Crypto News Today: Litecoin Price Surges as Bitcoin Holds Steady Above $97K

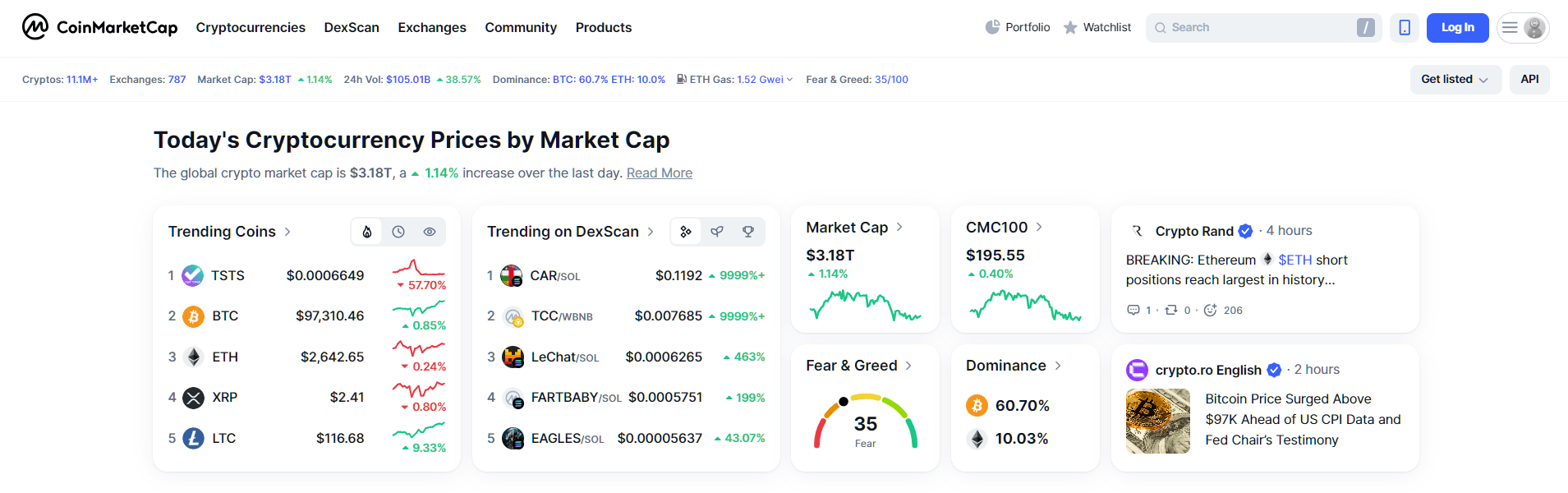

The cryptocurrency market is exhibiting resilience , with Bitcoin maintaining its position above the $97,000 threshold and Litecoin experiencing a notable surge. As of February 10, 2025, the global crypto market capitalization stands at approximately $3.18 trillion, reflecting a slight 1.14% increase over the past 24 hours.

