Bitcoin Price Short-Term Outlook: Weak Demand Suggests Drop Under $80,000 Possible

Bitcoin’s demand is shrinking, with the sharpest decline since July 2024. While long-term holders accumulate, BTC risks dropping under $80,000.

Bitcoin has been experiencing a sustained downtrend despite maintaining a broader macro-bullish outlook. While long-term projections remain positive, short-term weakness suggests BTC may continue to face selling pressure.

Investor behavior has not been particularly supportive, contributing to further uncertainty in the market.

Bitcoin Needs Investors’ Backing

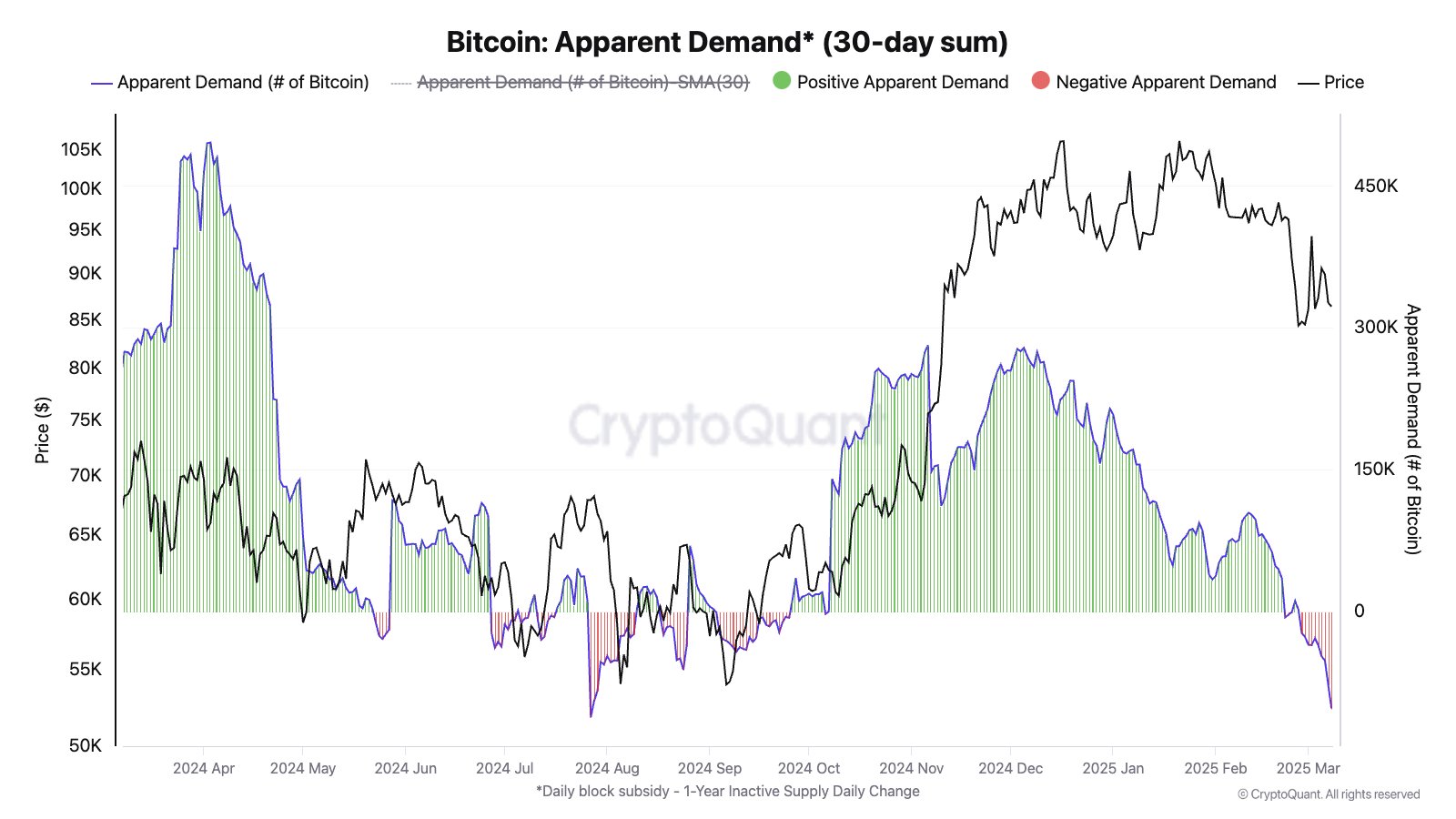

Bitcoin’s apparent demand has taken a significant hit, with spot demand contracting sharply in recent days. This contraction marks the most substantial decline since July 2024 and the first instance in over four months. The drop indicates rising skepticism among investors, leading to reduced buying interest and increased short-term bearish pressure.

A shrinking demand suggests that market participants are hesitant to enter new positions. If demand does not recover soon, Bitcoin could struggle to sustain its current price levels, increasing the risk of further drawdowns.

