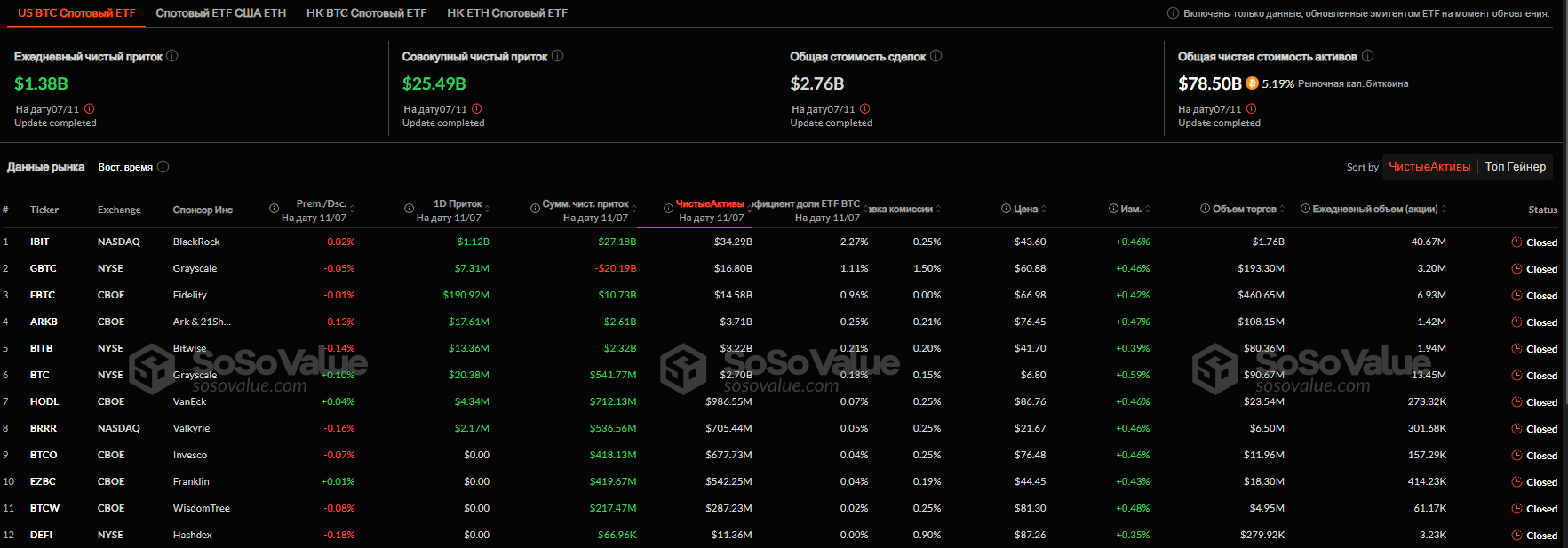

On Thursday, November 7, spot US currencies traded Bitcoin -funds have seen record daily inflows since launch. Collectively, investors have invested in ETF more than $ 1,38 billion

I told you we were likely to see a big influx into the funds, but even I'm surprised by the size of it. This is the largest single-day inflow of spot BTC- ETF in their entire history," wrote Bloomberg stock analyst Eric Balchunas.

According to SoSoValue, the IBIT fund from BlackRock once again became the leader in terms of inflow of funds. The largest spot bitcoin ETF accounted for more than 81% of the investment, namely about $1,12 billion. This is the maximum in the entire history of exchange-traded funds based on the flagship cryptocurrency.

Inflow into spot bitcoin ETF

The second largest inflow was from Fidelity's FBTC. Over the past trading day, investors invested in Bitcoin - the fund is about $190,92 million. This is less than the $308,8 million that it received ETF the day before.

Bitcoin Mini Trust from Grayscale received almost $20,38 million, ARKB from ARK and 21Shares - $17,61 million, BITB from Bitwise - $13,36 million, HODL from VanEck - $4,34 million, BRRR from Valkyrie - $2,17 million.

Issuers of other spot bitcoin ETF reported zero inflows.

On November 7, the total trading volume reached $2,76 billion. This is significantly lower than the $6,07 billion recorded on November 6.