Cosmos cofounder blames Iqlusion's Zaki Manian for North Korea-linked security risks in network's liquid staking module

Quick Take Cosmos co-founder Jae Kwon said a significant part of the network’s liquid staking module was developed by North Korean agents, which proceeded under the alleged negligence of Iqlusion’s Zaki Manian. Kwon called for the Cosmos governance community to immediately conduct a comprehensive audit of the LSM.

Cosmos co-founder Jae Kwon highlighted concerns about the integrity and security of Cosmos Hub ATOM -2.17% 's liquid staking module in a post on Tuesday. It was revealed earlier that North Korean agents developed a significant part of the module.

“For sixteen months, the LSM was developed by individuals linked to North Korea, and their contributions were integrated into the Cosmos Hub without proper security vetting,” said Kwon, blaming the “gross negligence” of Cosmos validator hosting firm Iqlusion and its leader Zaki Manian.

Iqlusion and Manian started developing the LSM in August 2021 with Jun Kai and Sarawut Sanit. Later, Kwon claimed they were North Korean agents. Kwon claimed the two alleged agents contributed most of the code.

Despite knowing the involvement of North Korean agents since March 2023, as the Iqlusion leader admitted on social media, Manian hid the issue as well as other unresolved security issues until earlier this month, Kwon wrote in the post.

“Rather than taking proactive measures, such as conducting an additional audit or disclosing this issue to the Cosmos community, Zaki publicly asserted that the module was ‘ready to be deployed,’” Kwon stated. “Zaki’s lack of transparency and poor judgment represents a profound breach of the trust placed in Iqlusion by the Cosmos community,” he added.

While critical vulnerabilities in LSM were discovered in an audit in 2022, the same North Korean agents were responsible for fixing it, and Kwon alleged that the last code merge was the same. Meanwhile, Manian claimed he rewrote the LSM code, presumably before deployment, along with the staking firm Stride.

Kwon further alleged that as LSM is not a “standalone” module but a collection of modifications and extensions built on top of the existing Cosmos staking modules, such vulnerabilities hold critical risks to potentially all staked Cosmos’ ATOM tokens.

He called for the Cosmos governance community to immediately conduct a comprehensive audit of the LSM. He urged the Interchain Foundation to implement stricter auditing requirements and develop an oversight protocol to ensure safety in new Cosmos implementations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zach Rector Share Quick XRP Update

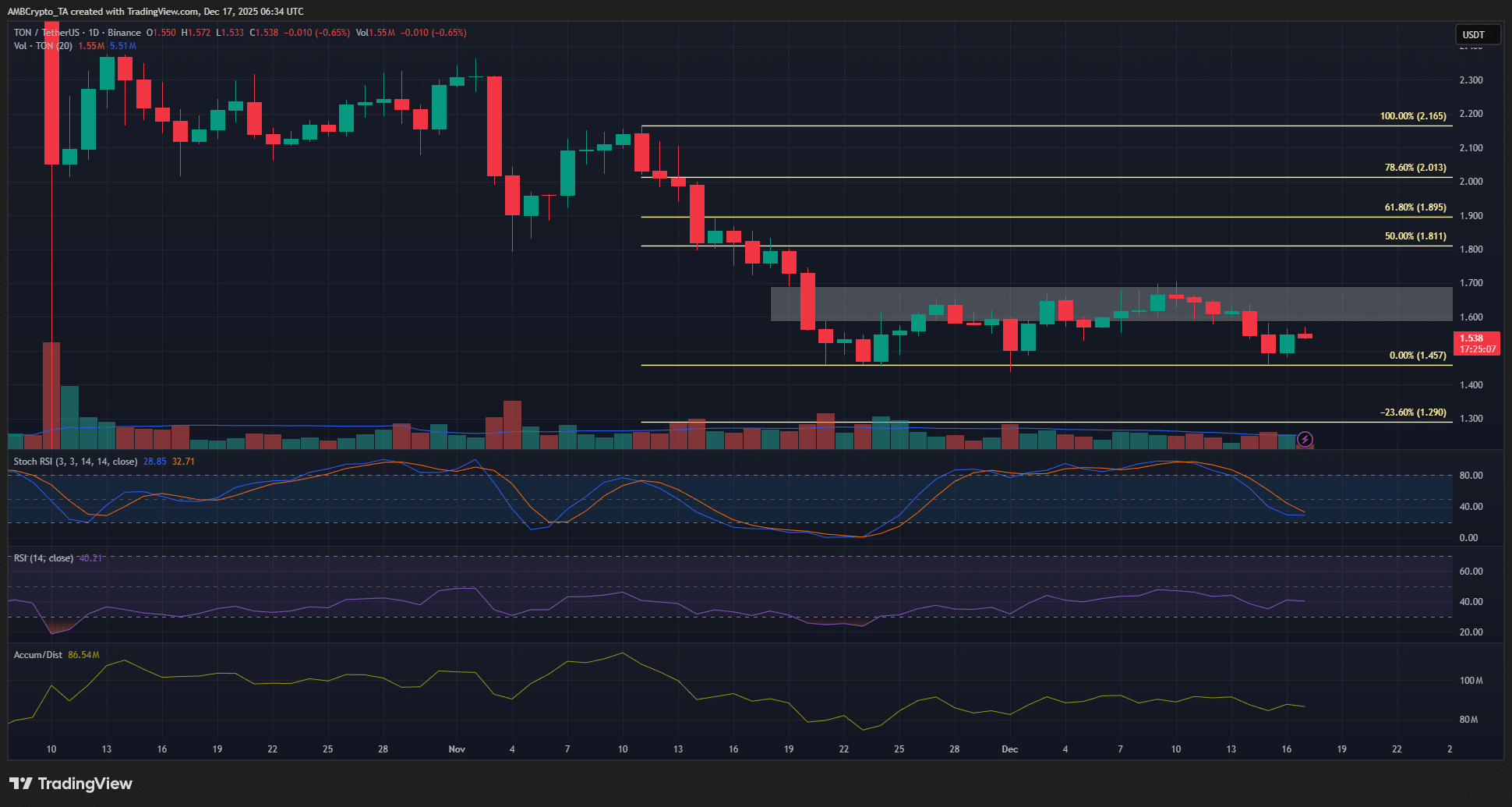

Can Toncoin eye $2? – Why THIS level remains TON’s major hurdle