Bitcoin is Trump’s next opportunity to beat Biden

Biden’s victory in 2020 aligned with a big rally for bitcoin — can Trump beat the Biden bump?

This is a segment from the Empire newsletter. To read full editions, subscribe .

Biden dropped out of the presidential race too soon for Trump to get proper revenge for 2016, and he’ll have to settle for taking out his VP instead.

Luckily, there’s still time to beat Biden in perhaps the only popular vote that really counts: bitcoin.

Bitcoin already set record highs alongside the stock market around Trump’s win this week — the SP 500 is up 4% in the past month to bitcoin’s 18%.

Newsletter

Subscribe to Empire Newsletter

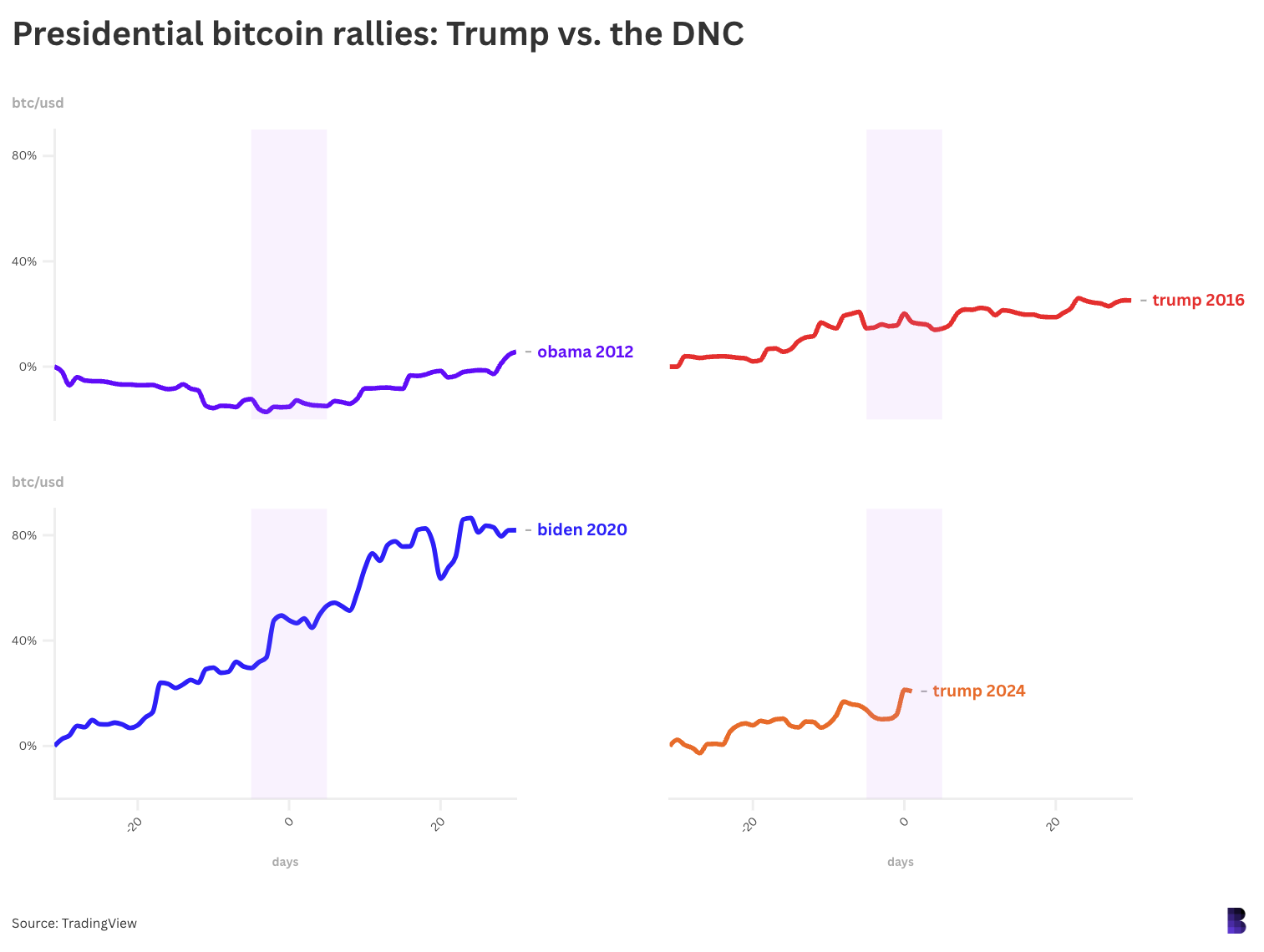

That’s much more than what happened after Trump’s win in 2016, which was good for a brief 5% jump.

Obama’s win in 2012 meanwhile coincided with bitcoin’s price dropping by one-fifth in the leadup to Election Day, before recovering over following weeks.

But Biden’s victory in 2020 aligned with a far bigger rally. Bitcoin had risen 30% in the month heading into the vote and continued on for another 50% in the 30 days after.

Each line is bitcoin’s price performance around Election Day, with the week either side shown by the shaded area

Each line is bitcoin’s price performance around Election Day, with the week either side shown by the shaded area

This was the start of bitcoin’s monstrous pandemic run from $10,000 to $60,000, as Trump was handing over the White House, which spanned September 2020 to March 2021.

Of course, bitcoin today is a much bigger beast. BTC’s market cap was under $300 billion at the time — now it’s almost $1.5 trillion. It takes much more to move the needle so far.

If it happened, it would be big. Bitcoin rallied up to 87% in the 60 days surrounding Biden’s election win.

BTC has so far gone about 20% for Trump, and another 70% would put bitcoin at almost $130,000 before year’s end.

We’re gonna need bigger bulls.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter .

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the Forward Guidance newsletter .

Get alpha directly in your inbox with the 0xResearch newsletter — market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

- BTC

- Empire Newsletter

- Joe Biden

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Spot Margin Announcement on Suspension of HIGH/USDT, GTC/USDT, SLP/USDT, PERP/USDT Margin Trading Services

CandyBomb x IR: Trade IR or BTC to share 1,104,000 IR

Bitget to delist the BABY On-chain Earn product

Earn Up to 25 USDT:Buy Crypto with Google Pay/Apple Pay!