Bitcoin Poised for Parabolic Surge if This Level Holds, Says Crypto Expert

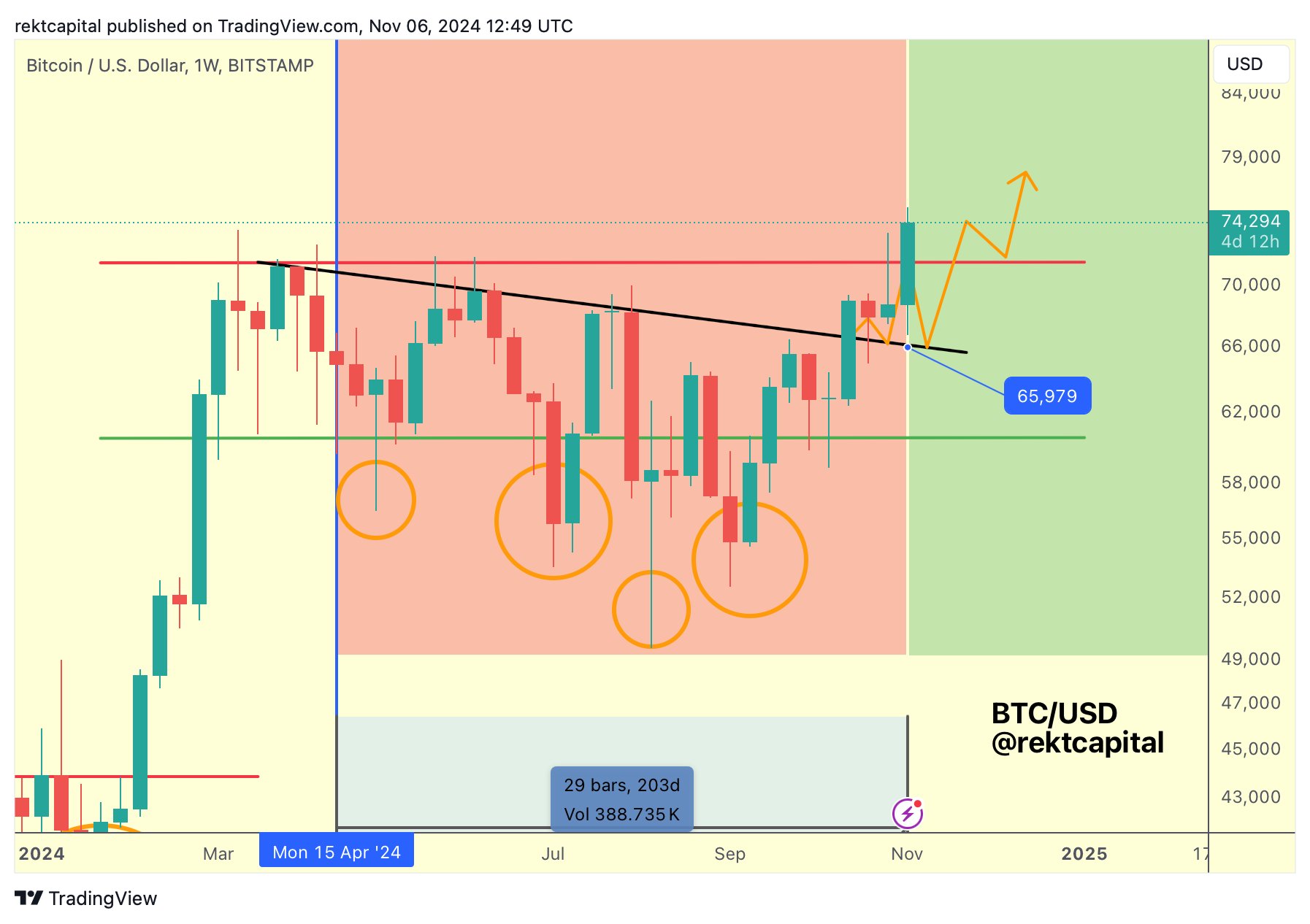

Bitcoin has recently achieved a major milestone, rallying to new all-time highs after successfully filling a significant CME Gap, as noted by prominent cryptocurrency analyst Rekt Capital.

The price action has closely followed a predicted pathway outlined in the RC Newsletter three weeks ago, highlighting a positive shift for the leading digital asset.

The latest price surge marks a successful retest of the May highs, which were previously set at around $67,500. This level has since transitioned from resistance to support, effectively acting as a springboard for Bitcoin’s new record-breaking highs. The fact that Bitcoin has managed to break through these key levels signals strength in its ongoing rally.

Looking ahead, Bitcoin is at a critical juncture. To confirm its transition from the reaccumulation phase into a parabolic upside phase, BTC needs to maintain a weekly close above the $71,500 mark. A sustained hold above this level would indicate that the market is prepared for further upward movement.

READ MORE:

Bitcoin Dominates Market as Altcoins Struggle to Keep UpIf Bitcoin can secure a monthly close around this level, it would set a historic precedent for the cryptocurrency. Analysts and investors alike will be watching closely to see if Bitcoin can maintain its momentum and continue to build on this newfound support around $71,500.

For now, Bitcoin’s path appears bullish, but the key test will be whether it can hold above this crucial support level in the coming weeks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone

Bitget Trading Club Championship (Phase 21)—Up to 1250 BGB per user, plus a ZETA pool and Mystery Boxes

Bitget Spot Margin Announcement on Suspension of MDT/USDT, RAD/USDT, FIS/USDT, CHESS/USDT, RDNT/USDT Margin Trading Services

STABLEUSDT now launched for futures trading and trading bots