Bitwise, Strive Launch ETFs Targeting Bitcoin-Heavy Firms

- Bitwise files for ETF with a focus on companies that hold minimum 1000 BTC in their treasury.

- The ETFs are assigned based on their Bitcoin reserve weight, rather than on market cap.

- Vivek Ramaswamy’s Strive ETFs focus on Bitcoin bonds from firms like MicroStrategy.

Bitwise has proposed to launch a new exchange-traded fund (ETF) seeking companies with large Bitcoin reserves in their treasuries. The Bitwise Bitcoin Standard Corporations ETF is targeting firms that use the ‘Bitcoin standard’, which implies that they must have a minimum of 1,000 Bitcoins in their holdings.

Nate Geraci, in his X post, stated that the BTC treasury operation virus is spreading and that Bitwise would own stocks of companies that have adopted the ‘Bitcoin standard.’ Further, the filing also stated that the firms should also have a market capital of $100 million, average daily trading volume of $1 million and a free float of less than 10%.

Unlike traditional ETFs that weigh holdings based on market capitalization fund, Bitwise would assign weight according to the market value of each company’s Bitcoin reserves, with a maximum weight of 25%. For example, despite Elon Musk’s Tesla having a $1.42 trillion market cap, its weightage in the ETF would be lesser than MicroStrategy. This is because MSTR holds about 444,262 BTC holdings, whereas Musk holds only about 9,720 BTC.

On the other hand, Strive, a firm founded by Vivek Ramaswamy in 2022, has filed for another ETF. Compared to Bitwise, Strive plans to create a Bitcoin ETF with investment in the convertible bonds with companies like MicroStrategy that utilize Bitcoin as part of their corporate strategy.

These bonds are supposed to provide investors with an opportunity to invest in Bitcoin without investing directly in the cryptocurrency and Strive’s fund would be actively managed. Although the management fee has not been specified, it is stated that the actively managed funds are charged more than passive index funds.

Notably, the Bitcoin ETFs idea has stemmed from MicroStrategy’s Bitcoin holdings. The founder, Michael Saylor, has been buying the crypto since 2020 and accumulates it at every given opportunity. Currently, the firm holds about $56 billion in Bitcoin. As the interest in cryptocurrencies continues to rise, crypto experts predicted that more crypto ETFs would be approved in 2025, with President-elect Donald Trump at the helm.

The post Bitwise, Strive Launch ETFs Targeting Bitcoin-Heavy Firms appeared first on CryptoTale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Novogratz Warns XRP and ADA Must Prove Real Value Now

UNIfication Greenlights 100M UNI Burn and Switches On Protocol Fees

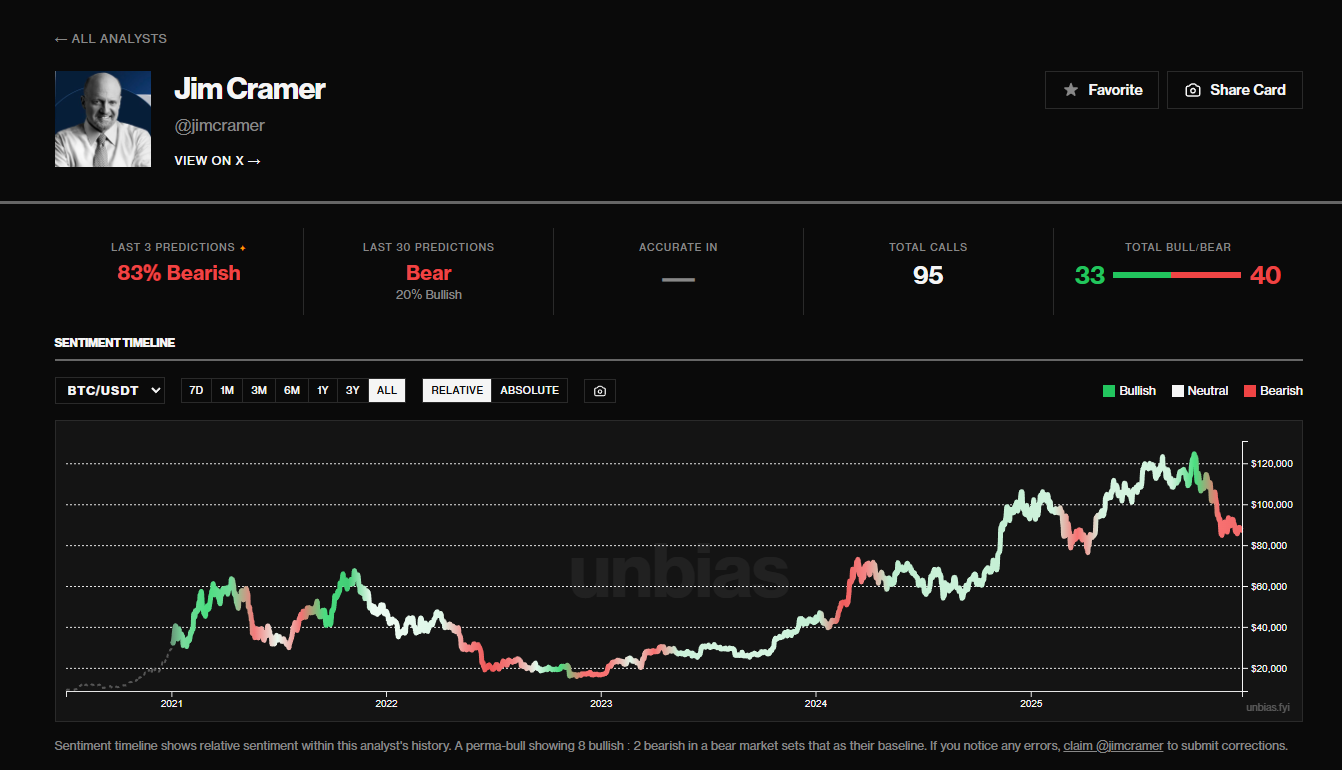

Jim Cramer's Bitcoin Bear Growl: Time to Buy the Dip? – Kriptoworld.com

Dive into Dogecoin’s Dramatic Decline and its Potential Rebound Signals