XRP Price Crash Recovery Hinges on Bitcoin’s Next Move

XRP’s price struggles after losing key support, but Bitcoin’s recovery could trigger a rebound. Can XRP break resistance and resume its uptrend?

XRP recently attempted to form a new all-time high but faced resistance due to market top pressure. The failure led to significant losses for investors as selling pressure increased.

Now, the cryptocurrency’s recovery hinges on Bitcoin’s trajectory, with its price movement influencing XRP’s future performance.

XRP Loses Key Supports

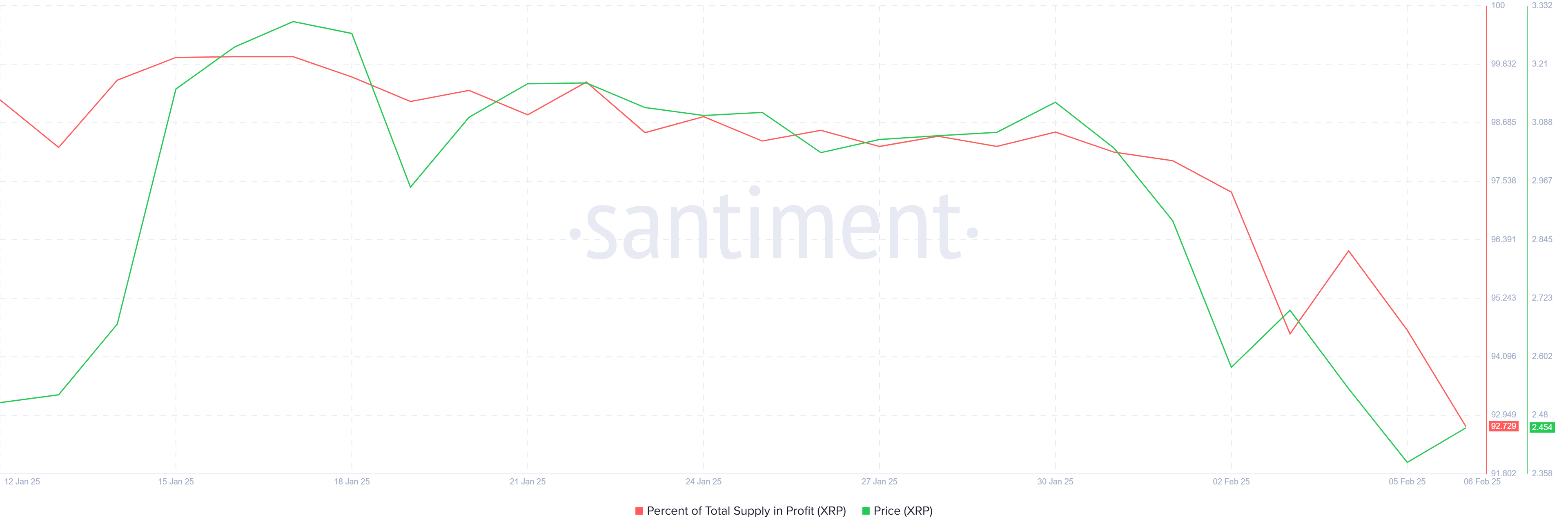

The percentage of XRP’s supply in profit surpassed 95% earlier this week, signaling a market top. This development triggered a wave of selling pressure, resulting in a sharp drawdown. As a consequence, 3% of the profit supply has already been wiped out, increasing concerns among investors.

Declining profits present a significant risk, as more holders may sell to lock in gains. If this trend continues, downward pressure could further drive prices lower. The asset’s ability to retain investor confidence will be crucial in determining its next move.

XRP Supply In Profit. Source:

Santiment

XRP Supply In Profit. Source:

