Tornado Cash OFAC Sanctions Overturned: A Huge Win for Crypto Privacy and a 150% TORN Price Surge

The U.S. court’s recent decision to reverse sanctions on Tornado Cash has sent ripples through the crypto world. This landmark ruling not only underscores the importance of privacy in the blockchain space but also catalyzed a significant surge in TORN price. Here’s an in-depth analysis of this ruling, its implications for the crypto industry, and the outlook for the TORN token .

Court Reverses OFAC Tornado Cash Sanctions: A Win for Crypto Privacy

In a groundbreaking decision, a U.S. court ruled against the sanctions imposed on Tornado Cash, a leading Ethereum-based privacy protocol . Initially sanctioned by the Office of Foreign Assets Control (OFAC) for alleged facilitation of money laundering, the court determined that the agency had overstepped its authority. Legal experts hailed this decision as a milestone, reinforcing the notion that open-source software cannot be penalized for misuse by malicious actors.

The court emphasized the importance of preserving the innovation and privacy that decentralized protocols like Tornado Cash bring to the blockchain ecosystem . This ruling sets a significant precedent for other privacy-centric projects, highlighting the balance between regulatory oversight and technological advancement.

Crypto Industry Implications: Regulatory Clarity and Market Confidence

The court’s decision has broader implications for the crypto industry. By challenging OFAC’s sanctions, the ruling underscores the need for precise regulatory frameworks that distinguish between technology providers and bad actors. This clarity boosts market confidence, encouraging further investment and innovation in decentralized finance (DeFi) and blockchain privacy solutions.

Moreover, the case highlights the resilience of decentralized protocols. Despite regulatory headwinds, Tornado Cash and similar projects continue to demonstrate their value in enabling financial privacy and freedom, critical pillars of the blockchain ethos.

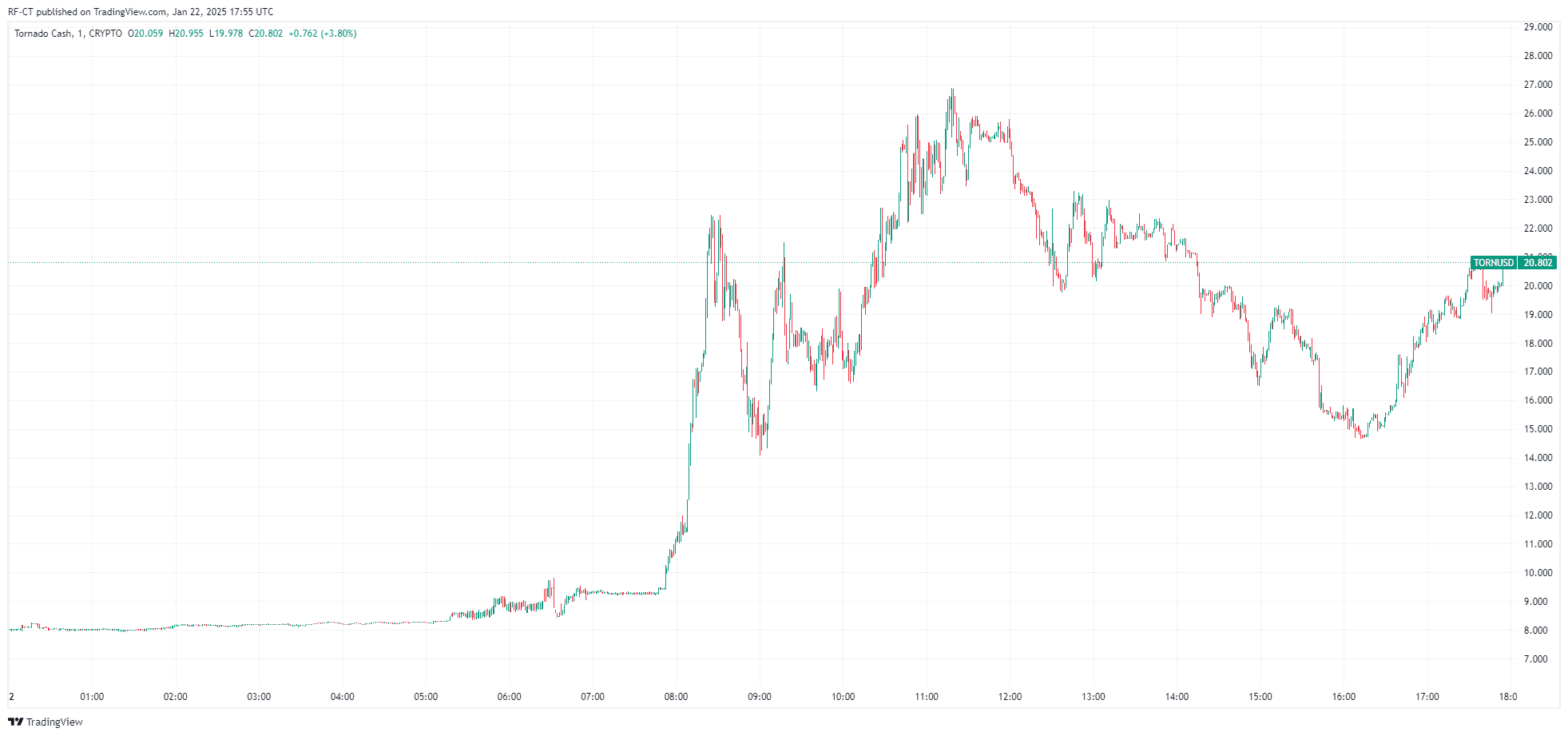

Tornado Cash Price Analysis of the 150% TORN Price Surge

Tornado Cash Price Analysis

The reversal of sanctions had an immediate and profound impact on Tornado Cash’s native token, TORN . Its price surged by over 150%, reaching $25.94 within hours of the announcement. This rally was driven by renewed investor confidence and heightened trading volumes, which exceeded $200 million in a single day.

