CryptoQuant says recent stablecoin market cap growth is providing liquidity for bitcoin price increase

Quick Take The recent rise in stablecoin market cap is providing liquidity that could help an uptrend in bitcoin and other major cryptocurrencies, according to CryptoQuant. K33 Research highlighted bullish factors for bitcoin in the fourth quarter, including the Federal Reserve’s policy shift, China’s liquidity push, and the SEC’s recent approval of options trading on spot bitcoin ETFs.

The rise in stablecoin market capitalization over the past few months could contribute to a potential uptrend in bitcoin and other major cryptocurrencies, according to an analyst.

CryptoQuant Head of Research Julio Moreno told The Block that the increasing market cap of stablecoins is a critical factor in driving cryptocurrency price growth, as they provide liquidity to crypto markets.

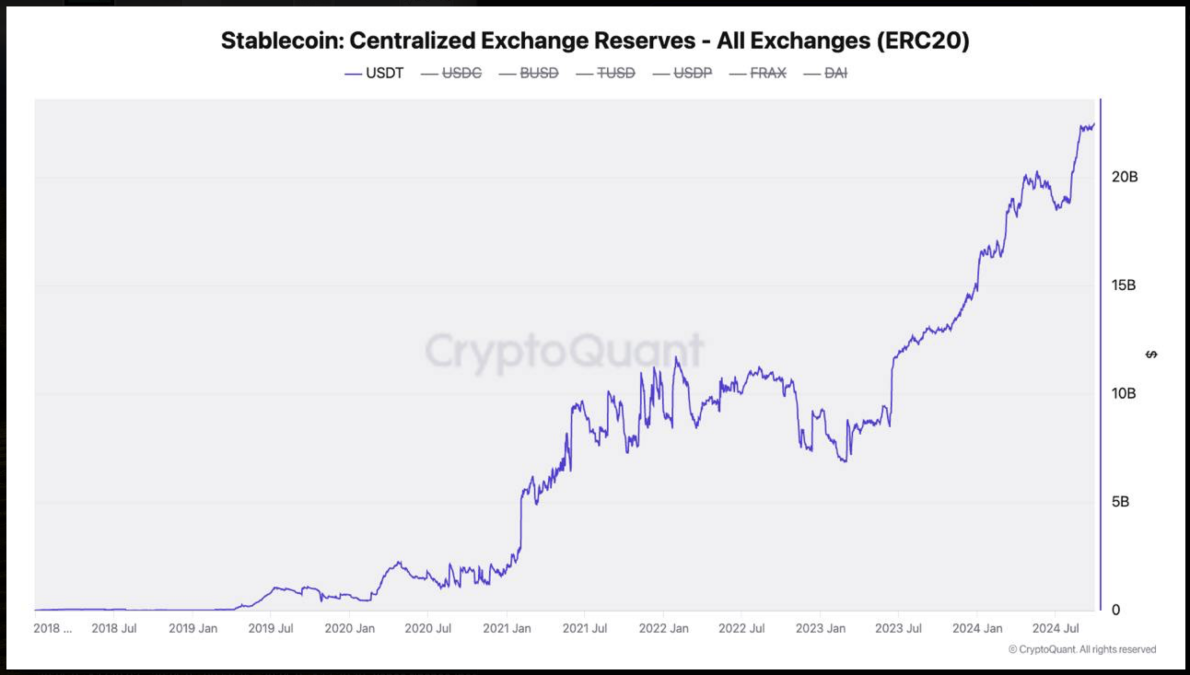

Moreno cited data from CryptoQuant that showed a net inflow of stablecoins onto centralized cryptocurrency exchanges over the past two months.

"Stablecoins on exchanges have grown, with USDT reserves on centralized exchanges also reaching a record-high of $22.5 billion so far in 2024," he said.

The rise in stablecoin market capitalization is providing liquidity to help fuel a bitcoin rally. Image: CryptoQuant.

Moreno pointed to data that showed that the stablecoin market capitalization has reached a record high of $169 billion this year. "The total market capitalization of stablecoins are positively correlated with higher bitcoin prices," he added.

A CryptoQuant analysis post from Monday stated that the net inflow of stablecoins onto centralized cryptocurrency exchanges can serve as an important indicator for predicting bitcoin's future price.

"Interestingly, we observed a high correlation between bitcoin's price and net inflows of stablecoins to exchanges in September. In particular, stablecoin net inflows influenced the price increase observed towards the end of September," the post added.

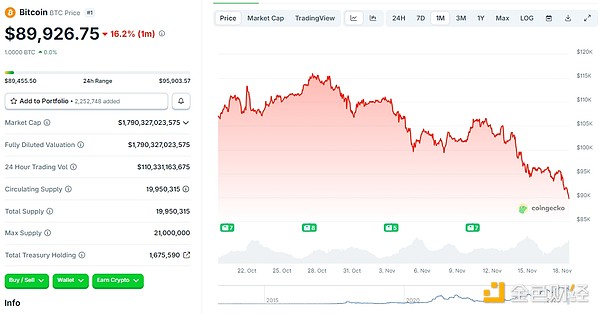

Bullish factors for bitcoin going into Q4

In a separate report, K33 Research outlined bullish factors for bitcoin as the market enters the fourth quarter.

"The Federal Reserve's policy shift has already generated momentum, and China’s efforts to boost liquidity are likely to drive further global market activity," the report noted.

Additionally, Tuesday's K33 Research report said the approval of institutional options trading on BlackRock's spot bitcoin exchange-traded fund in September is another factor driving optimism in the market.

"Another fundamentally bullish development occurred in September with the SEC’s approval of IBIT options. We expect these options to lead to a new wave of ETF inflows to accommodate demand for options exposure," K33 said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Monad (MON)

Is the crypto market bearish? See what industry insiders have to say

Whales make big bets, institutions deeply trapped, crypto market faces a cold wave