BREAKING: Bitwise files for XRP ETF via Delaware trust

Key Takeaways

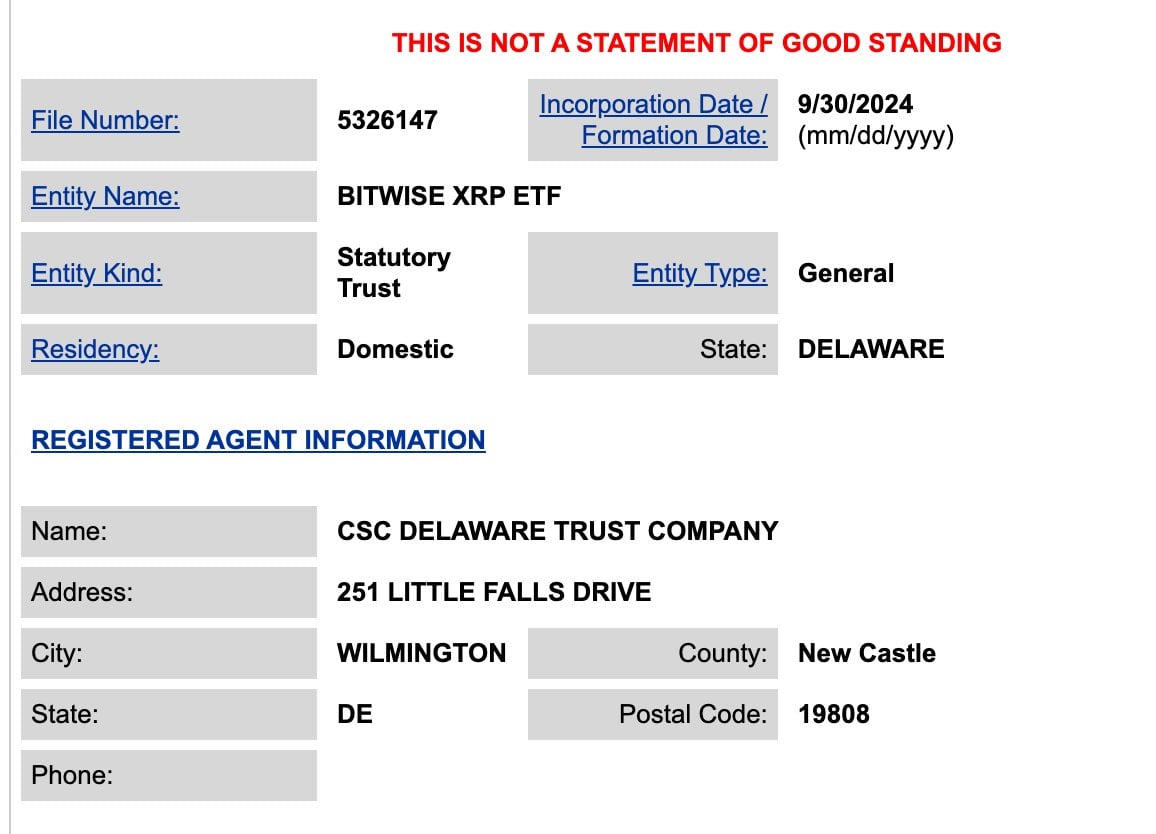

- Bitwise establishes a Delaware trust as a precursor to an XRP ETF.

- SEC's cautious stance on crypto ETFs reflects in the lengthy approval process.

Crypto asset manager Bitwise has taken a step toward launching an XRP ETF. According to a filing with the Delaware Division of Corporations, the company has established a trust that could serve as the foundation for a potential XRP ETF.

As of this writing, no corresponding documentation has appeared in the SEC’s EDGAR database, which is the typical repository for official ETF proposals.

This action follows a pattern seen in the crypto ETF sector, where asset managers create trusts before seeking approval from the SEC for an exchange-traded product.

The filing has drawn attention within the crypto community, particularly among those interested in XRP, the digital asset associated with Ripple. XRP has been a subject of regulatory scrutiny in recent years.

The path to an approved XRP ETF may face challenges. The SEC has approached crypto-based ETFs with caution, only recently approving Bitcoin and Ethereum ETFs after a lengthy process of applications and regulatory discussions.

Bitwise’s action follows the launch of Bitcoin ETFs by firms such as BlackRock and Fidelity earlier this year. These approvals marked a shift in the regulatory landscape for crypto investment products.

A potential XRP ETF would represent another development in the integration of digital assets into traditional finance. However, regulatory approval is not assured, and the process could be lengthy.

As the crypto market continues to evolve, Bitwise’s filing for an XRP trust via Delaware is a development that market participants are watching. It could potentially lead to new investment vehicles for XRP, a crypto that has been the subject of ongoing regulatory and market debates.

Last month, Grayscale introduced an XRP trust in the US targeting accredited investors, potentially paving the way for an ETF conversion, amidst Ripple’s ongoing legal confrontations with the SEC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial listing] Bitget to list Theoriq (THQ). Grab a share of 3,016,600 THQ

CandyBomb x VSN: Trade VSN, XRP or SOL to share 2,931,200 VSN

New users get a 100 USDT margin gift—Trade to earn up to 1088 USDT!

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— Enjoy up to 10% APR and trade to unlock an additional pool of 50,000 USDT