- Ripple CEO Brad Garlinghouse anticipates more XRP ETF filings after Bitwise’s recent S-1 submission to the SEC.

- Legal clarity from Judge Analisa Torres stating XRP isn’t a security boosts potential for ETF approvals.

Brad Garlinghouse, CEO of Ripple, projects an increase in applications for XRP-based Exchange-Traded Funds (ETFs) following the recent submission of an S-1 form by Bitwise Asset Management to the U.S. Securities and Exchange Commission (SEC).

Today we filed an initial registration statement on Form S-1 for a new Bitwise XRP ETP.

“We believe blockchains will usher in new apolitical monetary assets and permissionless applications for the 21st century,” said Bitwise CEO Hunter Horsley. “We aim to help investors access…

— Bitwise (@BitwiseInvest) October 2, 2024

This development signals potential growth in the traditional finance sector’s engagement with XRP.

First BTC, then ETH…it was only a matter of time.

This move underscores the growing trust integration of digital assets like XRP into traditional finance, marking the continued adoption and maturation of the crypto market. I sense this is just the beginning. https://t.co/s1pHpIEqth

— Brad Garlinghouse (@bgarlinghouse) October 2, 2024

In a recent statement on platform X, Garlinghouse suggested that Bitwise’s action might prompt other asset managers to pursue similar ETFs for XRP. This follows earlier approvals for Spot Bitcoin and Ethereum ETFs this year, indicating a regulatory shift towards acceptance of digital assets within mainstream financial products.

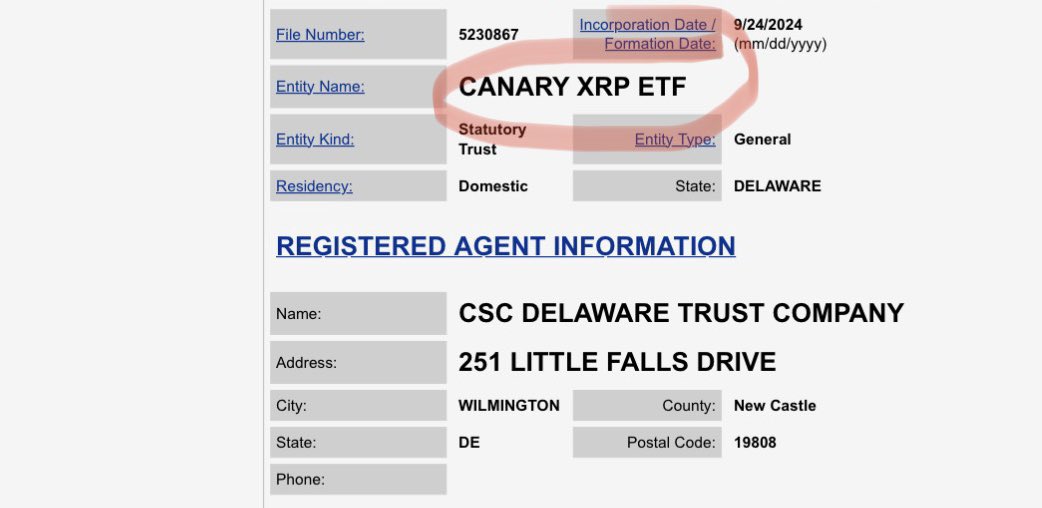

Further interest in XRP ETFs was noted with Canary Capital’s registration related to an XRP ETF with the Delaware Division of Corporations, although no formal SEC filing has yet been made. This preparatory step reflects growing financial interest in the digital currency.

Source: @EleanorTerrett

Source: @EleanorTerrett

Legal clarity achieved earlier from Judge Analisa Torres, who ruled that XRP does not qualify as a security, enhances the cryptocurrency’s potential for further integration into financial markets. This legal standpoint is expected to facilitate the filing and approval of future XRP-related financial products.

Garlinghouse also remarked on the Bitwise filing, noting it as indicative of increasing confidence in crypto assets like XRP among traditional financial institutions. This move is seen as a part of the ongoing broader acceptance and maturation of the cryptocurrency market.

While Grayscale excluded XRP from its Q4 top crypto selections , it launched the Grayscale XRP Trust. This development positions Grayscale to potentially convert this trust into an ETF, broadening institutional access to XRP.

Today we filed an S-1 for a Bitwise XRP ETP!

For more than a decade, XRP has been an enduring crypto asset that many investors want exposure to.

Over the past 6+ years we’ve worked to pioneer investment vehicles that provide access to the emerging opportunities in the space.…

— Hunter Horsley (@HHorsley) October 2, 2024

Bitwise has publicly confirmed their SEC filing for an XRP ETF that aims to provide institutional investors with direct exposure to XRP.

Bitwise issues press release on XRP ETF filing…

Not something you see everyday.

“We believe blockchains will usher in new, apolitical monetary assets and permissionless applications for the 21st century.” https://t.co/djfKJEEoDT pic.twitter.com/YGnhEdavDM

— Nate Geraci (@NateGeraci) October 2, 2024

The success of this filing, and potential future filings, now largely hinges on continued regulatory recognition of XRP’s status as a commodity following recent legal decisions.

“At Bitwise, we believe blockchains will usher in new, apolitical monetary assets and permissionless applications for the 21st century.”

Hunter Horsley, CEO of Bitwise, expressed commitment to leveraging blockchain technology for new financial assets and applications, emphasizing ongoing efforts to expand investment opportunities in this space, highlighting the progressive integration of blockchain technology into conventional financial systems.

XRP is currently trading at $0.587 with a daily drop of -3.95%. The day’s range fluctuated between $0.5788 and $0.6053. Over the past 52 weeks, XRP has traded in the range of $0.3911 – $0.7421. Additionally, the 24-hour trading volume stands at approximately $2.78 billion, indicating significant market activity.

Source: Tradingview

Source: Tradingview

XRP is currently experiencing a downtrend as indicated by the recent price drop. The support level lies around $0.578, with resistance at $0.605.

The technical indicators, such as the Relative Strength Index (RSI), may suggest an oversold condition, potentially leading to a minor rebound if the bearish pressure weakens. However, if XRP breaks below its current support level, further declines could be expected.