Crypto investment products hit record annual inflows of $29 billion this year: CoinShares

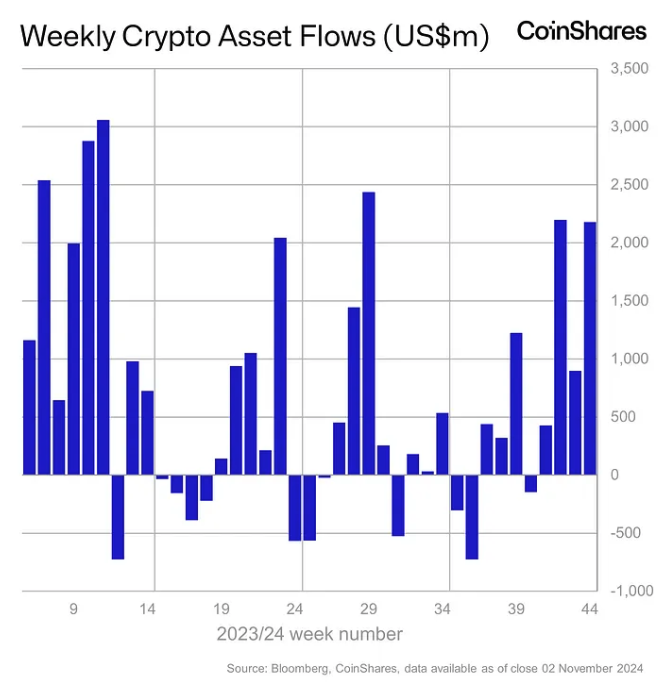

Crypro investment products attracted another $2.18 billion worth of net inflows globally last week, bringing year-to-date figures to a record $29.2 billion, according to CoinShares.The firm’s head of research, James Butterfill, said the weekly inflows were driven by “election euphoria” over a Republican win.

Global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered net inflows of $2.18 billion last week, according to CoinShares, bringing year-to-date figures to a record $29.2 billion.

“We believe euphoria around the prospect of a Republican victory was the likely reason for these inflows as they were in the first few days of last week, as polls have turned, we saw minor outflows on Friday, highlighting how sensitive bitcoin is to the U.S. elections at present,” CoinShares Head of Research James Butterfill said in a Monday report.

Combined with price appreciation over the last couple of months, the flows have driven total assets under management at the funds to over $100 billion for only the second time, matching June's $102 billion peak. Weekly trading volumes also surged 67% to $19.2 billion, accounting for 35% of bitcoin's trading on trusted exchanges, Butterfill noted.

Weekly crypto asset flows. Images: CoinShares .

The price of the foremost cryptocurrency is up more than 30% from a low of $52,600 in early September to currently trade for $68,818, according to The Block’s Bitcoin Price Page . However, it has fallen around 7% from $73,500 on Oct. 29 amid recent convergence in Republican Donald Trump and Democrat Kamala Harris’ odds to win the U.S. presidential race on the decentralized predictions platform Polymarket.

Earlier on Monday, analysts at research and brokerage firm Bernstein reiterated that they expect bitcoin to break all-time highs of nearly $74,000 and reach $80,000 to $90,000 following a Trump win in the run-up to inauguration day on Jan. 20. However, a Harris win could see bitcoin drop to $50,000 over the same period before any recovery, they warned, up from their previously predicted $30,000 to $40,000 range in that scenario.

US continues to dominate global inflows, with bitcoin products almost the sole beneficiary

U.S.-based funds dominated last week’s net inflows, adding $2.23 billion, while investment products in Canada, Germany and Switzerland saw $24.4 million, $20.3 million and $13.8 million in net weekly outflows, respectively. Bitcoin products were the main beneficiary, accounting for $2.16 billion in net weekly inflows globally, with the U.S. spot bitcoin exchange-traded funds registering $2.22 billion last week. However, this was also accompanied by $8.9 million worth of net weekly inflows into short-bitcoin products.

Meanwhile, Ethereum-based investment products also registered net inflows of $9.5 million last week but that “remains in stark contrast to the bullishness seen in Bitcoin or Solana,” Butterfill said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

100% rebate for KYB users: Earn fee rebates on EUR bank deposits!

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone

Bitget Trading Club Championship (Phase 21)—Up to 1250 BGB per user, plus a ZETA pool and Mystery Boxes

Bitget Spot Margin Announcement on Suspension of MDT/USDT, RAD/USDT, FIS/USDT, CHESS/USDT, RDNT/USDT Margin Trading Services