-

The memecoin BONK has experienced a significant outflow of $45.73 million from exchanges, signaling a potential bullish trend amidst market recovery.

-

The recent price action reflects heightened investor interest, suggesting that BONK might achieve a 250% surge to the $0.000137 level in the future.

-

“Data from Coinglass highlights a strong uptick in whale accumulation, indicating confidence in BONK’s price recovery,” said a representative from the analytics firm.

This article explores the recent surge in BONK’s trading activity and potential price movements, revealing why it has captured the attention of investors.

Whale’s rising interest in BONK

Recent reports indicate that a growing number of whales and long-term holders are accumulating BONK, contributing to a substantial outflow of $45.73 million from exchanges, as highlighted by Coinglass. This trend has emerged even amid market volatility, particularly highlighted by a price decline observed on December 10th.

The notable outflow indicates a shift in sentiment, with investors moving their assets from exchanges to personal wallets, often viewed as bullish behavior. The significance of this trend becomes clearer against the backdrop of the cryptocurrency market’s overall recovery.

Technical analysis and key levels

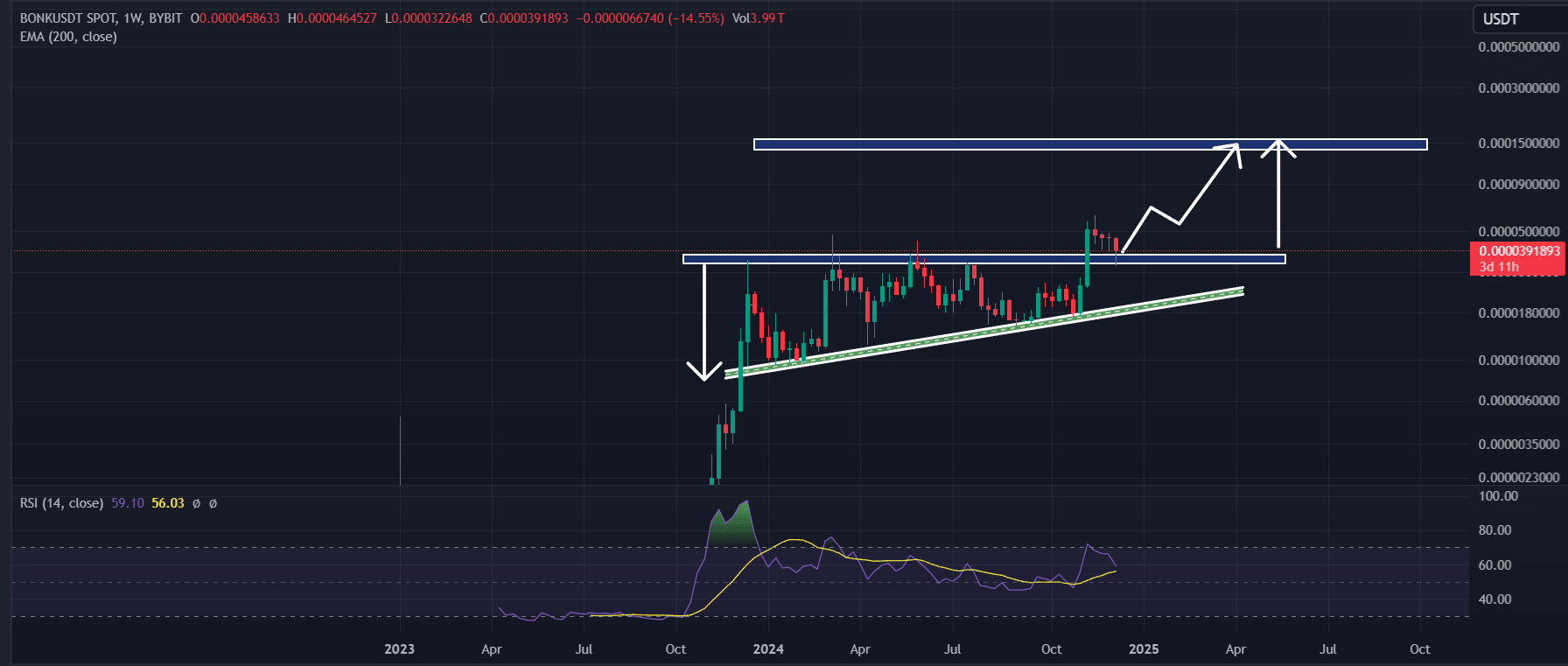

According to COINOTAG’s recent technical analysis, BONK has successfully retested its breakout level from a weekly ascending triangle pattern. Following a recent price pullback, it has not only found support but also formed a bullish engulfing candle pattern, signaling potential upward momentum.

Source: Trading View

Currently, there exists a strong possibility for BONK to rise by 40% in the near timeframe, targeting a price of $0.0000545. Should the bullish trend continue, there could be potential for a larger leap approaching 250% toward the $0.000137 mark—this could establish a significant waypoint for traders.

The Relative Strength Index (RSI) for BONK is currently at 46, indicating it is nearing an oversold condition, which could foreshadow a reversal in prices within the coming days. As of now, BONK trades near $0.000395, marking an increase of over 5.65% in the last 24 hours.

Conclusion

With significant whale accumulation and strong technical indicators collaborating to create a bullish outlook, BONK appears to be at a pivotal moment for both short-term and long-term investors. The recent outflow from exchanges serves as a clear signal of confidence among holders and bolsters the potential for substantial price movements. Stay tuned for future updates as this memecoin evolves in the dynamic cryptocurrency landscape.