By CoinMarketCap - Trending Coins on 2025-02-10

By CoinMarketCap - Trending Coins on 2025-02-10

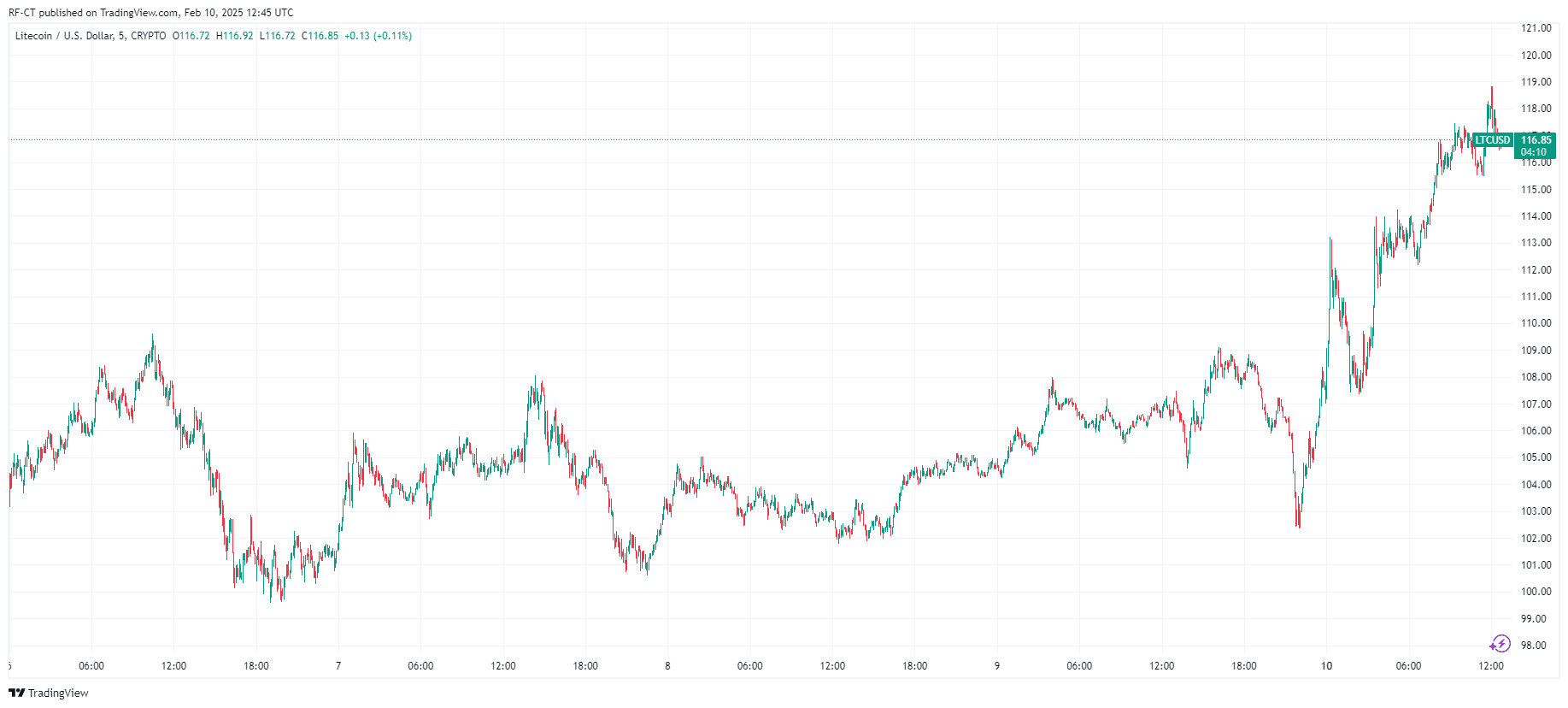

Litecoin Emerges as Top Performer

Litecoin (LTC) has outperformed major cryptocurrencies, recording a significant 9.52% increase to trade at $116.80. Analysts attribute this surge to growing optimism surrounding the potential approval of a spot Litecoin ETF by the U.S. Securities and Exchange Commission (SEC). The likelihood of such an approval has risen to 81%, with many traders anticipating a launch later this year.

By TradingView - LTCUSD_2025-02-10 (5D)

By TradingView - LTCUSD_2025-02-10 (5D)

