DeFi Altcoin Aave Is Set Up ‘Very Well’ for Next Leg of the Rally Due to These Factors: Investor Arthur Cheong

Venture capitalist Arthur Cheong believes that one decentralized finance (DeFi) altcoin may be gearing up for a massive breakout.

The DeFiance Capital CEO tells his 176,400 followers on the social media platform X that several factors are signaling bullishness for lending platform Aave ( AAVE ).

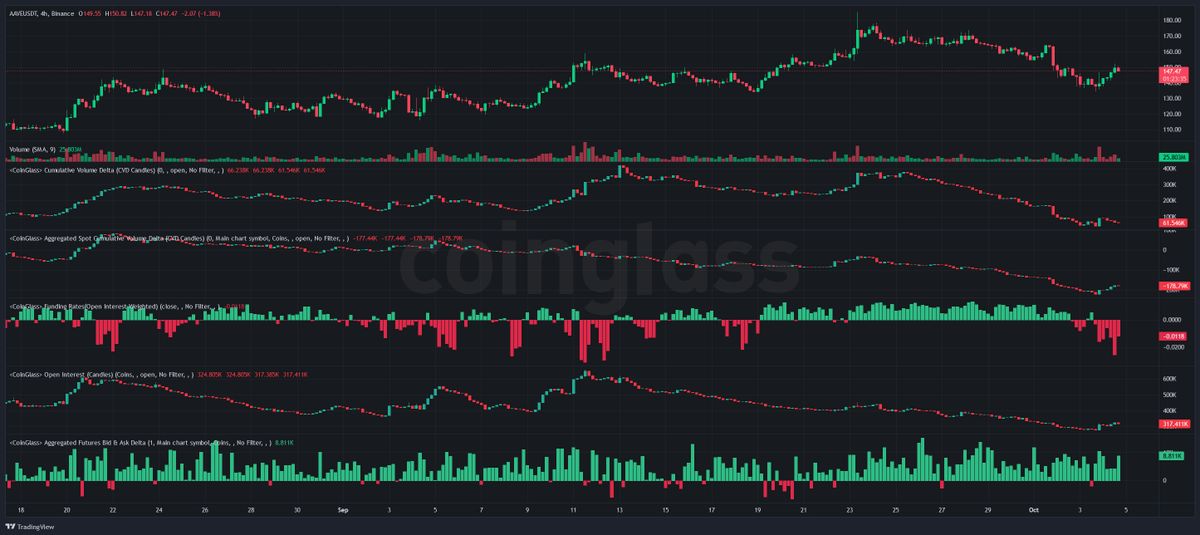

He suggests Aave’s open interest (OI), which is the total number of outstanding derivatives contracts for a given asset, may have bottomed after a large decline in the last month.

“AAVE price is holding up very well despite the leverage flush on the perps over the past few weeks:

1. Open Interest at 30 days low, dropped by 50% compared to September 11th.

2. Funding rate negative.

Set it up very well for the next leg of rally.”

Source: Arthur Cheong/X

Source: Arthur Cheong/X

A negative funding rate means there are more short positions than long positions on AAVE, which some traders perceive to be a bullish indicator.

He also suggests that that Former President Donald Trump using Aave for the launch of World Liberty Financial, his new DeFi crypto project, may be a bullish catalyst.

“If you tell me in 2020 we will have a former and potential future President of the USA supporting the launch of a separate instance on Aave, even the biggest DeFi bull wouldn’t believe it. But here we are. ‘We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.'”

Last month, he said Aave appeared to be breaking out of a multi-year consolidation pattern on the weekly timeframe.

“AAVE is trading at the highest level since May 2022 and seems to be breaking out from a two-year consolidation pattern. Expect ATH (all-time high) reclaim to further solidify DeFi Renaissance.”

