Aave Considers Fee Switch as USDe Pegging Proposal Draws Concerns

Aave, a leading DeFi platform, is preparing to activate a fee switch mechanism to enhance its revenue model and ensure long-term sustainability.

Aave, a leading decentralized finance (DeFi) platform, is gearing up to introduce a fee switch mechanism aimed at boosting its economic model.

This step aligns with broader efforts to ensure long-term sustainability and deliver value to the Aave ecosystem.

Aave’s Fee Switch Initiative

On January 4, Stani Kulechov, Aave’s founder, hinted at plans to activate a fee switch initiative. This proposal aims to enhance the platform’s revenue management by enabling the Aave DAO to adjust how fees are collected and distributed.

Such mechanisms are common in DeFi platforms and typically reward token holders and stakers through transaction fee redistribution.

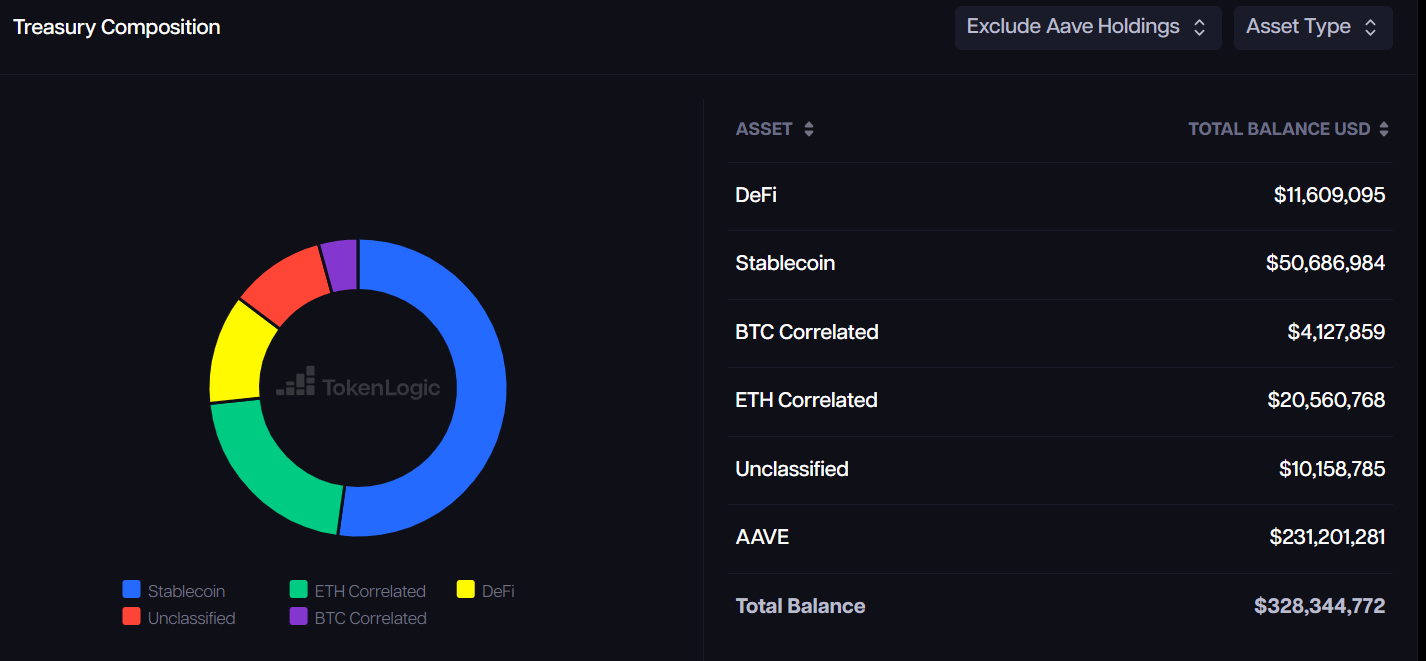

Aave’s robust financial standing supports this initiative. Its treasury holds nearly $100 million in non-native assets, including stablecoins, Ethereum, and other cryptocurrencies. When factoring in AAVE tokens, this figure exceeds $328 million, according to TokenLogic.

Aave’s Treasury. Source:

TokenLogic

Aave’s Treasury. Source:

TokenLogic

Marc Zeller, founder of Aave Chan, first introduced the idea of a fee switch last year and emphasized its inevitability earlier this year. According to Zeller, Aave’s net revenue significantly surpasses its operational expenses, making the move not just viable but strategic.

“When your protocol treasury looks like this, and DAO net revenue is more than twice the Opex (incentives included), The Fee Switch isn’t an if; it’s a when,” Zeller stated.

Aave is the largest DeFi lending protocol, providing users with decentralized borrowing and lending options. According to DeFillama data, more than $37 billion worth of assets are locked on the platform.

Aave’s USDe-USDT Proposal Sparks Criticism

Meanwhile, the Aave community is also evaluating a more contentious proposal to link Ethena’s USDe, a synthetic stablecoin, to Tether’s USDT.

This change would align USDe’s price with USDT using Aave’s pricing feeds, replacing the existing Chainlink oracle. The goal is to mitigate risks associated with price fluctuations and unprofitable liquidations.

USDe stands out from traditional stablecoins like USDT due to its reliance on derivatives and digital assets like Ethereum and Bitcoin rather than fiat reserves. USDe is the third-largest stablecoin, behind USDT and USDC, according to DeFillama data.

Despite significant support for the proposal, some community members have argued that it could create conflicts of interest, as advisors involved in drafting the proposal have ties to Aave and Ethena. Critics, like ImperiumPaper, have suggested that these advisors recuse themselves to ensure impartiality.

“LlamaRisk is on Ethena’s Risk Committee, which comes with monthly compensation. Ethena hired Chaos early on to help design and develop the risk frameworks used by Ethena. Both should recuse themselves from any oversight of USDe parameters,” Imperium Paper stated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What is the overseas crypto community talking about today?

What were foreigners most concerned about in the past 24 hours?

The Dark Side of Altcoins

Why is it said that almost all altcoins will go to zero, with only a few exceptions?

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.