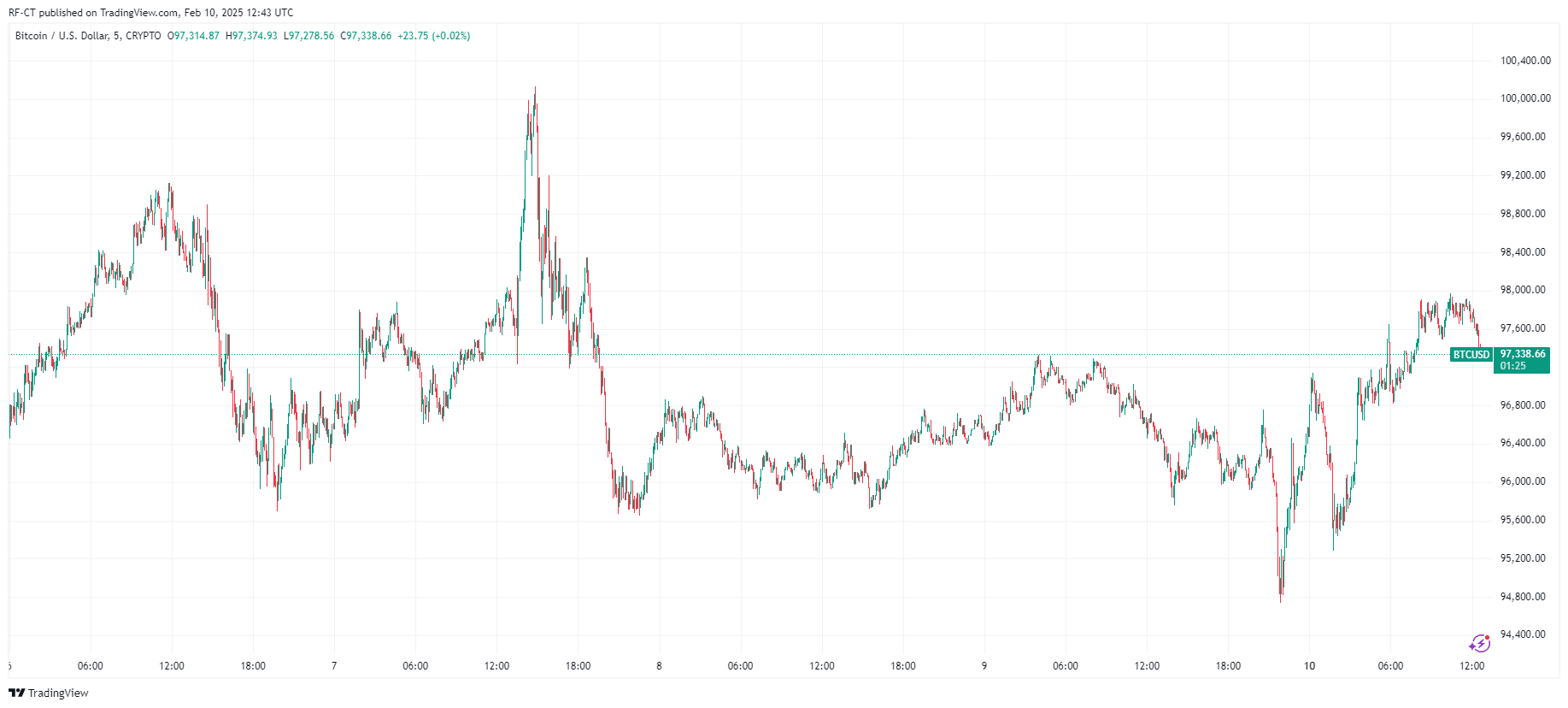

Bitcoin Defends Key Support Level

Bitcoin (BTC) has demonstrated stability, trading at around $97,336 marking a modest 1.01% gain in the last 24 hours. The leading cryptocurrency briefly dipped below $95,000 but quickly rebounded, reaching highs of $98,000, yet still below $100,000. This resilience underscores Bitcoin's strong support at the $95,000 level, a critical threshold for maintaining its bullish outlook.

By TradingView - BTCUSD_2025-02-10 (5D)

By TradingView - BTCUSD_2025-02-10 (5D)