Market analysts attribute TORN’s rebound to the clarity and legitimacy the ruling brings to privacy-focused tokens. With a circulating supply of just over 5.25 million and a maximum supply capped at 10 million, TORN’s scarcity further amplified the price movement. The token’s performance suggests a promising outlook, with predictions indicating a potential climb to $50 or higher in the coming weeks, provided the broader market sentiment remains positive.

By TradingView - TORNUSD_2025-01-22 (1D)

By TradingView - TORNUSD_2025-01-22 (1D)

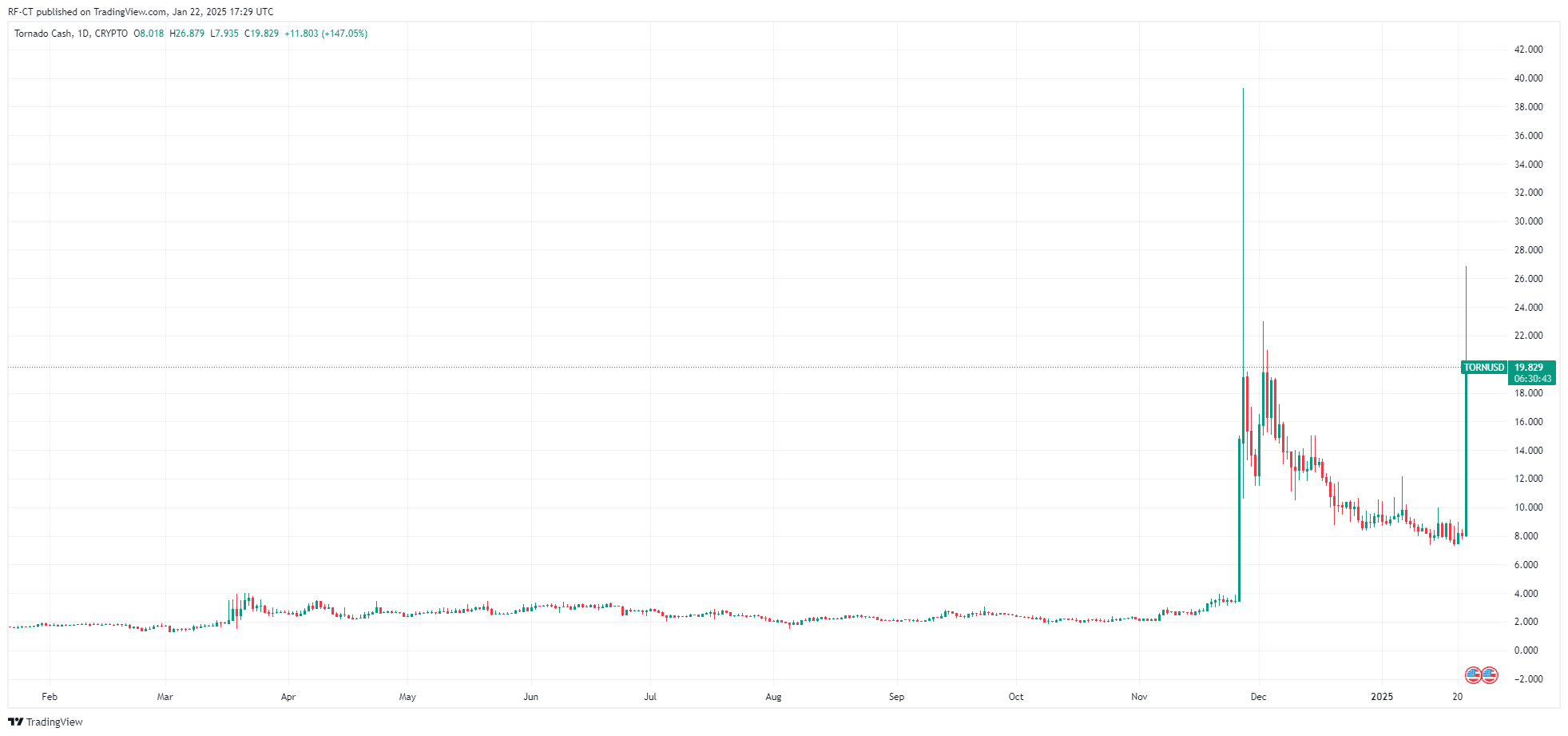

TORN Price Prediction

Analysts anticipate sustained momentum for TORN, with short-term resistance levels at $20 and long-term potential to retest highs of $100, to potentially reclaim its ATH of $437 achieved during the 2021 bull run. Today's impressive surge of over 150% pushed TORN price from lows of $7.84 to highs of $25.94. While TORN price hovers now at the $20 support level , it is only 95% away from its 2021 ATH, but 1450% over its all-time low of $1.34 reached a year from now, in January 2024. With this impressive performance, following the latest news, and with the new pro-crypto administration, a bullish scenario seems hopeful for TORN price in the short term.

By TradingView - TORNUSD_2025-01-22 (1Y)

By TradingView - TORNUSD_2025-01-22 (1Y)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."