Source: Arthur Cheong/X

Source: Arthur Cheong/X

Aave is trading for $148.88 at time of writing, up 7.4% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/iurii/AtlasbyAtlas Studio

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

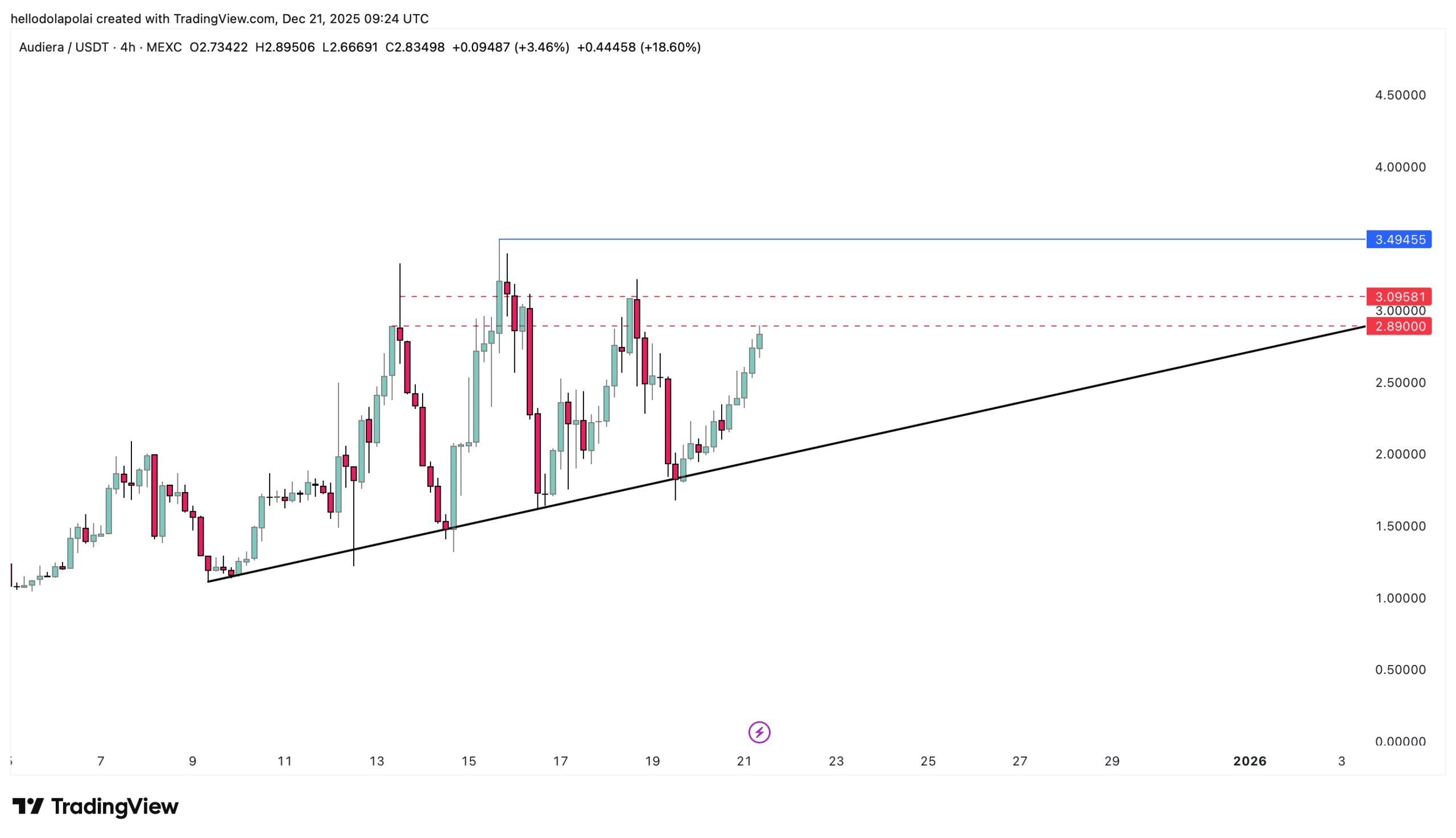

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreBitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low

Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)