Santiment

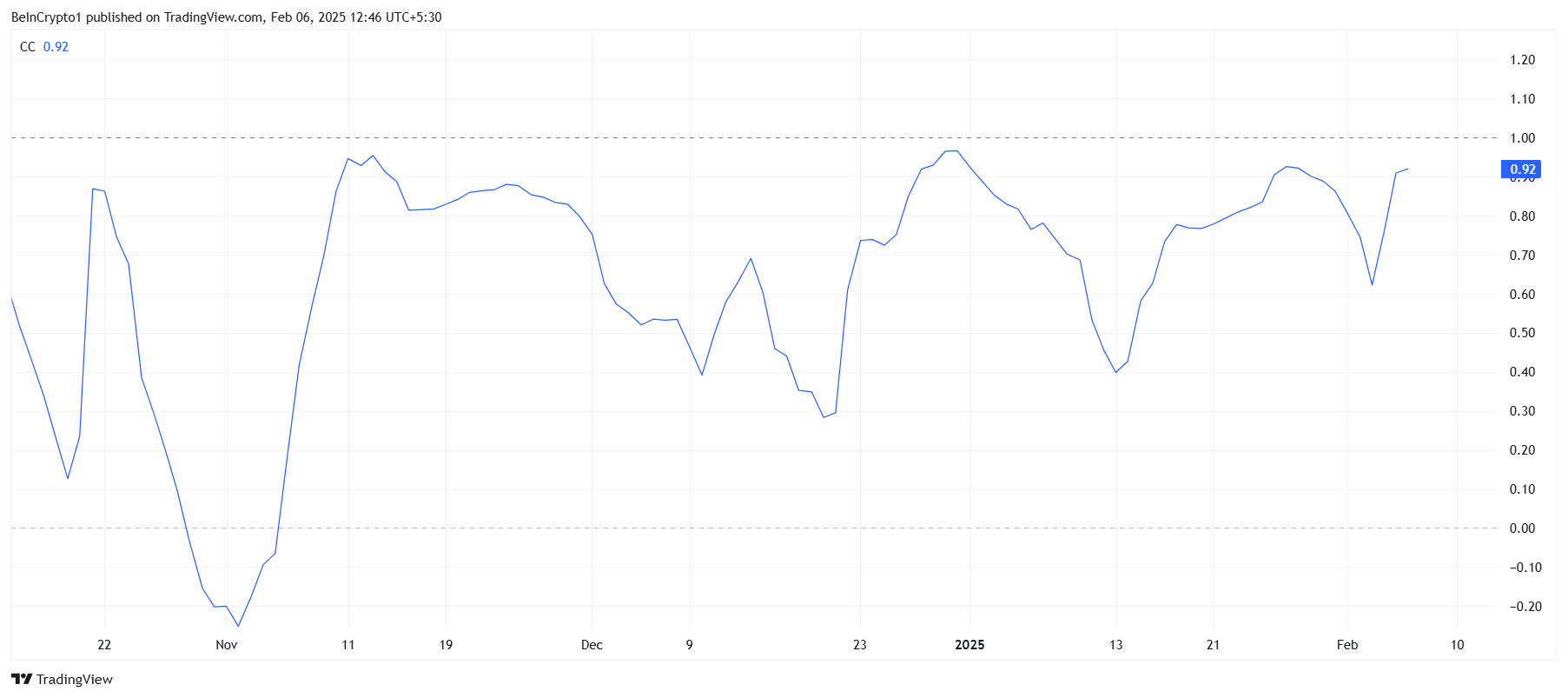

XRP’s macro momentum remains closely tied to Bitcoin, with its correlation now at 0.92. This strong relationship means XRP is likely to mirror Bitcoin’s price movements, which could be beneficial given Bitcoin’s bullish outlook.

Bitcoin appears poised to reclaim support at $100,000, which would likely uplift the broader market, including XRP. If Bitcoin’s price stabilizes and trends upward, XRP could find the support it needs to resume its own recovery.

XRP Correlation With Bitcoin. Source:

TradingView

XRP Correlation With Bitcoin. Source:

TradingView

XRP Price Prediction: Escaping The Bears

XRP is currently trading at $2.46, having dropped below critical support levels at $2.95 and $2.70. The price decline paused when the altcoin tested support at $2.33, preventing further losses for the time being.

The altcoin’s next challenge lies in reclaiming lost ground. However, breaking past $2.70 may prove difficult, as resistance at this level remains strong. Consolidation under this price point is a possible scenario unless stronger bullish momentum emerges.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

If XRP follows Bitcoin’s lead, a significant recovery could be on the horizon. Reclaiming $2.70 would be a key turning point, potentially opening the path for further gains. A move beyond $2.95 would invalidate the current bearish-neutral outlook, paving the way for a full recovery and further upside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Impact of Artificial Intelligence on Learning and Professional Development

- Global AI in education market to grow from $7.57B in 2025 to $32.27B by 2030 (31.2% CAGR), driven by classroom AI adoption and workforce training. - Asia-Pacific leads growth (35.3% CAGR), with 60% U.S. teachers and 86% global students using AI for personalized learning and content summarization. - Institutions like Farmingdale State College pioneer AI integration through interdisciplinary programs and NSF-funded ethical AI research initiatives. - Strategic partnerships (e.g., IBM-Pearson) and platforms

The Influence of TWT’s Updated Tokenomics on the Dynamics of the Cryptocurrency Market

- TWT/TON's 2025 tokenomics shift from speculative governance to utility-driven ecosystem integration, embedding tokens in platform functions like Trust Premium. - Deflationary mechanisms (88.9B tokens burned) and cross-chain FlexGas systems create scarcity, mitigating oversupply risks while expanding transactional use cases. - Governance reforms prioritize community voting on fees and partnerships, but face challenges from regulatory uncertainty and Solana network dependencies. - Institutional adoption gr

Astar (ASTR) Price Spike: Unraveling the Reasons for Recent Market Fluctuations

- Astar (ASTR) price surged amid Tokenomics 3.0 reforms, institutional capital inflows, and strategic partnerships in November 2025. - Deflationary mechanisms like Burndrop and a $29.15M buyback program reduced circulating supply to 8.24B tokens. - Galaxy Digital's $3. 3M OTC purchase and Coinbase listing roadmap signaled institutional confidence in ASTR's long-term potential. - Partnerships with Sony , Toyota , and Japan Airlines expanded ASTR's real-world utility in logistics and digital identity sectors

The Increasing Importance of STEM Education as a Strategic Asset in a Technology-Focused World Economy

- U.S. STEM education is reshaping curricula and partnerships to meet AI, cybersecurity, and renewable energy demands, driven by $75M investments like Farmingdale State College's expanded Computer Sciences Center. - Public-private collaborations, including NSF AI Education Act and Google/IBM workforce pledges, are accelerating workforce readiness through AI research and micro-credential programs. - STEM-focused universities achieved 11.5% average endowment returns in 2025, but proposed excise taxes threate