-

Solana (SOL) is at a critical juncture, with its price and transaction activity sparking debate about the sustainability of its bullish outlook.

-

The recent increase in transaction counts may indicate a recovering network, but market trends show persistent selling pressure that could challenge further gains.

-

“While Solana’s transaction metrics look favorable, the overall selling activity indicates that buyers are yet to reclaim control,” noted analysts from COINOTAG.

Solana’s recent transaction surge is overshadowed by selling pressure, raising questions about sustainability as it strives to maintain bullish momentum.

Transaction counts surge, but sellers dominate

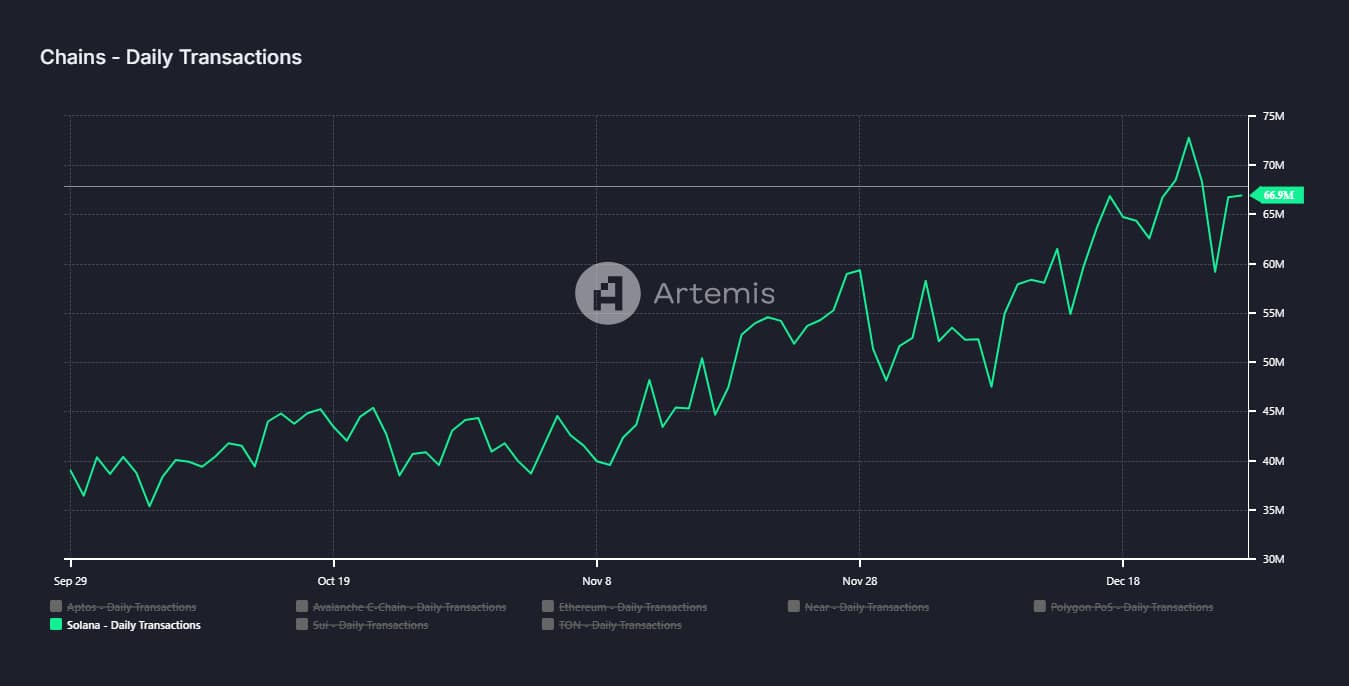

Solana’s network has recorded a surge in transaction activity, with 66.9 million transactions executed in the past 24 hours. This comes as the asset gradually recovers from its recent downturn.

Source: Artemis

A spike in transaction counts can signal either bullish or bearish sentiment, depending on whether market participants are buying or selling. To discern the trend, COINOTAG analyzed Solana’s Exchange Netflow.

