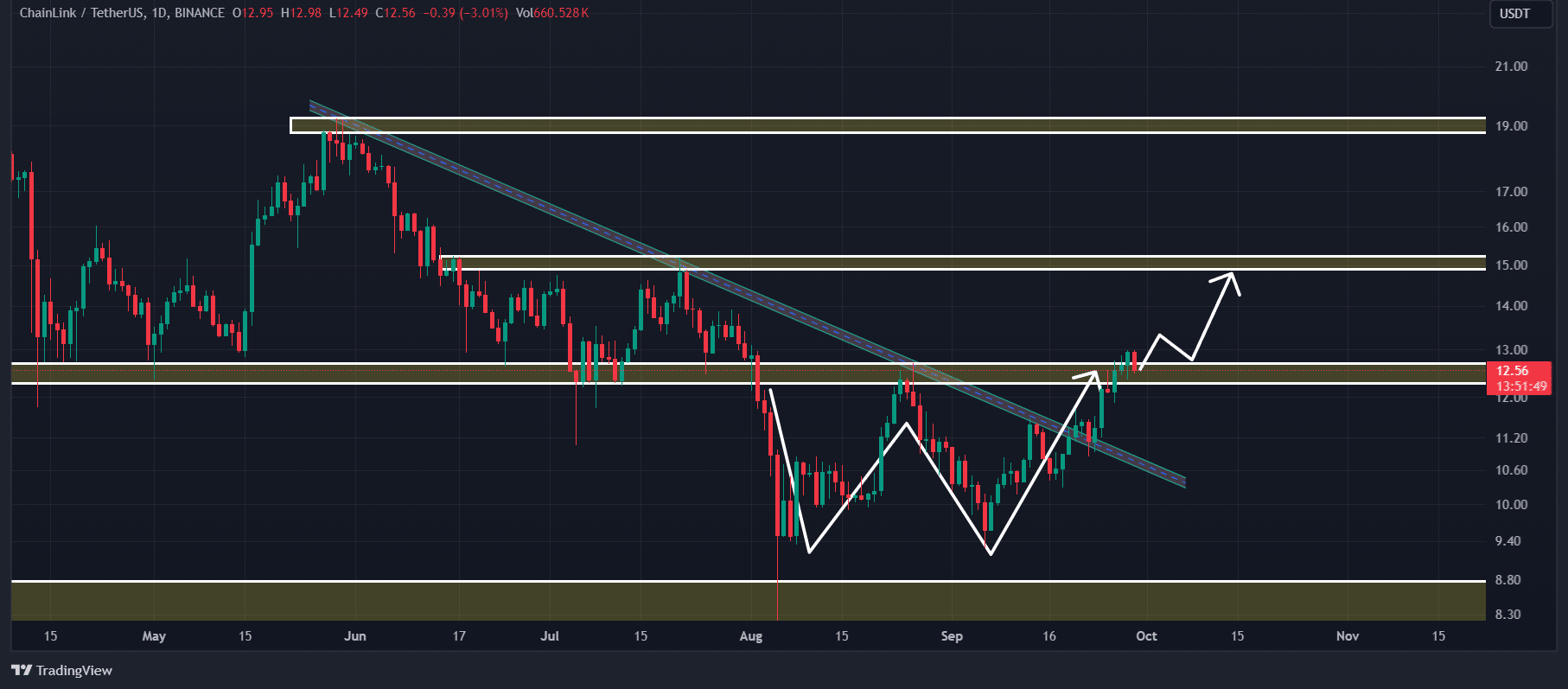

Chainlink (LINK) recently demonstrated a pattern in its price movement that analysts believe could lead to a substantial increase. The cryptocurrency broke out of a double-bottom pattern on the daily chart, a development typically considered bullish by market analysts.

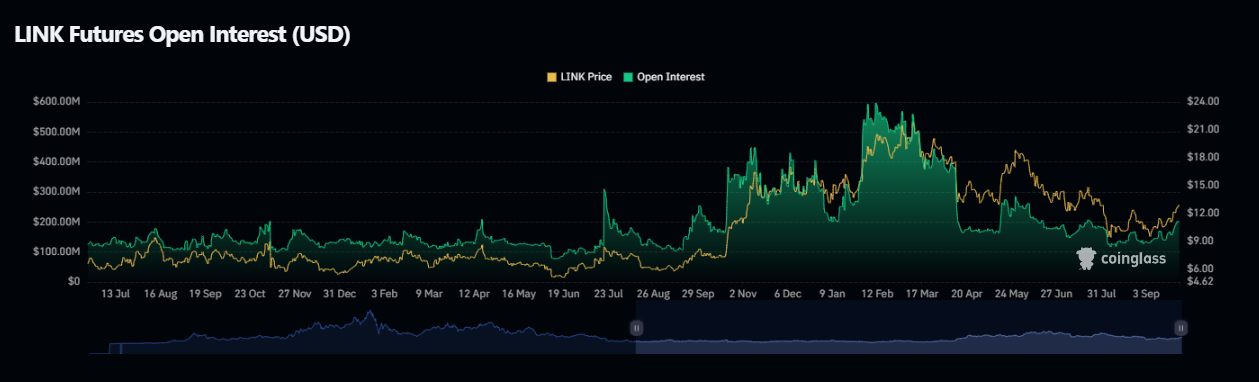

Source: Coinglass

Source: Coinglass

According to the latest data from on-chain analytics firm Coinglass, the Long/Short ratio for LINK is currently 1.031. This metric indicates a bullish sentiment among traders. Moreover, the positive Open Interest (OI)-weighted funding rate of 0.0087% supports this optimistic view among market participants.

Source: Tradingview

Source: Tradingview

Technical analysis provided by ETHNews confirms that Chainlink’s recent price behavior might lead to further gains. If LINK maintains a close above $13.10, it could potentially increase to $15.00 in the near future.

Source: Tradingview

Source: Tradingview

However, the Relative Strength Index (RSI), a tool used to assess whether an asset is overbought or oversold, suggests that LINK is currently in a downtrend.

The on-chain metrics offer a mixed sentiment beyond the bullish indicators. LINK’s future open interest has remained stable over the last 24 hours, showing no significant changes.

This stability implies that traders are maintaining their positions without significant liquidations or new positions, possibly due to concerns about an impending price correction.

Source: Coinglass

Source: Coinglass

Coinglass also notes that the major liquidation levels for LINK lie at $12.12 and $13.16. These figures represent thresholds where traders might be excessively leveraged, which could lead to rapid price movements if these levels are breached.

Source: Coinglass

Source: Coinglass

As of the latest trading data by ETHNews , LINK is priced at approximately $12.65, having increased by 1.2% over the last 24 hours. Despite this recent uptick, the trading volume has decreased by 25%, indicating a reduction in trading activity.

This reduction suggests that traders might be adopting a cautious approach, waiting for clearer market signals before increasing their positions.

Chainlink’s current technical and on-chain indicators point to potential upward movement , the mixed signals and cautious market activity advise traders to stay alert to both opportunities and risks in the near term.

At present, LINK faces key resistance at $13.9 and $15. If the price manages to break through these levels, it could rally up to $19. Moreover, the Market Value to Realized Value (MVRV) ratio is at 7.9%, signaling that while the price has room to grow.