U.S. Senator Says Trump Could Launch National Bitcoin Reserve Within Months

US Senator Cynthia Lummis is optimistic that her proposal to create a national Bitcoin reserve will gain traction within the first 100 days of Donald Trump’s second presidential term.

Lummis shared on Nov. 11 that bipartisan support, coupled with public backing, could help push the bill forward, highlighting the potential benefits for the US financial system and its position as a leader in the Bitcoin space.

In her statement, Lummis emphasized that the Bitcoin Act, introduced in July, would allow the US to acquire one million BTC, positioning the country as the largest government holder, similar to its gold reserves. The proposal also includes measures to safeguard Bitcoin ownership rights, establish a Bitcoin reserve, and ensure top-tier asset protection through a decentralized vault system managed by the Treasury Department.

Although the bill faced delays in the Senate, the proposal has garnered strong support, particularly from those close to Trump’s agenda, including David Bailey, who views the Bitcoin reserve as a key priority for the President-elect’s early days in office. However, the bill still requires approval from both the Senate and House before reaching the President’s desk.

READ MORE:

Small Nation’s Bitcoin Holdings Surpass $1 Billion Amid Market SurgeThe idea of a national Bitcoin reserve has received interest across party lines. Democratic Representative Ro Khanna recently expressed his support, citing Bitcoin’s growth potential and its role in enhancing the US financial system. Matthew Sigel, Head of Digital Assets Research at VanEck, also backed the plan, suggesting that a strategic Bitcoin reserve could expand US influence in areas like energy, AI, and decentralized finance, while also facilitating partnerships to mine additional BTC without significant risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Former Federal Reserve Governor Coogler faced an ethics investigation before resigning.

Nillion will gradually migrate to Ethereum.

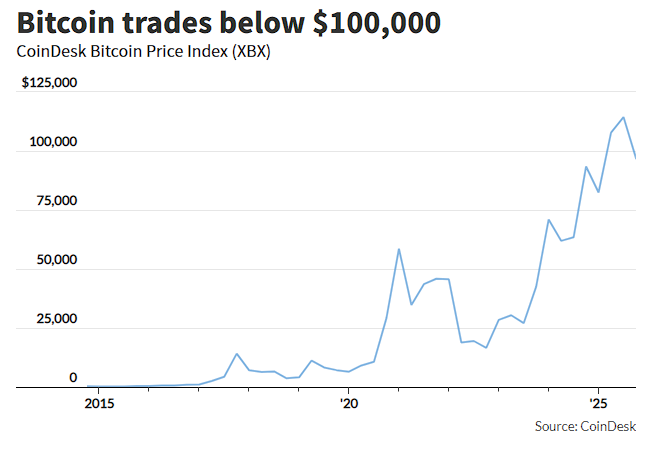

Both gold and tech stocks have seen dip-buying, but only bitcoin remains "sluggish."

Compared with the capital inflows into tech stocks and gold's sharp rebound after a plunge, bitcoin was a clear exception in Friday's market: it defied the trend by dropping 5%, hitting a six-month low, and has now declined for three consecutive weeks. This contrast highlights the unusual situation in the bitcoin market: even as it maintains a high correlation of 0.8 with the Nasdaq 100 Index, bitcoin exhibits an asymmetric pattern of "falling more on declines and rising less on rallies." Meanwhile, intensified whale sell-offs and concentrated selling by long-term holders are jointly suppressing bitcoin.

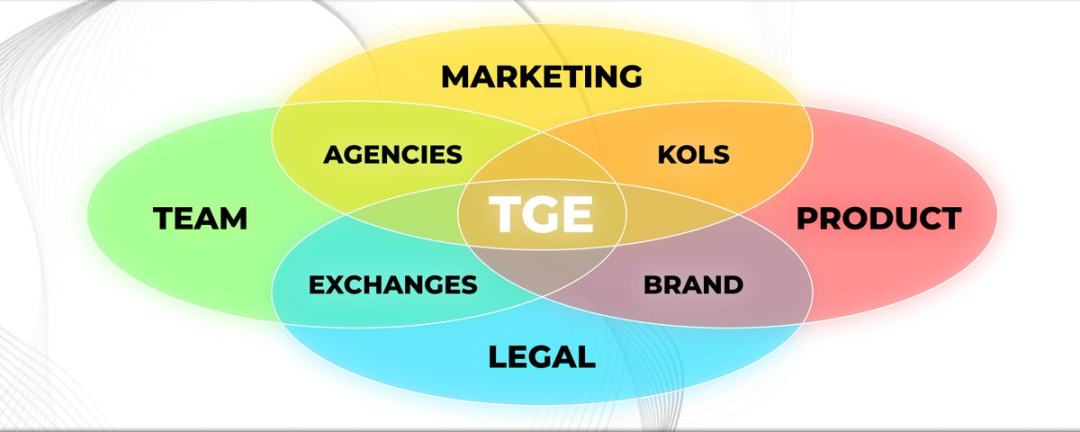

Why do 90% of project TGEs end in failure?

Doing these things is a prerequisite for a successful TGE.