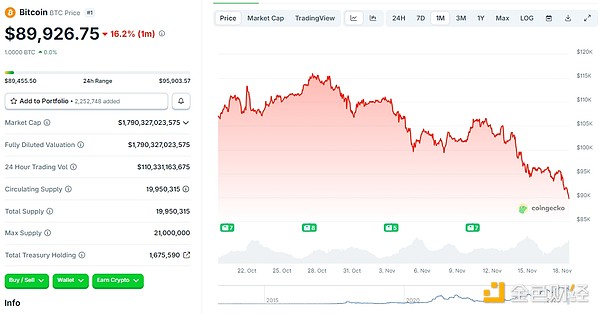

U.S. State Proposes Bill to Allow Bitcoin Payments for Taxes and Fees

Ohio State Senator Niraj Antani has proposed a new law that would allow residents to pay taxes and fees using Bitcoin and other cryptocurrencies.

Introduced on September 30, the legislation aims to enhance the state’s acceptance of digital currencies in government transactions.

Antani emphasized the importance of cryptocurrencies in today’s economy, stating that Ohio should foster innovation and entrepreneurship. The state initially accepted crypto payments for taxes in 2018 under then-Treasurer Josh Mandel, but this initiative stalled in 2019 due to regulatory hurdles.

The new bill seeks to circumvent the inaction of the State Board of Deposits and aims to position Ohio as a leader in technological growth. In addition to tax payments, it would permit state universities and public pension funds to invest in digital assets, broadening their financial options.

READ MORE:

CryptoQuant CEO Calls for Regulation to Drive Web3 GrowthAmid a federal climate of caution regarding cryptocurrency, various states are considering similar measures. While New Hampshire’s early efforts did not succeed, Ohio’s renewed initiative could see it join Colorado, which began accepting crypto for taxes in 2022. Wyoming and Arizona are also exploring legislation to enable crypto tax payments, with Wyoming being particularly proactive in adopting crypto-friendly policies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Monad (MON)

Is the crypto market bearish? See what industry insiders have to say

Whales make big bets, institutions deeply trapped, crypto market faces a cold wave