Organization: If the core CPI in the United States drops, the dollar may decline

On December 11, the US inflation data for November will be announced later today, with the dollar slightly higher beforehand. However, Mario Schimmels from the research department of Germany's Central Cooperative Bank said that if the annual core inflation rate drops from 3.3% in October to 3.2% in November as expected by the bank, the dollar may "depreciate" in the short term. "Although the price suppression effect of energy prices may have lost some of its effectiveness, it is expected that price pressure in service industries will ease," he said. Wage pressure has eased and apartment rents have only risen slightly in new contracts. Most analysts surveyed by The Wall Street Journal expect core CPI to remain unchanged at 3.3%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase

SOL treasury companies and ETF total holdings exceed 24.2 million SOL, equivalent to approximately $3.44 billions

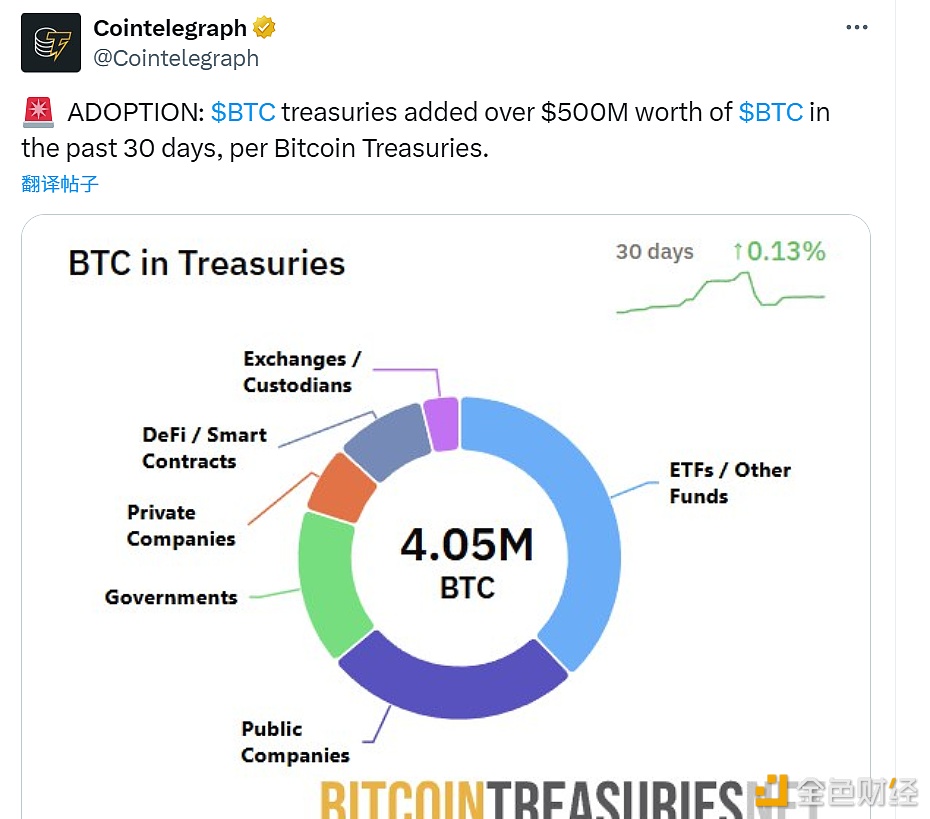

Institutions increased their BTC holdings by over $500 million in the past 30 days