Bitcoin Apparent Demand. Source:

CryptoQuant

Bitcoin Apparent Demand. Source:

CryptoQuant

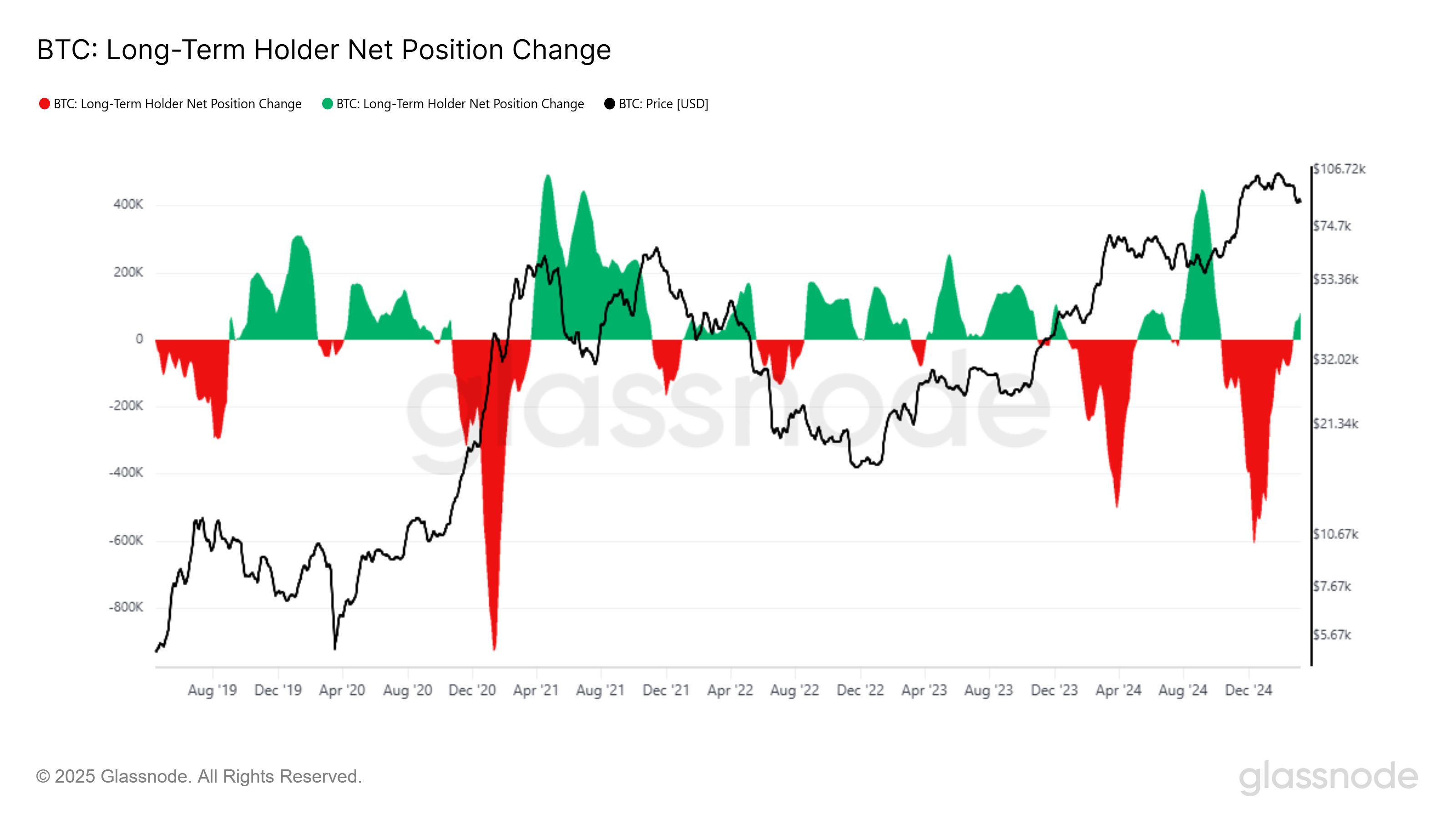

Long-term holders (LTHs) have shifted toward accumulation overselling, as shown by the LTH Net Position Change metric. Over the past 30 days, these investors have accumulated more than 107,413 BTC. Historically, LTH accumulation signals long-term confidence, but in the short term, it has often preceded periods of price weakness.

LTHs tend to accumulate at lower prices and begin distributing during bull runs. This pattern suggests Bitcoin might still face some downside before a meaningful recovery begins. While long-term accumulation is positive, the immediate impact could be additional short-term volatility and potential price corrections.

Bitcoin LTH Net Position Change. Source:

Glassnode

Bitcoin LTH Net Position Change. Source:

Glassnode

BTC Price Could Fall Further

Bitcoin’s price, currently at $82,305, is moving within a broadening descending wedge. While this pattern is historically bullish on a macro scale, in the short term, it indicates a higher likelihood of continued downside. BTC may need to test lower support levels before confirming a reversal.

Given the market conditions, the short term price prediction is that, Bitcoin could lose the crucial $80,000 support level and fall to test $76,741. If broader macroeconomic factors worsen, the decline could extend further, potentially reaching as low as $72,000. Such a scenario would put additional bearish pressure on the crypto market.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, a shift in investor sentiment could change this trajectory. If accumulation increases at the psychological support of $80,000, Bitcoin may regain bullish momentum. A move past $82,761 would pave the way for BTC to surpass $85,000, eventually reaching $87,041. Such a development would invalidate the bearish outlook and signal renewed market strength.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster announces a $10 million trading competition, combined with Stage 4 airdrop and Rocket Launch incentives, driving multi-layered growth in platform depth and liquidity.

After achieving strong performance in Stage 3, Stage 4 (Harvest) airdrop plan was launched, and the “Double Harvest” trading competition with a total reward of 10 million USD will be introduced on November 17.

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.