Whale Loses $74,980,000 in One Trade Trying to Short Bitcoin (BTC) on Election Day: Lookonchain

A trader attempting to short Bitcoin ( BTC ) is reportedly now suffering tens of millions of dollars in losses after the flagship crypto asset soared on Election Day.

Blockchain tracking firm Lookonchain says one crypto whale suffered a $74,980,000 liquidation as US presidential vote tallies began to break toward pro-crypto candidate Donald Trump.

Bitcoin hit new all-time highs as Trump prevailed over Democratic challenger Kamala Harris.

“So crazy! After BTC hit a new all-time high, a whale shorting BTC got liquidated for $74.98 million!”

According to crypto exchange data aggregator Coinglass, $413.8 million worth of short positions were liquidated on Election Day, the vast majority being short positions on BTC.

Binance saw the most liquidations, followed by OKX and Bybit.

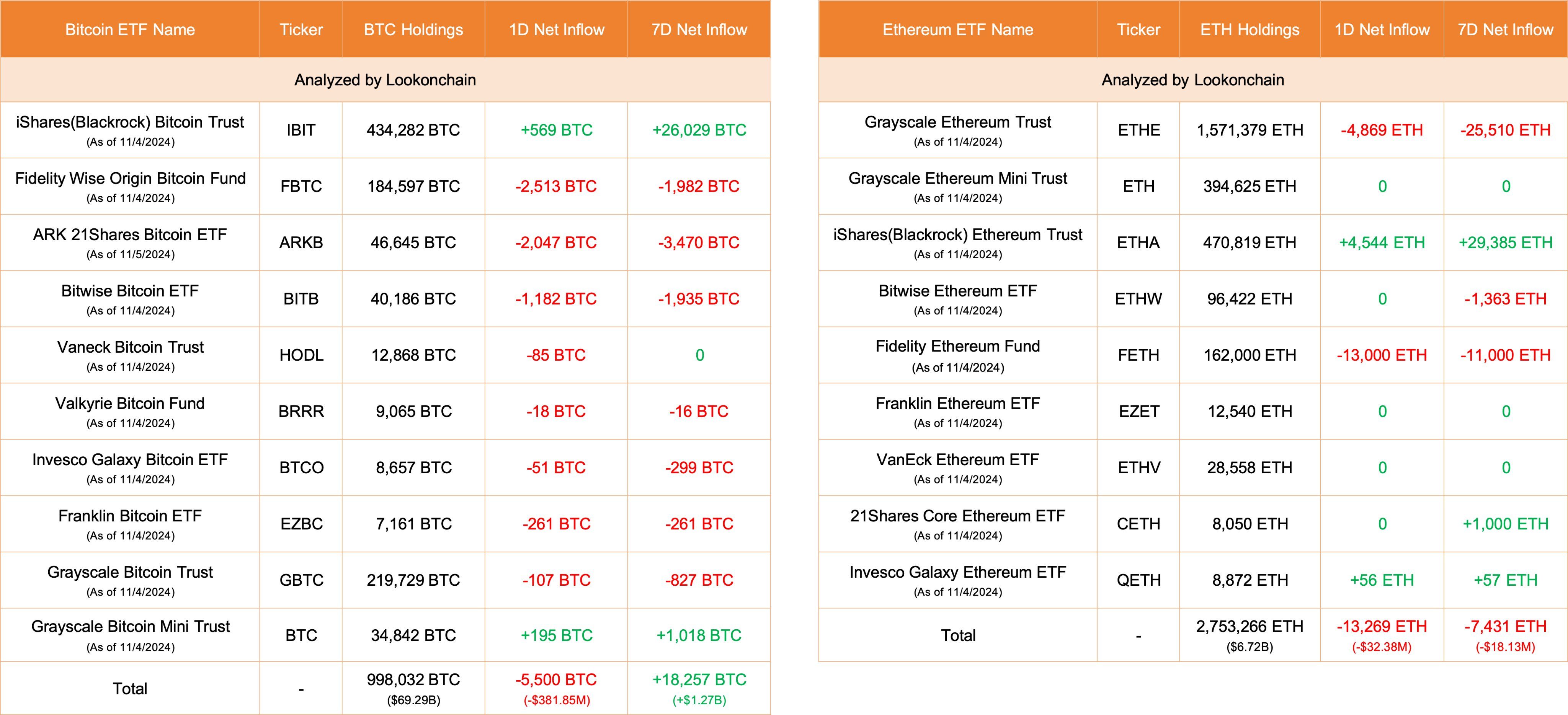

Lookonchain also reports there were large outflows from spot market Bitcoin and Ethereum ( ETH ) exchange-traded funds (ETFs) on Election Day before the polls closed. Fidelity’s ETH and BTC ETFs saw the largest outflows among the different ETFs.

“November 5th update:

10 Bitcoin ETFs:

- NetFlow: -5,500 BTC (-$381.85 million).

- Fidelity outflows 2,513 BTC ($174.44 million) and currently holds 184,597 BTC ($12.82 billion).

Nine Ethereum ETFs:

- NetFlow: -13,269 ETH (-$32.38 million).

- Fidelity outflows 13,000 ETH ($31.72 million) and currently holds 162,000 ETH ($395.28 million).”

Source: Lookonchain/X

Source: Lookonchain/X

Bitcoin is trading for $75,880 at time of writing, up 10.2% in the last 24 hours. Meanwhile, ETH is trading for $2,689 up more than 11% on the day.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List Planck (PLANCK) in the Innovation, AI and DePIN Zone

Buy PLAI,Get 100% fee rebate in PLAI!

Bitget to support loan and margin functions for select assets in unified account

Bitget launches cross margin trading for BGB/USDT and BGB/USDC