MicroStrategy was one of the early institutional investors in Bitcoin. The move has now paid off a 36x return on its initial investment as it remains the largest public holder of BTC.

Over the last year, Bitcoin has surged by about 150%, while MicroStrategy (MSTR) stock has a higher Sharpe ratio. Despite MicroStrategy’s performance driven by its Bitcoin holdings, MSTR stock is more volatile.

MSTR has proved a better bet than BTC itself

Over the last year, Bitcoin has gained about 150% in value while MSTR reports almost a 300% rise. From the price rise, MicroStrategy’s Bitcoin holdings have generated 36 times the return based on the acquisition cost.

According to recent data cited by MicroStrategy founder Michael Saylor, MSTR has generated over a 1000% return after adopting the Bitcoin strategy. BTC forms around 46% of the company’s market cap as MicroStrategy owns close to 1% of the total Bitcoin supply. The cost of 252,220 BTC held by the company comes to $458 million as per calculations by Bitcoin Treasuries.

FactSet data places Nvidia second to MSTR with 900% returns in the S&P 500. As the largest listed corporate owner of Bitcoin, mining companies like Marathon and Riot also come next to MSTR in terms of performance.

As per CNBC , MSTR stock rose by 124% year-to-date and outperformed Bitcoin as it rose by 35-40% in the same period. However, MSTR stock might be considered more volatile.

As per calculations by Portfolio Slab, the Saylor-founded company has a volatility of 25% while BTC-USD volatility is about 14%. Sharpe Ratio, which measures investment’s returns with respect to the risks, offers a clearer picture for investors. As per the platform, Bitcoin (BTC-USD) has a Sharpe Ratio of 1.73, reflecting a decent return.

But, MSTR offers a much higher Sharpe Ratio of 4.70. With a higher standard deviation or risk compared to BTC, MSTR seems to be compensating investors well with the returns. Therefore, an appetite for higher investment risk for higher return might make MSTR a better bet than BTC for certain investors.

MicroStrategy credits Bitcoin for strong performance

In September, public companies hold 361,735 BTC. Over the last year, listed firms have accumulated over 100,000 more Bitcoin during its run-up to an all-time high of $73K, reached in March 2024.

While Bitcoin is around 13% below its record high, MSTR managed a 20-30% rise from its March performance in September. In terms of correlation, MSTR and BTC-USD show a low 0.19. However, CNBC noted that MSTR stock rose about 8% in a single day and 24% in a week after announcing additional Bitcoin purchases in September.

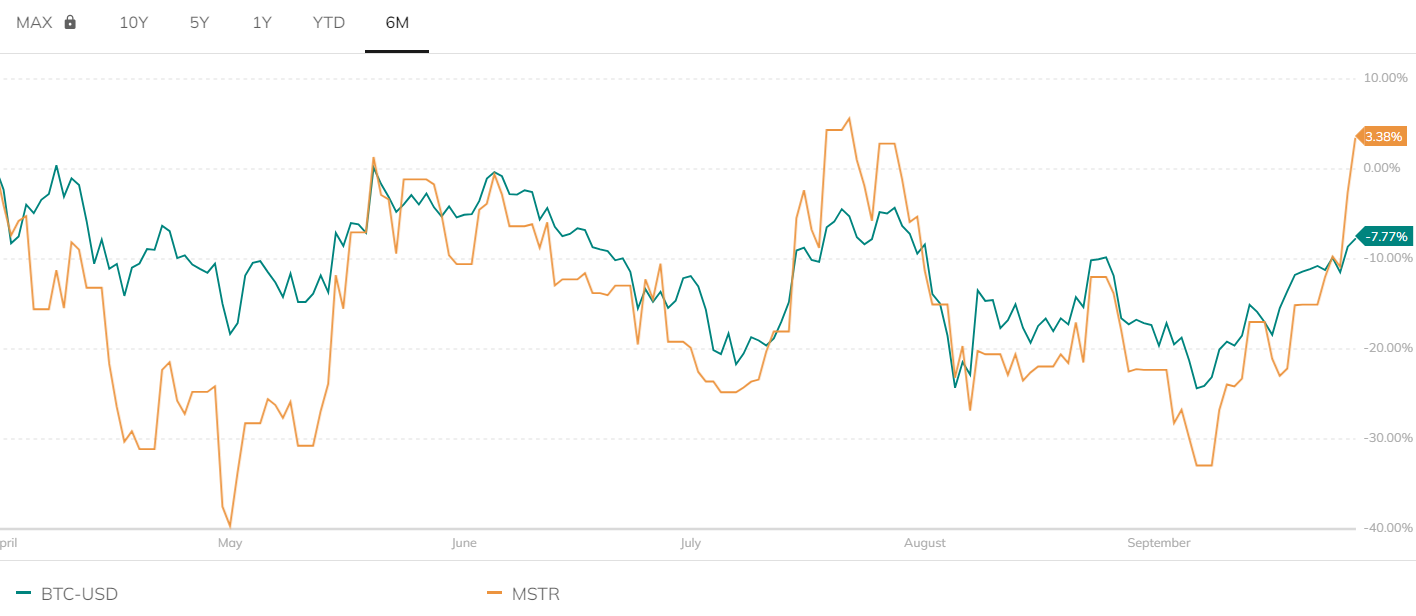

MSTR Vs BTC | Source: Portfolio Slab

MSTR Vs BTC | Source: Portfolio Slab

That said, MSTR announced its Q2 results in August and called it ” yet another successful quarter” due to its Bitcoin strategy. Phong Le, President and Chief Executive Officer of MicroStrategy, is pinning hopes for the company’s performance on 2 key areas – Bitcoin adoption and the growth of MicroStrategy’s cloud-powered business and artificial intelligence (AI) software.

According to a recent study , 74% of institutions handle Bitcoin as custodians. Meanwhile, 67% of institutions are involved in the asset through ETFs or ETPs as the approval has made exposure easier. Reportedly, 54% handle Bitcoin as part of client trading. With the strong institutional profile behind Bitcoin, a positive market trajectory can be expected from BTC.