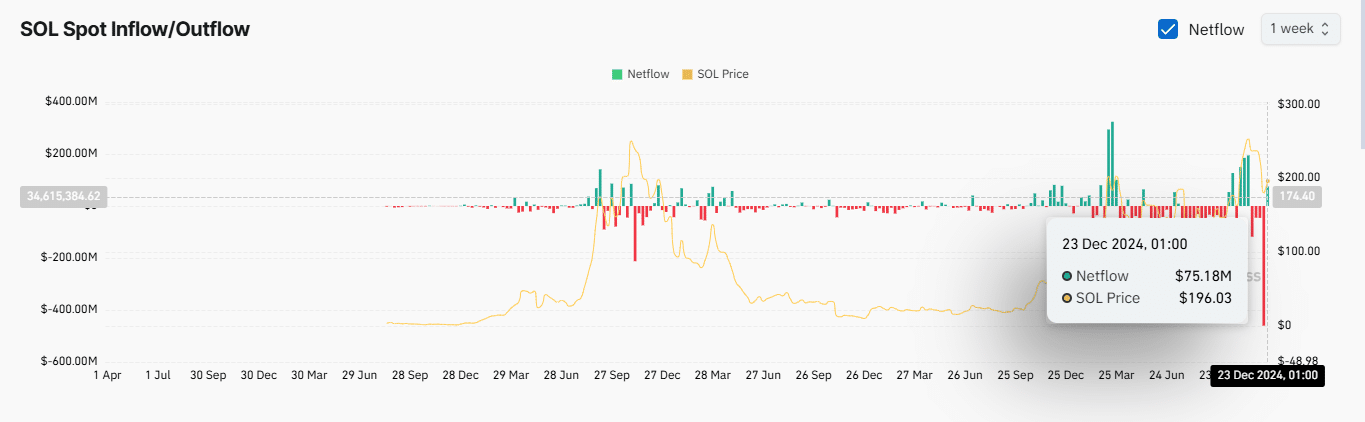

Exchange Netflow measures the difference between the inflows and outflows on exchanges. A positive netflow indicates more selling activity, while a negative netflow suggests that buying pressure dominates.

As of now, Solana’s Exchange Netflow is negative on both daily and weekly timeframes, suggesting that buying activity has outpaced selling.

In the past 24 hours, $6.15 million worth of SOL has been sold, and $75.18 million in the past seven days.

Source: Coinglass

Despite the observed buying pressure, SOL’s price surge of 5.42% over the last 24 hours appeared fragile.

A closer analysis of trading volume revealed a 25% decline, indicating that the recent rally may lack sufficient market momentum to sustain itself.

Typically, when a price surge is accompanied by a drop in volume, it signals a temporary rally without substantial market support.

Unless Solana sees a corresponding increase in trading volume to back its price movement, the asset remains at risk of a deeper pullback.

SOL maintains bullish potential despite pressure

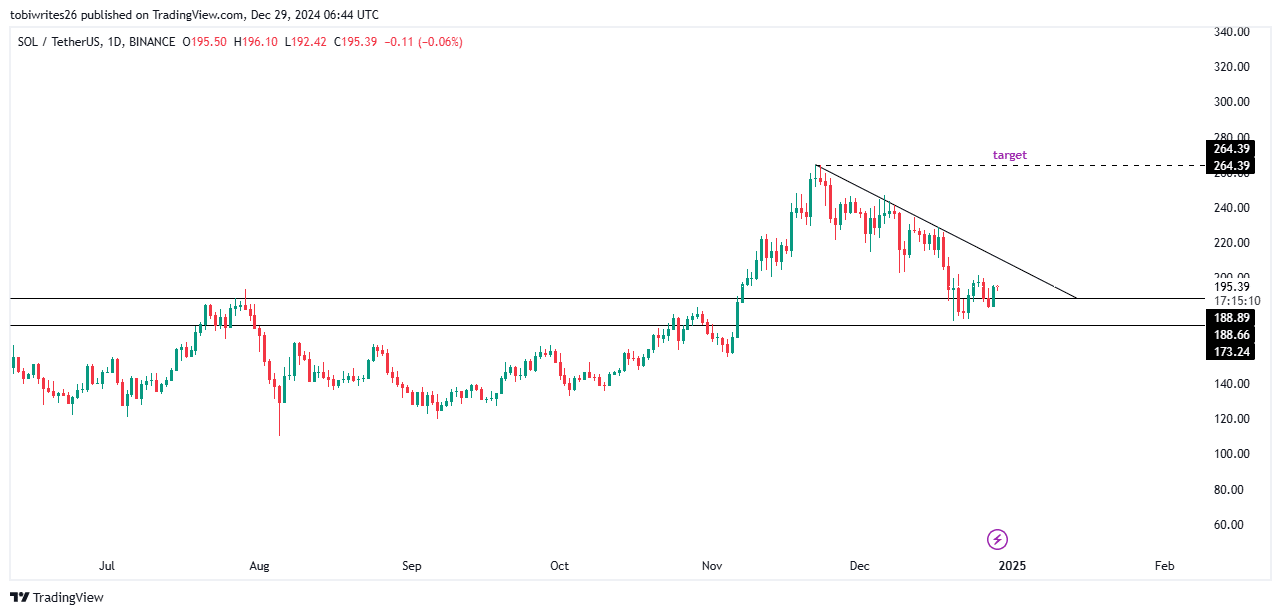

SOL has entered a key support zone on the chart, trading within a bullish triangle structure.

This support level ranges between $188.89 and $173.24, an area historically associated with significant buying pressure, though such activity has yet to materialize currently.

Source: TradingView

If SOL breaches this support zone, it is likely to re-enter the consolidation phase it recently exited.

Conversely, if the support level serves as a catalyst for a rally, the asset could experience a significant upside. This could propel SOL toward its previous all-time high and potentially beyond.

Conclusion

In summary, while Solana’s recent transaction uptick and price recovery provide grounds for cautious optimism, substantial challenges remain. The interplay of market sentiment and trading volume will be crucial in determining whether SOL can sustain its bullish trajectory. Without a notable shift in buyer activity or support from trading volume, Solana could find itself vulnerable to further corrections, emphasizing the need for vigilant monitoring in the coming days.