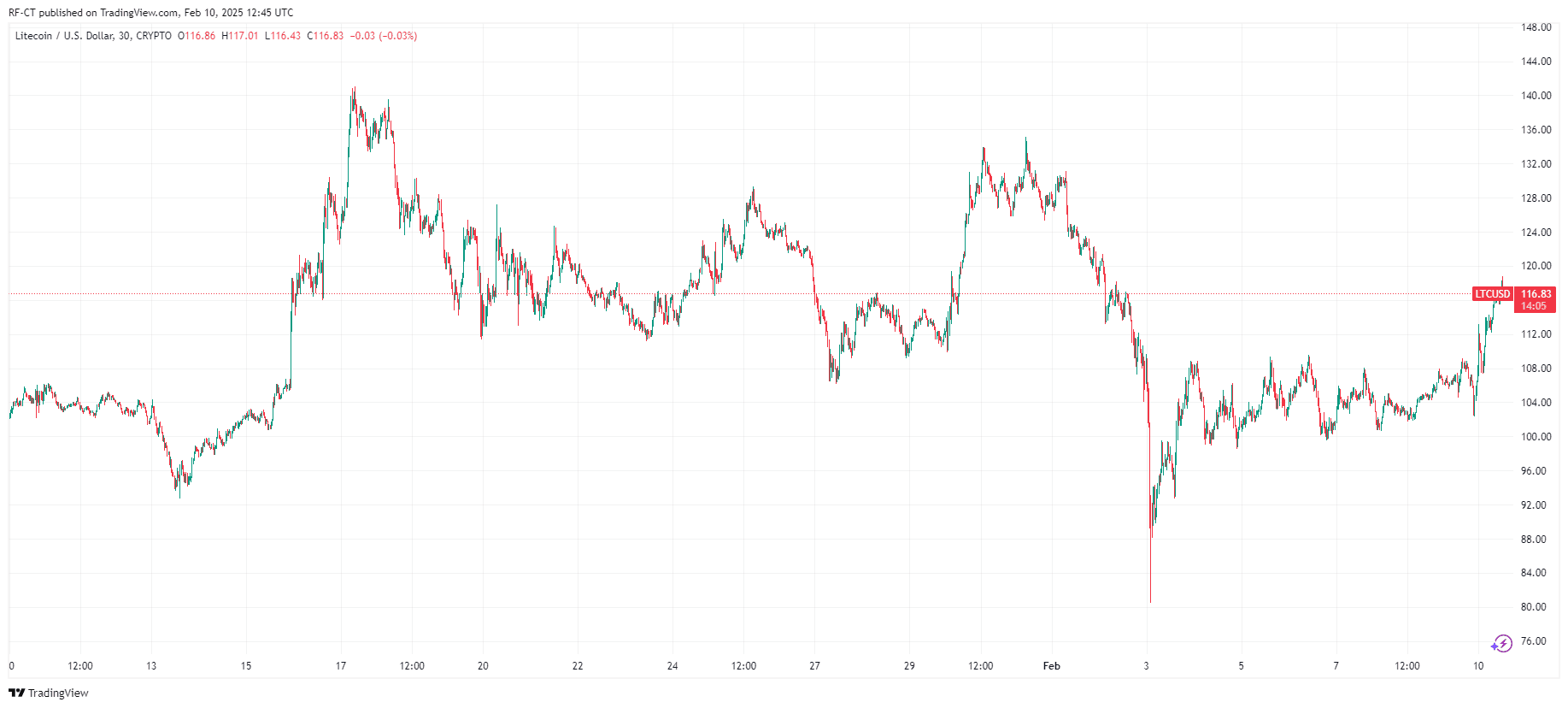

Market Outlook and Key Considerations

The overall cryptocurrency market remains stable, with the total market capitalization holding steady at $3.18 trillion. Bitcoin's ability to maintain its position above the $97,000 support level is crucial for sustaining its bullish momentum. Meanwhile, Litecoin's impressive performance highlights its potential as a promising asset in the current market landscape.

By TradingView - LTCUSD_2025-02-10 (1M)

By TradingView - LTCUSD_2025-02-10 (1M)

In summary, the cryptocurrency market is displaying signs of resilience, with Bitcoin defending key support levels and Litecoin leading in gains. Investors are advised to monitor these developments closely, as they may signal further opportunities in the evolving crypto landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investment Prospects in STEM Learning and Workforce-Ready Talent Streams: Linking with Astar 2.0

- Global STEM education demand surges as AI, blockchain, and biotech reshape industries, creating workforce skill gaps. - Astar 2.0's DeFi innovations (ZK Rollups, interoperability) indirectly support STEM through blockchain infrastructure and cross-chain collaboration. - U.S. and Singapore prioritize tech-integrated workforce strategies, aligning with Astar 2.0's potential to bridge DeFi and STEM education via scalable tools. - Investors can leverage Astar 2.0's $1.399B TVL and hybrid AMM-CEX model to fun

The ZK Transformation: Evaluating How Zero-Knowledge Technology Influences the Future Development of Blockchain

- ZK-rollups scale blockchain networks by bundling transactions, achieving 43,000 TPS and 30% lower gas fees, attracting institutions like Goldman Sachs and JPMorgan . - ZK technology resolves privacy-scalability paradox by enabling verifiable transactions without data exposure, adopted by EU regulators and enterprises like Nike and Sony . - Challenges persist: ZK-SNARKs require heavy computation, trusted setup risks exist, and privacy conflicts with AML regulations in some jurisdictions. - $725M+ VC inves

The Influence of Vitalik Buterin's Support for ZKsync on the Advancement of Scalable Blockchain Technologies: Evaluating the Prospects for Long-Term Investment in Pr

- Vitalik Buterin's 2025 endorsement of ZKsync accelerated its rise as a scalable Ethereum Layer-2 solution with 30,000 TPS and $3.3B TVL. - ZKsync's EVM compatibility and institutional partnerships contrast with StarkNet's quantum-resistant STARK proofs and Aztec's privacy-first architecture. - Analysts project ZK token prices at $0.40–$0.60 by 2025, while StarkNet faces adoption barriers and Aztec navigates regulatory challenges in privacy-focused DeFi. - The $7.59B ZKP market (2033 forecast) hinges on b

ZK Atlas Enhancement: Transforming Blockchain Scalability and Paving the Way for Institutional Integration

- ZKsync’s 2025 Atlas Upgrade achieves 15,000–43,000 TPS with $0.0001/transaction costs, boosting blockchain scalability for institutions. - Deutsche Bank , Sony , and Citi adopt ZKsync for tokenized assets and privacy-driven transactions, citing compliance and efficiency gains. - Market forecasts predict 60.7% CAGR for ZK Layer-2 solutions through 2031, with Fusaka upgrade targeting 30,000 TPS to solidify ZKsync’s leadership.