Will Berachain (BERA) Price Break $7 or Face Another Drop?

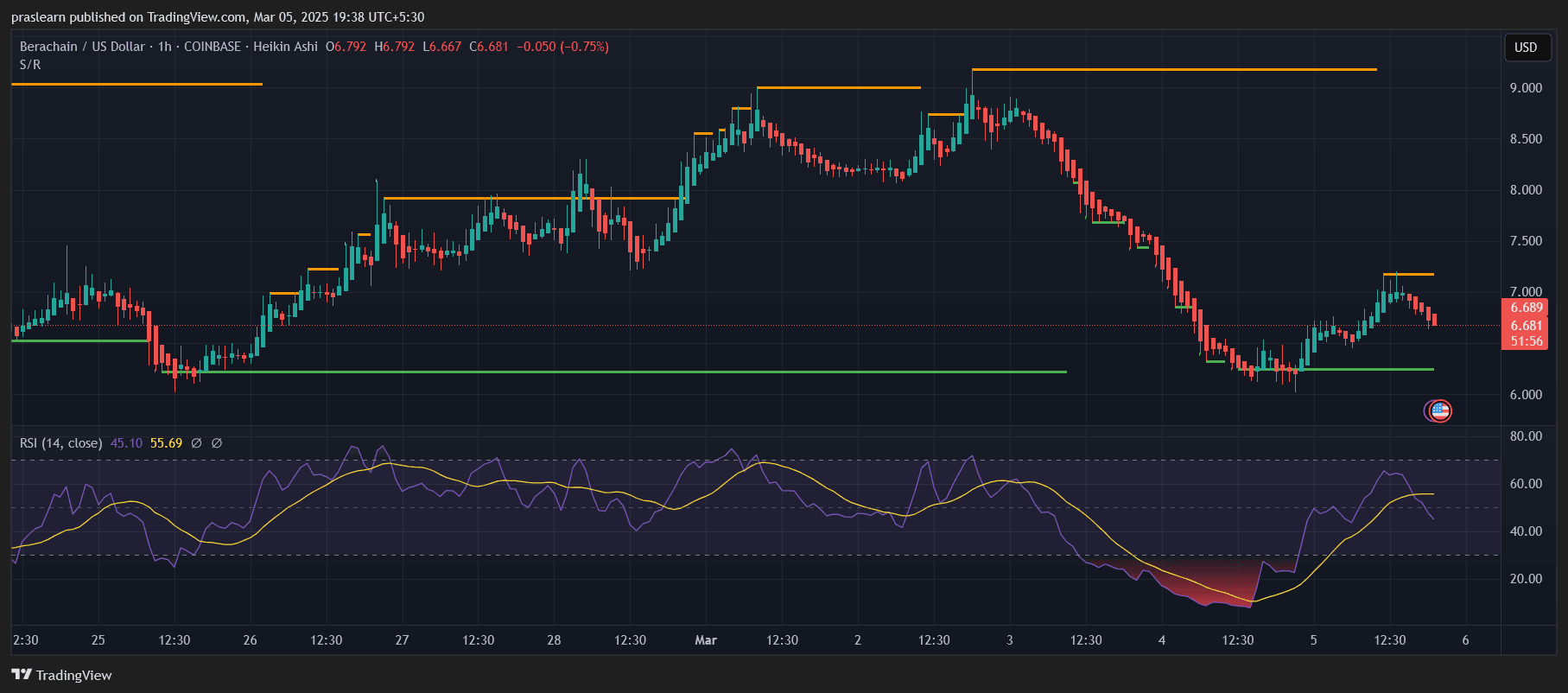

Berachain (BERA) has been showing strong volatility on the hourly chart, with recent price action forming both higher highs and sharp retracements. After reaching a peak above $9, the price corrected downward, falling below $6 before bouncing back. Now, BERA is trading around $6.68, leaving traders wondering—will BERA price break above $7 and start a new bullish run, or is another leg down coming?

This analysis will dive into BERA’s key support and resistance levels, technical indicators, and possible price targets in the short term.

Berachain Price Prediction: Is BERA Gaining Strength for a Bullish Breakout?

BERA/USD Hourly Chart- TradingView

BERA/USD Hourly Chart- TradingView

Berachain’s price action has formed a V-shaped recovery after testing a support level near $6, which suggests that buyers are stepping in at lower prices. However, despite this bounce, BERA price is currently facing resistance at $7, a level that previously acted as support before breaking down.

If bulls manage to push BERA above $7, the next target would be around $7.50-$8, where strong selling pressure may reappear. However, failure to break past $7 could result in another retest of the $6 support zone.

What Does RSI Indicate About BERA’s Momentum?

The Relative Strength Index (RSI) is currently at 45, which suggests that the asset is in a neutral zone—neither overbought nor oversold. Earlier, RSI dipped into the oversold territory, causing a strong rebound. However, RSI has started declining again, which could indicate that bullish momentum is weakening.

For a confirmed bullish trend, RSI needs to break above 55-60 and hold there. If RSI falls below 40, it could signal renewed selling pressure, leading to another leg down.

What Are the Key Support and Resistance Levels?

Berachain is currently trading between strong support at $6.00-$6.20 and immediate resistance at $7.00. A breakout above $7.00 could send BERA toward $7.50-$8.00, while a breakdown below $6.00 could lead to a further decline toward $5.50 or lower.

For short-term traders, these levels will be crucial in determining the next move. If BERA consolidates between $6.50-$7.00, a breakout or breakdown could set the stage for the next trend.

Berachain Price Prediction: Will BERA Price Retest Its Previous Highs?

For BERA price to retest its previous highs near $9.00, it must hold above $7.00 and establish strong buying momentum. If Bitcoin and the overall crypto market turn bullish, BERA could ride the momentum and aim for new highs. However, if market sentiment weakens, it may continue trading in a range or even drop further.

A successful breakout above $8.00 would indicate that bulls are in control, with $9.00-$9.50 being the next targets. On the other hand, failure to hold above $6.00 could trigger a further decline toward $5.50-$5.00, where long-term buyers may look to accumulate.

Final Thoughts: Is BERA a Buy at Current Levels?

BERA is currently at a crucial decision point, trading between strong support at $6.00 and immediate resistance at $7.00. A breakout above $7.00 could signal a bullish continuation, while failure to hold above $6.00 could lead to another bearish move.

For traders looking for short-term gains, waiting for a confirmed breakout above $7.00 may be a good strategy. Meanwhile, long-term investors could consider accumulating near $6.00, as this level has acted as strong support.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."