Stellar (XLM) Price Prediction: Is XLM Poised for a Rebound or More Downside?

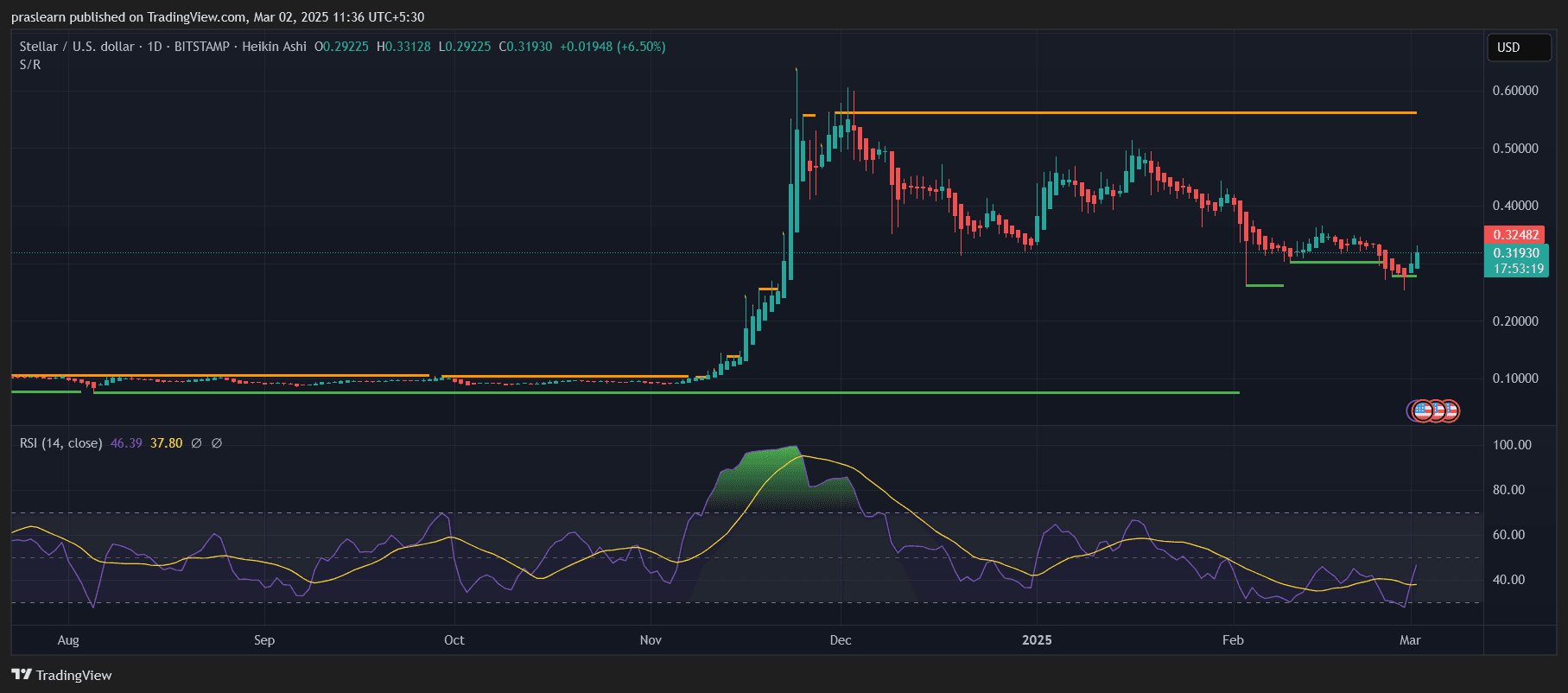

Stellar (XLM) has experienced a significant price movement over the past few months, first rallying strongly in late 2024 before entering a prolonged correction phase. After reaching a high near $0.60, XLM has since retraced, recently finding support around $0.28-$0.30. However, with a slight 6.50% bounce in the latest session, traders are now asking: Is Stellar about to break out of its downtrend, or is this just a temporary relief rally before another leg down?

This StellAR price prediction will explore key support and resistance levels, technical indicators, and potential price scenarios to determine whether XLM can sustain its recovery or if further declines are ahead.

Stellar Price Prediction: Is XLM Showing Signs of Recovery?

XLM/USD Daily Chart- TradingView

XLM/USD Daily Chart- TradingView

XLM’s latest price movement suggests early signs of a possible recovery, as the coin has bounced from its recent support zone around $0.28-$0.30 and is now trading around $0.3193. The 6.50% daily increase could indicate renewed buying interest, but the overall structure remains cautiously bearish, with lower highs and lower lows still intact.

One crucial factor to watch is whether this bounce can hold. If XLM can sustain gains and establish higher support, it might signal the start of a trend reversal. However, if selling pressure increases at key resistance levels, this move could turn into another bull trap before further declines.

What Is the RSI Indicating About XLM’s Momentum?

The Relative Strength Index (RSI) is currently at 46.39, a notable recovery from its recent lows. Although this suggests that XLM price is no longer in oversold territory, it remains below the 50-neutral level, meaning bullish momentum is not yet confirmed.

For a true reversal, the RSI needs to break above 50 and sustain a higher trend, signaling that buyers are taking control. If RSI remains under 50, XLM might continue consolidating or even retest lower supports before attempting a stronger rally.

What Are the Key Support and Resistance Levels?

Support Levels:

The most critical immediate support for XLM is around $0.28-$0.30, where the price recently bounced. If this level holds, XLM could build a base for further upward movement. However, a break below this range would expose the next major support at $0.20, which served as a previous accumulation zone before the November rally.

Resistance Levels:

On the upside, XLM must clear $0.35-$0.38 to confirm a bullish breakout. This region has acted as strong resistance during the recent downtrend, rejecting price recovery attempts. A decisive close above $0.38 could trigger a move toward $0.45, the next major resistance.

Beyond $0.45, the ultimate resistance stands at $0.60, where XLM last peaked. Breaking past this level would indicate a full trend reversal, paving the way for a potential rally toward new highs.

XLM Price Prediction: Can XLM Sustain Its Rally or Will It Face Another Rejection?

While today’s bounce is encouraging, XLM still faces strong resistance ahead . For a bullish continuation, the price must break above $0.35-$0.38 and establish it as a new support zone. If buying pressure continues and volume increases, XLM could attempt a run toward $0.45 and beyond.

However, failure to break above resistance levels could result in another rejection, sending XLM back toward its $0.28-$0.30 support. A breakdown below this level would open the door for further losses toward $0.20, delaying any potential bullish recovery.

What’s the Outlook for Stellar Price in the Coming Weeks?

Given the current market conditions, two possible scenarios could unfold:

- Bullish Scenario: If XLM price holds above $0.30 and breaks past $0.38, a bullish move toward $0.45-$0.50 could follow. Sustained volume and RSI moving above 50 would support this case.

- Bearish Scenario: If XLM price fails to break resistance and drops below $0.28, the next target would be $0.20, signaling continued weakness in the market.

XLM Price Prediction: Will Stellar (XLM) Continue Rising or Fall Further?

Stellar price is currently at a crucial turning point , attempting to recover after a prolonged correction. While today’s 6.50% bounce suggests renewed buying interest, strong resistance at $0.35-$0.38 remains a major hurdle.

For XLM to confirm a trend reversal, it must sustain higher price action and break key resistance zones. Until then, the market remains in a wait-and-see mode, with the risk of further downside still present.

Traders should keep an eye on volume, RSI movement, and price action near support and resistance zones to assess XLM’s next potential move. Will Stellar reclaim its bullish momentum, or is another leg down on the horizon? The next few weeks will be critical in shaping XLM’s future trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The 12 trillion financing market is in crisis! Institutions urge the Federal Reserve to step up rescue efforts

Wall Street financing costs are rising, highlighting signs of liquidity tightening. Although the Federal Reserve will stop quantitative tightening in December, institutions believe this is not enough and are calling on the Fed to resume bond purchases or increase short-term lending to ease the pressure.

Another Trump 2.0 era tragedy! The largest yen long position in nearly 40 years collapses

As the yen exchange rate hits a nine-month low, investors are pulling back from long positions. With a 300 basis point interest rate differential between the US and Japan, carry trades are dominating the market, putting the yen at further risk of depreciation.

Is a "cliff" in Russian oil production coming? IEA warns: US sanctions on Russia may have "far-reaching consequences"!

U.S. sanctions have dealt a heavy blow to Russia’s oil giants, and the IEA says this could have the most profound impact on the global oil market so far. Although Russian oil exports have not yet seen a significant decline, supply chain risks are spreading across borders.

Leading DEXs on Base and OP will merge and expand deployment to Arc and Ethereum

Uniswap's new proposal reduces LP earnings, while Aero integrates LPs into the entire protocol's cash flow.